What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? a $233,000 b.S289.000 e 387,000 d $331,000

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? a $233,000 b.S289.000 e 387,000 d $331,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.2BE: Adjustments to net incomeindirect method Ripley Corporations accumulated depreciationequipment...

Related questions

Question

Transcribed Image Text:Unit 2

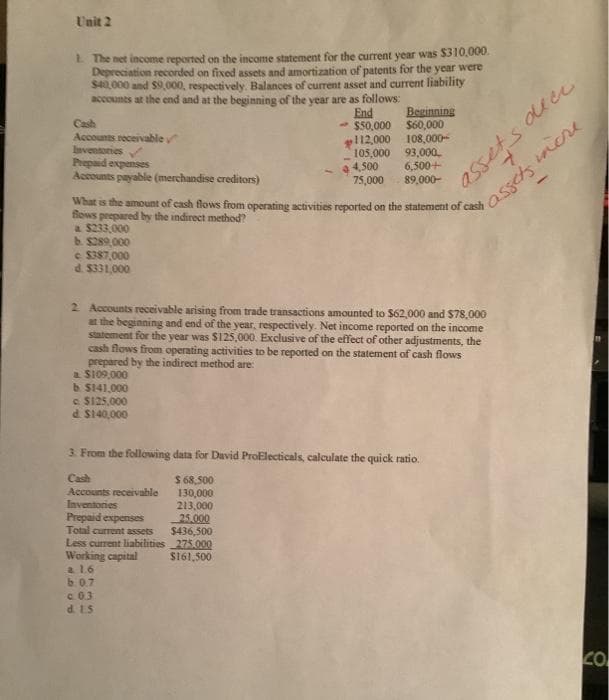

1 The net income reported on the income statement for the current year was $310,000.

Depreciation recorded on fixed assets and amortization of patents for the year were

assets duce

sassets incre

S40,000 and S9,000, respectively. Balances of current asset and current liability

accounts at the end and at the beginning of the year are as follows:

End

Beginning

$50,000 $60,000

112,000 108,000

105,000 93,000.

6,500+

89,000-

Cash

Accounts recervable

Inventories

Prepaid expenses

Accounts payable (merchandise creditors)

4,500

75,000

What is the amount of cash flows from operating activities reported on the statement of cash

flows prepared by the indirect method?

a $233,000

b. $289.000

e S387,000

d. $331,000

2 Accounts receivable arising from trade transactions amounted to $62,000 and $78.000

at the beginning and end of the year, respectively. Net income reported on the income

statement for the year was $125,000. Exclusive of the effect of other adjustments, the

cash flows from operating activities to be reported on the statement of cash flows

prepared by the indirect method are:

a S109,000

b S141,000

c. S125,000

d. S140,000

3 From the following data for David ProElecticals, calculate the quick ratio.

Cash

Accounts receivable

Inventories

Prepaid expenses

Total current assets

Less current liabilities 275.000

Working capital

$ 68,500

130,000

213,000

25.000

$436,500

S161,500

a16

b07

c.03

d. 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning