What is the asset turnover for 2021

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 3E

Related questions

Question

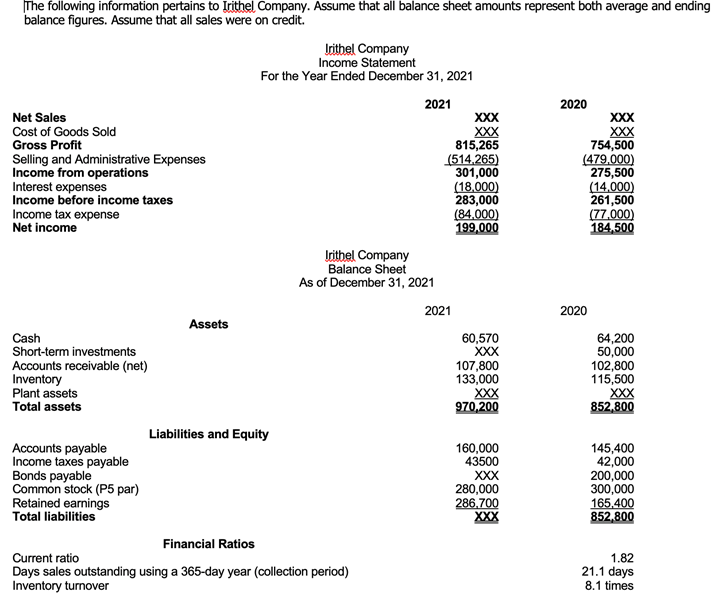

The following information pertains to Irithel Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the asset turnover for 2021?

Transcribed Image Text:The following information pertains to Trithel Company. Assume that all balance sheet amounts represent both average and ending

balance figures. Assume that all sales were on credit.

Net Sales

Cost of Goods Sold

Gross Profit

Selling and Administrative Expenses

Income from operations

Interest expenses

Income before income taxes

Income tax expense

Net income

Cash

Short-term investments

Accounts receivable (net)

Inventory

Plant assets

Total assets

Accounts payable

Income taxes payable

Bonds payable

Common stock (P5 par)

Retained earnings

Total liabilities

Assets

Irithel Company

Income Statement

For the Year Ended December 31, 2021

2021

Liabilities and Equity

Irithel Company

Balance Sheet

As of December 31, 2021

Financial Ratios

Current ratio

Days sales outstanding using a 365-day year (collection period)

Inventory turnover

XXX

XXX

815,265

(514,265)

301,000

2021

(18,000)

283,000

(84,000)

199,000

60,570

XXX

107,800

133,000

XXX

970,200

160,000

43500

XXX

280,000

286,700

XXX

2020

XXX

XXX

754,500

(479,000)

275,500

2020

(14,000)

261,500

(77,000)

184,500

64,200

50,000

102,800

115,500

XXX

852,800

145,400

42,000

200,000

300,000

165,400

852,800

1.82

21.1 days

8.1 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning