Percentages need to be entered in decimal format, for instance 3% would be entered as .03.

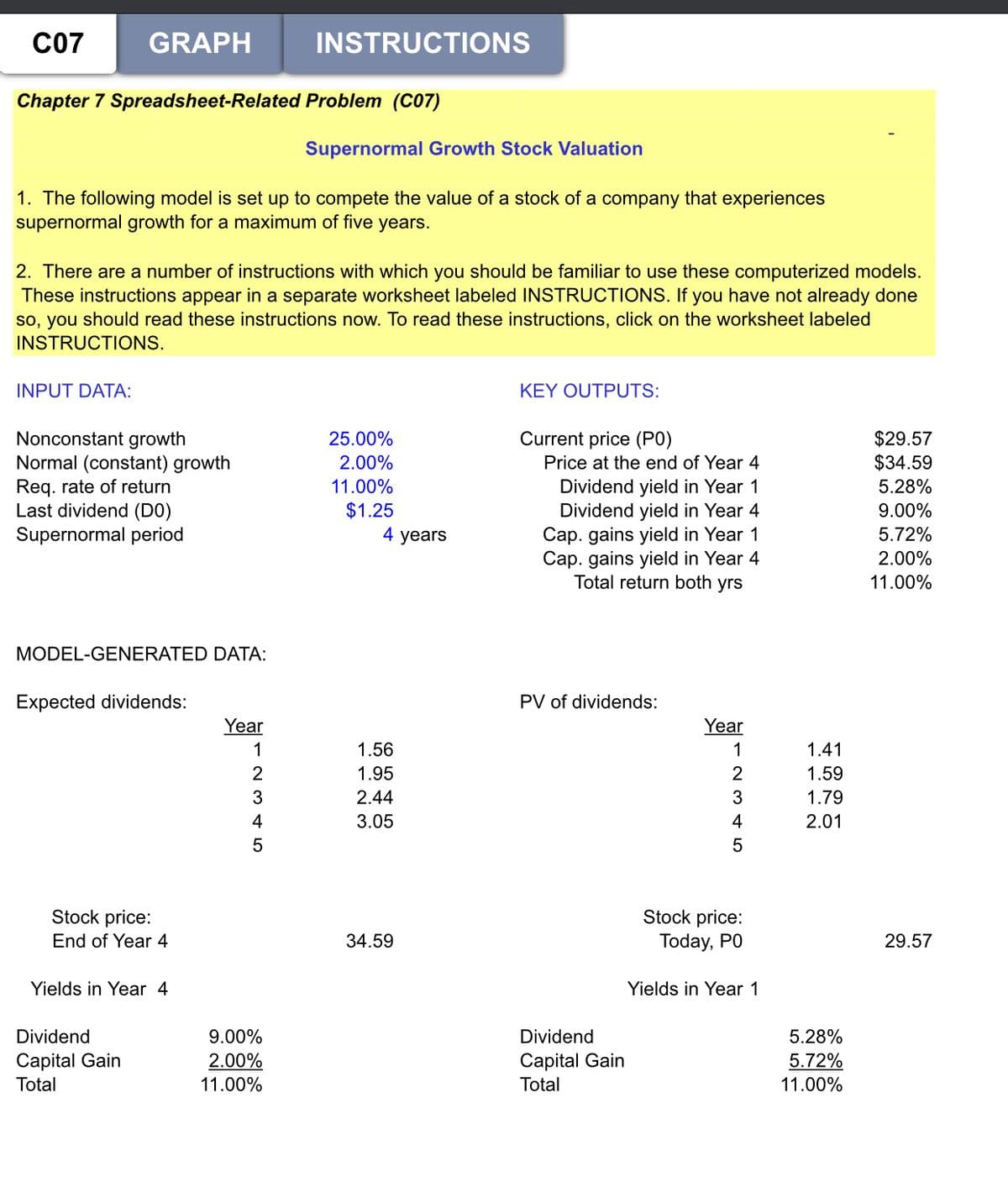

2.Ultimate Electric, Inc. has just developed a solar panel capable of generating 200% more electricity than any solar panel currently on the market. As a result, Ultimate is expected to experience a 15% annual (nonconstant) growth rate for the next five years (supernormal period). When the five-year period ends, other firms will have developed comparable technology, and Ultimate's growth rate will slow to 5% per year (constant) indefinitely. Stockholders require a return of 12% on Ultimate's stock. The firms's most recent annual dividend (D0), which was paid yesterday, was $1.75 per share. What is the current price (P0) of the stock today? What is the market value (price) at the end of Year

3.Consider the scenario in Question 2 and suppose your boss believes that Ultimate's annual nonconstant growth rate will only be 12% during the next five years and that the firm's normal growth rate will only be 4%. Under these conditions, what is the current price of Ultimate's stock? What is the price at the end of Year 5?

4. Consider the scenario in Question 2 and suppose your boss regards Ultimate as being quite risky; therefore, your boss believes that the required rate of return should be higher than the 12% originally specified. What is the current price of the stock, if the required rate of return is 13%? 15%? 20%? What is the effect of the higher required

Trending now

This is a popular solution!

Step by step

Solved in 3 steps