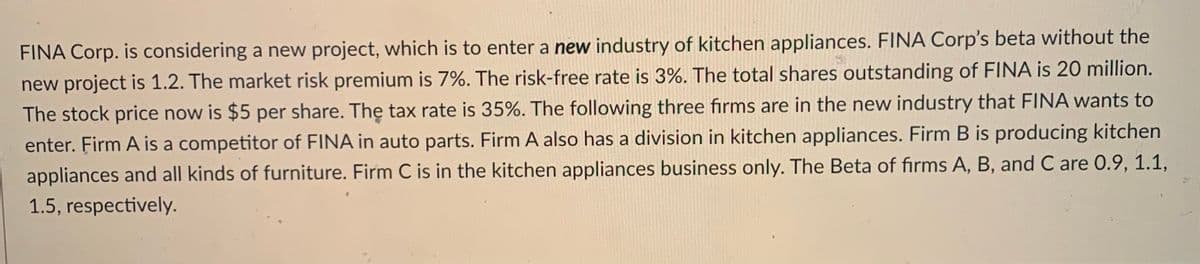

What is the current required rate of return on the equity of FINA corp? FINA issued 30 year bond 5 years ago. The current market value of debt is 50 million. The face value of the bond is 44.5 million. The coupon rate is 6%. The bond pays coupon semiannually. What is the current cost of debt?

Q: A Company has issued 55-year bond 17 years ago at a coupon rate of 12% quarterly basis. The face…

A: Bonds are debts instruments that are issued by entities to raise funds and meet their capital…

Q: Ninja Co. issued 14-year bonds a year ago at a coupon rate of 6.9 percent. The bonds make semiannual…

A: Current price of the bond is the sum of present value of maturity value of bond value and present…

Q: Jiminy’s Cricket Farm issued a bond with 15 years to maturity and a semiannual coupon rate of 5…

A: Working note for part a and b as follows:

Q: To help finance a major expansion, GAMA Company sold a bond with 20 years to maturity. This bond has…

A: The question is based on the concept of Valuation of bonds.

Q: What is the annual coupon rate rounded to 2 decimal places if ABC Inc. recently issued a 20-year…

A: Bonds are the debt security which is offered or issued by corporates or the governments to collect…

Q: National Inc. has 100 bonds outstanding with maturity value each of P1,000. The nominal required…

A: Par value of bond (FV) = P1000 Coupon rate = C Semi annual coupon amount (P) = 1000*C/2 = 500C Years…

Q: Watters Umbrella Corp. issued 15-year bonds 2 years ago at a coupon rate of 8 percent. The bonds…

A: Given, Time=15 years bond coupon rate=8% bond currently selling =115%

Q: The Altoona Company issued a 25-year bond 5 years ago with a face value of $1,000. The bond pays…

A: “Hey, since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Safeway Stores issued a 15-year bond 5 years ago; it has $1,000 face value and a 7% coupon rate. If…

A: The cost of debts is the effective interest rate paid by the company to the investors on the amount…

Q: Lepus has issued bonds of $100 nominnal value with annual interest of 9%per year, based on the…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: RMB, Inc. sold a 20-year bond at par 12 years ago. The bond pays an 8% annual coupon, has a $1,000…

A: Given that;Face value is $1000Present value is $893.30

Q: A company has outstanding long-term bonds with a face value of $1,000, a 9% coupon rate, 20 years…

A: Cost of debt is YTM of the bond

Q: Jimiax's Cricket Farm issued a 15 year, 4percent semiannual coupon bond 2 years ago. The bond…

A: Part (a): Calculation of company’s pre-tax cost of debt: Answer: Company’s pre-tax cost of debt is…

Q: Suppose Hillard Manufacturing sold an issue of bonds with a 12-year maturity, a $1,000 par value, a…

A: The current price of the bond is the sum of the present value of future interest payment and the…

Q: Jiminy’s Cricket Farm issued a bond with 25 years to maturity and a semiannual coupon rate of 6…

A: Calculation of Total Book Value of Debt, Total Market Value of Debt and After-tax Cost of Debt:The…

Q: Several years ago, the ABC Company sold a $1,000 par value bond that now has 20 years to maturity…

A:

Q: The firm has bonds outstanding that mature in five years. The par value of each bond is $1,000, the…

A: Face value of bond is $1000 Coupon rate is 5% The bond pays annual coupons for 5 years until…

Q: Westco Co. issued 15-year bonds a year ago at a coupon rate of 5.4 percent. The bonds make…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: Assume that three years ago, you purchased a 10-year corporate bond that pays 8.0 percent. The…

A: Lets understand the basics. When market rate of interest rate is same as bond interest rate then…

Q: Jiminy's Cricket Farm issued a bond with 25 years to maturity and a semiannual coupon rate of 6…

A: This question has two parts: In part (a) we need to compute the pretax cost of debt. In part (b) we…

Q: One year ago a company issued 15-year, noncallable, 7.5% annual coupon bonds at their par value of…

A: Given information: Par value : $1,000 Coupon rate : 7.5% Market rate : 5.5% Time to maturity : 14…

Q: What is the bond's nominal coupon interest rate?

A: Face value FV = 1000 For semi annual N= 30*2=60 YTM= 10.55/2 = 5.275% Currnet price of bond = 925

Q: Several years ago, the ABC Company sold a $1,000 par value bond that now has 15 years to maturity…

A: The cost of raising the funds through borrowing or the financing cost is termed as the required rate…

Q: The Sky is the Limit, Inc., has a bond outstanding with a coupon rate of 6.2 percent and semiannual…

A: PERIOD (22*2) 44 COUPON RATE (6.20%/2) 3.10% PMT (COUPON AMOUNT) $31.00 PRESENT VALUE…

Q: The Altoona Company issued a 25-year bond 5 years ago with a face value of $1,000. The bond pays…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: The Altoona Company issued a 25-year bond 5 years ago with a face value of $1,000. The bond pays…

A: Price and interest rate are inversely related. When interest rate is increasing, price will be…

Q: BP has a bond outstanding with 15 years to maturity, a $1,000 par value, a coupon rate of 6.3%, with…

A: Cost of debt refers to the interest that companies pay on their debt. Companies can finance their…

Q: Jiminy's Cricket Farm Issued a bond with 30 years to maturity and a semiannual coupon rate of 6…

A: The Pre-tax cost of debt is the cost that is considered before taking tax into consideration. It is…

Q: Several years ago a company sold a $1,000 par value, noncallable bond that now has 20 years to…

A: The cost of debt can be solved with help of Rate Function of Excel. The Rate function can be found…

Q: In December 2002, DoubleDown, Inc. issued $100 million in bonds. These bonds originally had a 20…

A: Bonds: These are the interest-paying securities issued by a corporation or the government to raise…

Q: Mary's Institute issued a 30 year, 8% semi-annual bond 3 years ago. The bond currently sells for 93%…

A: Given:30 years, 8% semi annully bond, 3 year ago.selling at 93% of face value Tax rate=35%To…

Q: Last year, Denison Corporation raised $100 million through a new bond issuance. The bonds have a…

A: Amount of bonds = $100 Million Coupon rate = 3.2% Period 6 years YTM = 3.5%

Q: Dewey Cheetham & Howe Accounting firm is considering the purchase of a $1,000 New Haven Municipal…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Suppose Hillard Manufacturing sold an issue of bonds with a 30-year maturity, a $1,000 par value, a…

A: Discounting all the remaining future cash flows( Coupon + Principal) provides the present value.

Q: Stone Sour Corp. issued 20-year bonds two years ago at a coupon rate of 7.1 percent. The bonds make…

A: Given information: Face value of bond is $100 Selling price is $105 Maturity is 20 2 years ago…

Q: Pearce's Cricket Farm issued a 15-year, 10% semiannual bond 4 years ago. The Bohd 2uneny company's…

A: Bond Valuation The purpose of issuing the bond to raise the additional debt fund which are used for…

Q: Sarkozi Watches SpA issued 15-year bonds two years ago at a coupon rate of 7.8 percent. The bonds…

A: Has the bond is issued two years ago Number of years =NPER =(Number of years -2)*2 = (15-2)*2 = 26…

Q: Magliaro Industries issued a 30-year, 10% semiannual bond 4 years ago. The bond currently sells for…

A: Cost of debt is the total cost involved in raising debt funds for the company. It is generally…

Q: Suppose ABE Co. issued a 20-year, 8 percent coupon rate bond three years ago. The bond is currently…

A: YEARS (20-3) 17 COUPON RATE 8% PMT (COUPON AMOUNT) $80 PRESENT VALUE $715 FACE VALUE (FV)…

Q: Jiminy's Cricket Farm issued a bond with 25 years to maturity and a semiannual coupon rate of 6…

A: Given, Coupon rate = 6%

Q: ABC Retailers just issued 200 16-year bonds with face value of €5,000. The quoted price of those…

A: Face Value = €5,000 Quoted price = 96.268 Time Period = 16 Years Yield to Maturity = 5.27%

Q: year maturity date. The coupon rate is 8%, and interest is paid quarterly. The required nominal…

A: Bond price is the current discounted value of a bond's future cash stream.

Q: What is the interest payment for this bond annually e) What is the interest payment on…

A: Introduction: Bonds can be defined as fixed income instruments. In this case loan is provided by the…

Q: A $1,000 per value bond with a 5.8% coupon and semi-annual interest payments has 25 years to…

A: Given data, Face Value = $1000 Coupon rate = 5.8% Maturity = 25 years Current price = $1122.75

Q: West Corp. issued 15-year bonds two years ago at a coupon rate of 8.5 percent. The bonds make…

A: Note: Bond pays coupon semiannually NPER = Number of periods = (15-2)*2 = 26 PMT = Coupon =…

What is the current required rate of

FINA issued 30 year bond 5 years ago. The current market value of debt is 50 million. The face

Step by step

Solved in 3 steps

- Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: What are the steps in valuing a merger using the compressed APV approach?Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Why can’t we estimate LL’s value to Hager’s by discounting the FCFs at the WACC? What method is appropriate? Use the projections and other data to determine the LL division’s free cash flows and interest tax savings for 2020 through 2024. Notice that the LL division’s sales are expected to grow rapidly during the first years before leveling off at a sustainable long-term growth rate.Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Briefly describe the differences between a hostile merger and a friendly merger.

- Higgs Bassoon Corporation is a custom manufacturer of bassoons and other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs has $110 million face value, zero coupon debt that is due in 3 years. The risk-free rate is 5%, and the standard deviation of returns for similar companies is 60%. The owners of Higgs Bassoon view their equity investment as an option and would like to know the value of their investment. Using the Black-Scholes Option Pricing Model, how much is the equity worth? How much is the debt worth today? What is its yield? How much would the equity value and the yield on the debt change if Fethe's management were able to use risk management techniques to reduce its volatility to 45 percent? Can you explain this?Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 35%. It can issue preferred stock that pays a constant dividend of $3 per year at $44 per share. Also, its common stock currently sells for $36 per share; the next expected dividend, D1, is $3.75; and the dividend is expected to grow at a constant rate of 7% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. A. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Cost of debt Cost of preferred stock Cost of retained earnings B. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations.Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 35%. It can issue preferred stock that pays a constant dividend of $6 per year at $57 per share. Also, its common stock currently sells for $39 per share; the next expected dividend, D1, is $4.50; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Cost of debt _________% Cost…

- Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $4.00 per year at $57.00 per share. Also, its common stock currently sells for $41.00 per share; the next expected dividend, D1, is $3.75; and the dividend is expected to grow at a constant rate of 7% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two…Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $6.00 per year at $56.00 per share. Also, its common stock currently sells for $43.00 per share; the next expected dividend, D1, is $3.75; and the dividend is expected to grow at a constant rate of 7% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to…Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $4.00 per year at $48.00 per share. Also, its common stock currently sells for $33.00 per share; the next expected dividend, D1, is $4.25; and the dividend is expected to grow at a constant rate of 4% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two…

- Turnbull Co. is considering a project that requires an initial investment of $1,708,000. The firm will raise the $1,708,000 in capital by issuing $750,000 of debt at a before-tax cost of 11.1%, $78,000 of preferred stock at a cost of 12.2%, and $880,000 of equity at a cost of 14.7%. The firm faces a tax rate of 40%. What will be the WACC for this project?Adams Corporation is considering four averagerisk projects with the following costs and rates of return: ‘The company estimates that it can issue debt at a rate of ry = 10%, and ifs tax rate is 30%. It can issue preferred stock that pays a constant dividend of $5.00 per year at $49.00 per share. Also, ifs common stock currently sells for $36.00 per share; the next expected dividend, Dy, is $3.50; and the dividend is expected to grow at a constant rate of 6% per year. The target capital structure consists of 75% common stock, 15% debt, and 10%preferred stock.a. What is the cost of each of the capital components?b. What is Adams’s WACC?c. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adams accept?The Norris Company is looking to fund a new project with capital from both bondholders and shareholders. The company will collect 5,000 from bondholders demanding a 7.5% interest rate, with the other 50% of financing coming from shareholders. The company predicts there is a 55% chance the project will be a failure. The value of the project to the firm if the project is a success is $15,000, while the overall expected value of the project to the firm is $9,280. What are the expected returns for each investor?