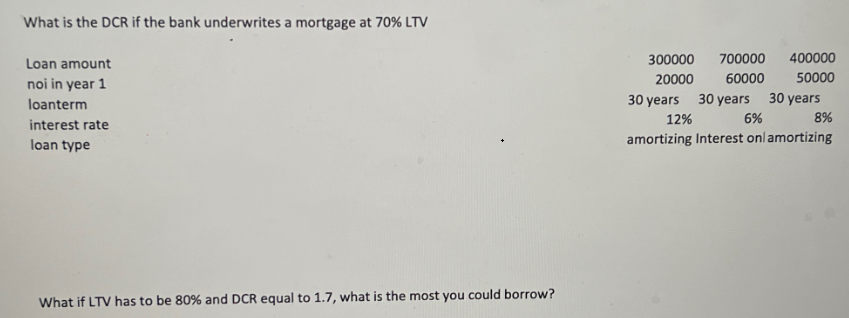

What is the DCR if the bank underwrites a mortgage at 70% LTV Loan amount noi in year 1 loanterm interest rate loan type What if LTV has to be 80% and DCR equal to 1.7, what is the most you could borrow? 300000 700000 400000 20000 60000 5000C 30 years 30 years 30 years 12% 6% 8% amortizing Interest onl amortizing

Q: Ayden's Toys, Incorporated, just purchased a $525,000 machine to produce toy cars. The machine will…

A: Financial break-even point refers to that point at which total revenue becomes equal to that of…

Q: You are managing a stock portfolio for a client that contains three assets, A, B, C. You currently…

A: Let's summarize the data given:Asset A: Expected return (E(r)) = 19%, Standard deviation (SD) =…

Q: You have found the following historical information for the Daniela Company: Stock price EPS Year 1…

A: The share price can be found by using various information available to the organization where price…

Q: You are offered the chance to participate in a project that produces the following cash flows: Co +$…

A: Cash Fow for Year 0 = cf0 = $6500Cash Fow for Year 1 = cf1 = $4750Cash Fow for Year 2 = cf2 =…

Q: A Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount…

A: A Treasury Bill is a short-term debt security issued by the U.S. government with a maturity…

Q: ou find the following Treasury bond quotes. To calculate the number of years until maturity, assume…

A: Par value =$1,000Payment frequencies = 2Current year = May 2022Maturity year = May 2049Coupon rate =…

Q: Calculate the correlation between the expected return and market capitalization for the following…

A: StockMarket Cap ($ MM)Liquidating dividend ($MM)A5001000B8001000C6001000D9001000To find: The…

Q: Baghiben

A: The objective of the question is to restate the given net cash flows in real terms and then discount…

Q: You have decided to refinance your mortgage. You plan to borrow whatever is outstanding on your…

A: Mortgage refers to an arrangement between borrower and lender of money in exchange of property as…

Q: Jason buys a large vacant lot in a predominantly residential neighborhood. He wants to build a…

A: The objective of the question is to identify the most likely reason why Jason would not be able to…

Q: As an Investment Analyst who researches and analyses markets, companies, and stocks to be invested…

A: Apple Inc. (AAPL)Financial Performance:Apple has shown robust financial performance with consistent…

Q: 21. NPV and Payback Period Kaleb Konstruction, Inc., has the following mutually exclusive projects…

A: Here, YearCash FlowsProject AProject B0 $ (195,000.00) $ (298,000.00)1 $…

Q: Under the terms of the deal, the CEO would step down from his position immediately. In exchange, he…

A: The abnormal return is the gap between what you anticipate and what really occurs when you invest in…

Q: Based on Exhibit 9.9 or using a financial calculator, what would be the monthly mortgage payments…

A: Loan amount 1 = $119,000Loan amount 2 = $103,000Loan amount 3 = $96,000Loan term 1 = 15 yearsLoan…

Q: An asset has an average return of 11.03 percent and a standard deviation of 21.10 percent. What…

A: Average return = 11.03%Standard deviation = 21.10%Probability = 95%,Z score equivalent to 95%…

Q: (Comprehensive problem) Over the past few years, Microsoft founder Bill Gates' net worth has…

A: Time value of money is the concept that a certain amount of money today is worth more than the same…

Q: Suppose that 6 - month, 12-month, 18 - month, 24 month, and 30 - month zero rates are 4%, 4.2%,…

A: The objective of the question is to calculate the cash price of a bond given the zero rates for…

Q: You work for a pharmaceutical company that has developed a new drug. The patent on the drug will…

A: The Present Value of a Growing Annuity refers to an annuity in which the amount increases after each…

Q: ($ thousands) Net cash flow Present value at 19% Net present value 0 1 3 -13,700 -13,700 3,541 (sum…

A: Net present value refers to the method of capital budgeting used for evaluating the viability of the…

Q: i need the answer quickly

A: Net Present Value (NPV) is an essential tool in capital budgeting and investment decision-making. It…

Q: The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year…

A: YearNominal returnInflation…

Q: You are the financial analyst for a tennis racket manufacturer. The company considering using a…

A: ScenarioPessimisticExpected OptimisticInitial Investment $ -13,18,000.00 $ -11,68,000.00 $…

Q: Mexican Motors' market cap is 200 billion pesos. Next year's free cash flow is 9.7 billion pesos.…

A: The question is based on the concept of valuing a company using the Gordon Growth Model, also known…

Q: The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year…

A: Returns refer to the income earned on an investment throughout the investment period, it constitutes…

Q: 2. Consider the production functions given below: a. Suppose that the production function faced by a…

A: The objective of the question is to analyze the production function of a bread producer, determine…

Q: Calculating Lessor Payment-Purchase Option Armstrong Inc. is negotiating an agreement to lease…

A: A lease payment is a contractual obligation that is comparable to monthly rent. It gives one party…

Q: Weston Corporation just paid a dividend of $3.5 a share (l.e., Do = $3.5). The dividend is expected…

A: The objective of the question is to calculate the expected dividend per share for each of the next 5…

Q: Stated Rate (APR) Number of Times Compounded 9.7 % Quarterly 18.7 Monthly 14.7 Daily 11.7 Infinite…

A: Effective Annual Rate is the actual rate earned on any investment when the interest is earned more…

Q: You are buying a house and will borrow $325,000 on a 25-year fixed rate mortgage with monthly…

A: Mortgage:A mortgage is a financial arrangement where a borrower obtains funds from a lender to…

Q: Bobbi Hilton, 62, is considering the purchase of a 77-year long-term care policy. If nursing home…

A: The objective of the question is to calculate the total amount Bobbi Hilton would have to pay…

Q: Scenario 1: An investment of $150,000 is expected to yield annual cash flows of $60,000 for three…

A: Initial investment = $150,000Expected annual cash flow for three years = $60,000

Q: Professor Wendy Smith has been offered the following opportunity: A law firm would like to retain…

A: IRR is the percentage of earning from the capital investment and as per the IRR rule the opportunity…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: Expected return of stock fund (S)17%Expected return of bond fund (B)11%Risk-free rate…

Q: Consider two mutually exclusive projects A and B: Project Cash Flows (dollars) NPV at 12% CO C 0 C1…

A: Project AProject BC0-$35,500-$55,500C1$25,400$38,500C2$25,400$38,500NPV@12%$7,427$9,567

Q: Current spot rate of CAD = $0.800. Interest rate in the U.S. = 7.0%. Interest rate in the Canada =…

A: > To Calculate the Covered Rate Of Return, Using the following formula:CRR = (forward rate/spot…

Q: Courtney Limited has capital project opportunities each of which would require an initial investment…

A: Net Present Value (NPV) is a financial measure used to analyze the profitability of an investment by…

Q: Calculate the NPV for each case for this project. Assume a negative taxable income generates a tax…

A: The net present value is a useful metric for determining the value of an investment. It compares the…

Q: Q3. Rock, Inc. has a 6% coupon bond that matures in 11 years. The bond pays interest quarterly. What…

A: The objective of this question is to calculate the market price of a bond given its face value,…

Q: A health insurance policy pays 80 percent of physical therapy costs after a deductible of $260. In…

A: The health insurance policy will pay 80% of the cost after a deductible of $260.It means out of…

Q: Suppose you purchase a bank accepted bill with a face value of $100,000. It has 120 days to maturity…

A: Bank accepted bills (BABs) don't have a traditional interest rate. Instead, the market sets an…

Q: You are considering making a movie. The movie is expected to cost $10.5 million up front and take a…

A: The payback period and NPV are essential capital budgeting techniques utilized to assess project…

Q: 6. Consider the following (incomplete) sinking fund schedule (table). Note that there is no payment…

A: A sinking fund is a specific savings account created to amass funds for an expense that has been…

Q: Estimating Share Value Using the DCF Model Following are forecasts of Home Depot's sales, net…

A: Value per share is the ratio computed by dividing the common shareholders by the number of…

Q: Lingenburger Cheese Corporation has 6.6 million shares of common stock outstanding, 235,000 shares…

A: Weighted average cost of capital is a metric which considers the market value of capital sources to…

Q: Suppose that you buy a two-year 8% bond at its face value. a. What will be your total nominal…

A: Rate = 8%Inflation rate in year 1 = 3%Inflation rate in year 2 = 5%

Q: Ted, Will, Mike, and Tom own a 20-room home as tenants in common. Mike and Tom, two of the owners,…

A: The question is asking whether Mike and Tom, who are part of a tenancy in common, can legally sell…

Q: Which of the following is NOT true O a. Futures contracts nearly always last longer than forward…

A: The following is not true:Answer: Futures contracts nearly always last longer than forward…

Q: Required: Fill in the table below for the following zero-coupon bonds, all of which have par values…

A: Zero Coupon Bonds are fixed-income securities that do not pay periodic interest but are sold at a…

Q: Village east expects to pay an annual dividend of $1.40 per share next year and skip dividends for…

A: This question is based on the concept of valuing stocks using the Dividend Discount Model (DDM).…

Q: The followings are the instructions for this case. Provide the excel file where the computations are…

A: To address your request, I visited Yahoo Finance and searched for Snap-On Tools (SNA) financial and…

Step by step

Solved in 3 steps with 2 images

- A mortgage has the following terms: Amount: $750,000 Rate: 6.25% Amortization (Years): 30 Term (Years): 20 Please determine the following: What is the Monthly Payment? In preparing an Income Statement, what is the Interest Expense for years 1 – 5? What is the Principal Balance at the end of year 6? What is the value of the loan at the expiration? If rates remain constant (flat), what would the benefit be to refinance this loan after year 10? do all the questions 1-5 and show the formulas in excel and show how you got itConsider a GNMA mortgage pool with principal of $50 million. The maturity is 30 years with a monthly mortgage payment of 13 percent per annum. Assume no prepayments. a) What is the monthly mortgage payment (100 percent amortizing) on the pool of mortgages? b)If the GNMA insurance fee is 5 basis points and the servicing fee is 45 basis points, what is the yield on the GNMA pass‑through? c) What is the monthly payment on the GNMA in part (b)? d)Calculate the first monthly servicing fee paid to the originating FIs. e) Calculate the first monthly insurance fee paid to GNMA.Consider a $100,000 30-year, fixed-rate mortgage with an annual interest rate of 5.50% and monthly payments. How much of the total expenses on mortgage payments go toward interest during the first three years (round to the nearest dollar)?$2, 540 $10, 220 $15,858 S4,274 $16, 167 $19, 172 $3,583

- A 30 year mortgage for $100,000 has been issued. The interet rate is 10% and payments are made anually. If your time value of money is 12%, what is the PW of the payments in Year-1 dollars if inflation is 0%, 3%, 6%, 9%?Consider a constant payment mortgage of $100,000, maturity 30 years, interest rate 6%, monthly payments. What is the value of the mortgage (PV of future cash flow) after 4 years, if the market yield after 4 years is: (a) 6% (b) 5% (c) 7%For a $100,000 mortgage for 25 years at a 11.5% rate (monthly payments), find 1) the monthly payment 2) the annual debt service and constant =(annual payments divided by loan amount) 3) the balance outstanding at the end of year 5 40 if 8.685 points are charged, what is the dollar amount actually loaned? 5) if the loan is held for 25 years, what is the yield to the lender? - hint - subtract 8.685% from the $100,000 loan amount and enter as negative PV, then enter the monthly payment amount as pmt, enter 300 as n, and solve for %I (and multiply the answer by 12 to get the annual rate).

- A borrower takes out a 30-year mortgage loan for $100,000with an interest rate of 6% plus 4 points. What is the effective annual interest rate on the loan if the loan is carried for all 30 years? A.) 6.4% B.) 6.0% C.) 6.6% D.) 5.6%1. You have just obtained a commercial mortgage for $6.25M with a 5-year term, 25-year amortization period and 6.50% mortgage interest rate. (a) Construct an amortization table for the term of the loan assuming annual payments. What is the annual payment? What is the balance at maturity? (b) What is the e¤ective cost of borrowing if the borrower pays an origination fee of $30,000? (c) The borrower can repay the balance of the loan at any time prior to its maturity, but must pay a penalty of 5% of the outstanding balance. What is the cost of borrowing if the borrower pays an origination fee of $30,000 and pays off the remaining balance of the loan after making payments for 4 years?Finance Assume we have a $500,000 mortgage at 3.5% original interest rate, with a 30-year term and monthly payments. The interest rate can be adjusted at the end of each year, and we assume the rate increases 0.15% after the first year and another 0.5% after the second year. What is the effective yield of the mortgage if the loan is paid off at the end of the third year?

- 9. Ms. Colonial has just taken out a $150,000 mortgage at an interest rate of 6 percent per year. If the mortgage calls for equal monthly payments for 20 years, what is the amount of each payment? (Assume monthly compounding or discounting.) A. $1,254.70B. $1,625.00C. $1,263.06D. $1,074.65Assume that you take out a 30-year mortgage (360 months) with a face value of $425,000 and a stated annual rate of 2.51%. Given this information, and assuming no prepayments, determine what percentage of your 153rd monthly payment will go towards interest. A) 51.15% B) 63% C) 53.37% D) 35.25% E) 41.06%Assume you borrow $10,000 today and promise to repay the loan in two payments, one in year 2 and the other in year 4, with the one in year 4 being only half as large as the one in year 2. At an interest rate of 10% per year, the size of the payment in year 4 will be closest to:a. $4280b. $3975c. $3850d. $2335