What is the difference between bad debts and doubtful debts?

eceivables arise due to a deferred sale, and companies are often unable to collect all their debts, which means that part of those debts may become non-existent or there is doubt about the possibility of collection.

1- What is the difference between

2- Draft an example (supported by numbers) to explain the method of doubtful debts in dealing with bad debts, provided that the explanation includes accounting restrictions and the impact on the financial statements?

3- Explain why the use of the direct method (bad debt method) conflicts with generally accepted accounting principles?

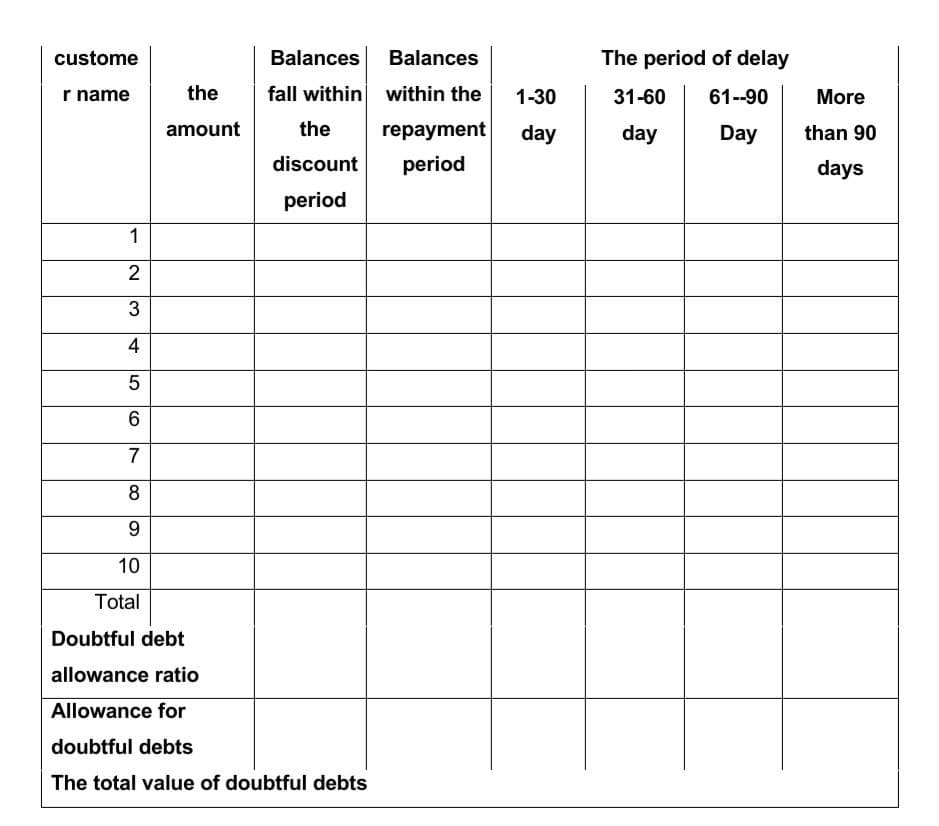

4- One of the methods for estimating doubtful debts is the deferred sales method, the receivables balance method, and the receivables aging method. Required: Formulate an example (enhanced by numbers) to explain the method of aging receivables in estimating doubtful debts, taking into account the following: (1) the number of clients should be 10 clients, (2) the percentages of the provision for doubtful debts should range between 1% -- 30%.

*** Note: The attached table can be use

Step by step

Solved in 3 steps