What is the effective annual return Friendly's earns on this lending business? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) If you were brave enough to ask, what APR would Friendly's say you were paying? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

What is the effective annual return Friendly's earns on this lending business? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) If you were brave enough to ask, what APR would Friendly's say you were paying? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 3P: Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of...

Related questions

Question

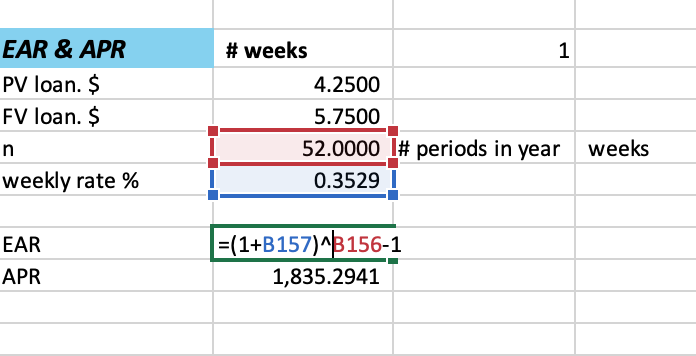

I dont understand how I keep getting the wrong EAR, is there something wrong with my Excel? I am inputting everything right

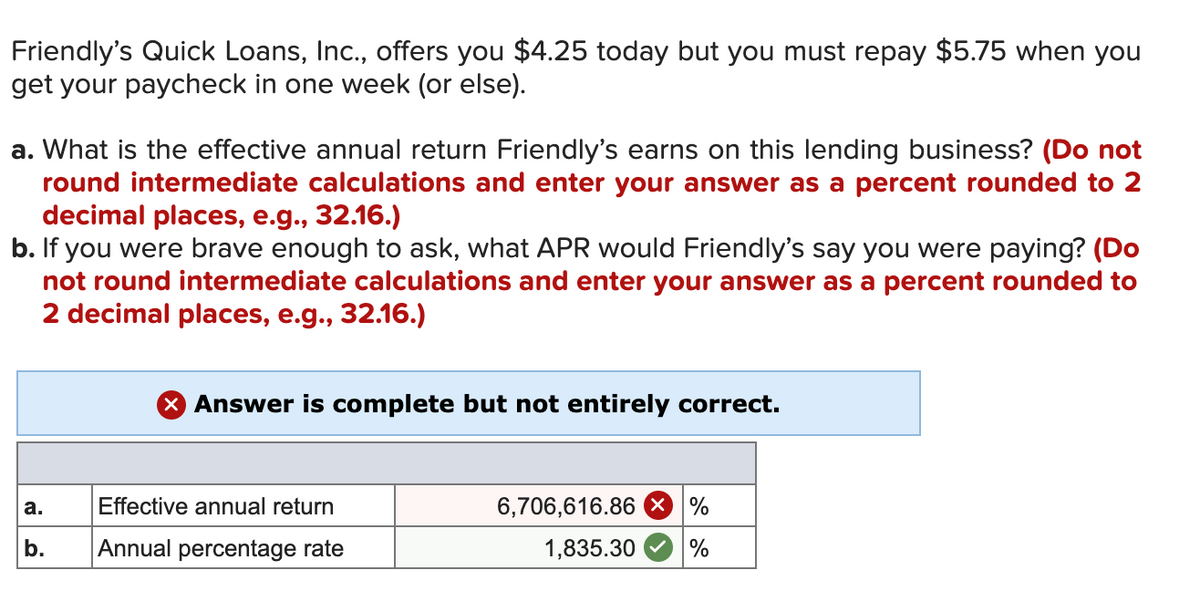

Transcribed Image Text:Friendly's Quick Loans, Inc., offers you $4.25 today but you must repay $5.75 when you

get your paycheck in one week (or else).

a. What is the effective annual return Friendly's earns on this lending business? (Do not

round intermediate calculations and enter your answer as a percent rounded to 2

decimal places, e.g., 32.16.)

b. If you were brave enough to ask, what APR would Friendly's say you were paying? (Do

not round intermediate calculations and enter your answer as a percent rounded to

2 decimal places, e.g., 32.16.)

X Answer is complete but not entirely correct.

Effective annual return

6,706,616.86 × %

а.

b.

Annual percentage rate

1,835.30

%

Transcribed Image Text:EAR & APR

# weeks

1

PV loan. $

4.2500

FV loan. $

5.7500

52.0000 I# periods in year weeks

weekly rate %

0.3529 |

EAR

=(1+B157)^B156-1

APR

1,835.2941

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College