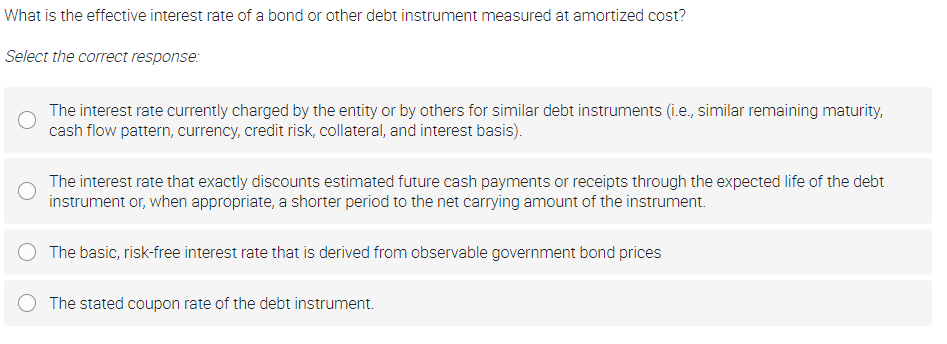

What is the effective interest rate of a bond or other debt instrument measured at amortized cost? Select the correct response: The interest rate currently charged by the entity or by others for similar debt instruments (i.e., similar remaining maturity, cash flow pattern, currency, credit risk, collateral, and interest basis). The interest rate that exactly discounts estimated future cash payments or receipts through the expected life of the debt instrument or, when appropriate, a shorter period to the net carrying amount of the instrument. The basic, risk-free interest rate that is derived from observable government bond prices The stated coupon rate of the debt instrument.

What is the effective interest rate of a bond or other debt instrument measured at amortized cost? Select the correct response: The interest rate currently charged by the entity or by others for similar debt instruments (i.e., similar remaining maturity, cash flow pattern, currency, credit risk, collateral, and interest basis). The interest rate that exactly discounts estimated future cash payments or receipts through the expected life of the debt instrument or, when appropriate, a shorter period to the net carrying amount of the instrument. The basic, risk-free interest rate that is derived from observable government bond prices The stated coupon rate of the debt instrument.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 10MC: The effective-interest method of bond amortization finds the difference between the ________ times...

Related questions

Question

100%

Transcribed Image Text:What is the effective interest rate of a bond or other debt instrument measured at amortized cost?

Select the correct response:

The interest rate currently charged by the entity or by others for similar debt instruments (i.e., similar remaining maturity,

cash flow pattern, currency, credit risk, collateral, and interest basis).

The interest rate that exactly discounts estimated future cash payments or receipts through the expected life of the debt

instrument or, when appropriate, a shorter period to the net carrying amount of the instrument.

The basic, risk-free interest rate that is derived from observable government bond prices

The stated coupon rate of the debt instrument.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning