Chapter3: International Financial Markets

Section: Chapter Questions

Problem 20QA

Related questions

Concept explainers

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Question

What is the expected return on the firms stock

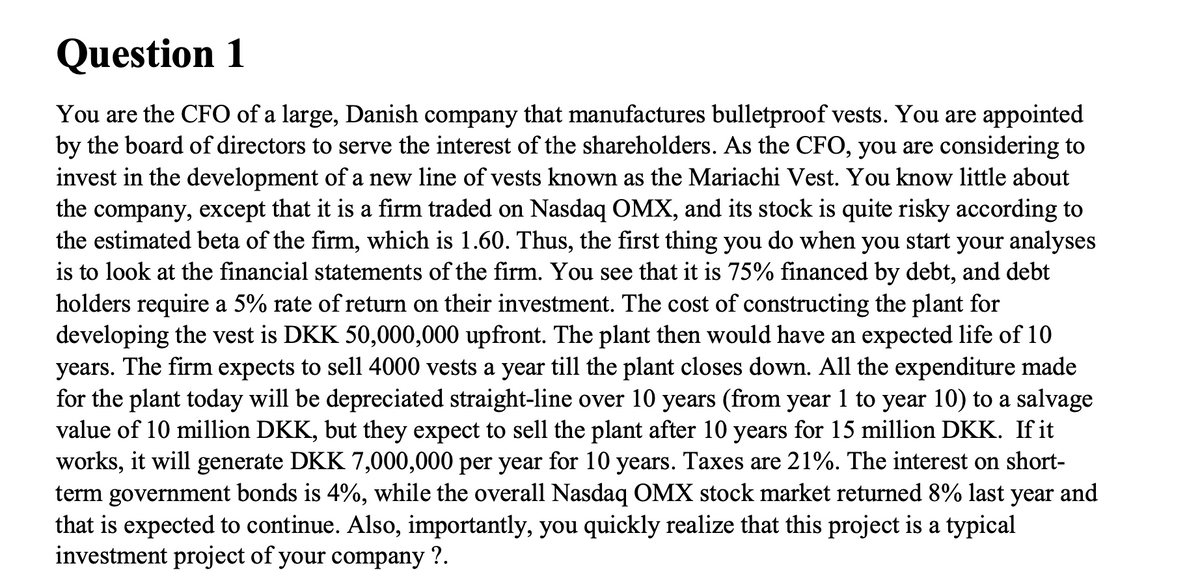

Transcribed Image Text:Question 1

You are the CFO of a large, Danish company that manufactures bulletproof vests. You are appointed

by the board of directors to serve the interest of the shareholders. As the CFO, you are considering to

invest in the development of a new line of vests known as the Mariachi Vest. You know little about

company, except that it is a firm traded on Nasdaq OMX, and its stock is quite risky according to

the estimated beta of the firm, which is 1.60. Thus, the first thing you do when you start your analyses

is to look at the financial statements of the firm. You see that it is 75% financed by debt, and debt

holders require a 5% rate of return on their investment. The cost of constructing the plant for

developing the vest is DKK 50,000,000 upfront. The plant then would have an expected life of 10

years. The firm expects to sell 4000 vests a year till the plant closes down. All the expenditure made

for the plant today will be depreciated straight-line over 10 years (from year 1 to year 10) to a salvage

value of 10 million DKK, but they expect to sell the plant after 10 years for 15 million DKK. If it

works, it will generate DKK 7,000,000 per year for 10 years. Taxes are 21%. The interest on short-

term government bonds is 4%, while the overall Nasdaq OMX stock market returned 8% last year and

that is expected to continue. Also, importantly, you quickly realize that this project is a typical

investment project of your company ?.

the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning