Q: Define beta risk

A: The portfolio beta is a measure of the portfolio’s volatility. It measures how the stock moves in…

Q: Define Efficient Markets Hypothesis (EMH

A: EMH states that prices of the securities (like stocks) reflect all the available info and data. The…

Q: What is the holding company's beta?

A: Beta refers to the concept of measuring the expected movement of stock in the overall market as a…

Q: Explain the concept of the world beta of a security

A: World beta is the measure of the volatility of returns of a stock or portfolio to the world stock…

Q: What is the beta of the portfolio held by Blue Co.?

A: Average beta = 1 (Always)

Q: What is levered beta?

A: Levered beta: Levered beta monitors the company’s risk with equity and debt in its structure of…

Q: What is the portfolio beta?

A: To calculate the portfolio beta we will multiply weight of each stock with beta of each stock.

Q: What is a yield curve, and what information would you need todraw this curve?

A: Yield curve: It could be a line plotting bond yields (coupon rates) of comparative credit quality…

Q: What is fundamental beta?

A: Introduction: Beta is nothing but a metric used to assess a portfolio’s uncertainty or risk, with a…

Q: Explain how we can calculate beta in practice. Briefly comment on methodology.

A: Beta is movement of stock prices of with the market index.

Q: What is beta?

A: Beta is the relativeness of the stock return with market returns. If the beta is more than 1, stock…

Q: Describe the intuition behind the Gordon growth model and the CAPM. What are the theoretical and…

A: Valuation of stock: Equity valuation refers to all tools and methodologies used by investors to…

Q: How do you calculate a weighted beta?

A: In portfolio there are number of stock present in portfolio. We have to calculate weight of each…

Q: What are all the possible values of Beta and what do they mean?

A: Beta is referred as a measurement tool of volatility or market risk. Beta of a security or an…

Q: Critically discuss the efficient market hypothesis

A: Efficient Market Hypothesis: The market is effective in handling data . Markets are correctly and…

Q: Why is FCF an important determinant of a firm’s value?

A: The cash available with a firm after paying operating expenses and capital expenditure of the firm…

Q: Do you think Polytech should be accepted as a new client? Create a PMI chart in analyzing this…

A: Auditing is the official inspection of the books of a company to determine whether they are…

Q: Define strong form of market efficiency

A: Strong form of market efficiency is considered to be the strongest form of efficient market…

Q: what are the sssumptions about market efficiency?

A: The theory that states that all the information available in the capital market is reflected in the…

Q: Why is beta the theoretically correct measure of a stock’s risk?

A: Introduction: Risk refers to the degree of volatility involved in the anticipated return on…

Q: how to calculate portfolio beta?

A: Beta is used while calculating the volatility of the investment. It measures the systematic risk of…

Q: What caused the potential for a bubble to develop?

A: The question is based on the concept of movement of stock price in stock market. The stock price…

Q: For a given firm, why does WACC change over time?Can the firm control the factors that lead to…

A: WACC is the weighted cost of funds to the firm. It represents the proportion of the different…

Q: . Which of the following business units has the highest beta factor?

A: Banks or any other business has one the feature or we can say a disadvantage which is the risk which…

Q: What is historical beta?

A: Step 1: Introduction Beta is a measure of systematic risk or it measures the volatility of a stock…

Q: What is market efficiency?

A: Market Efficiency term is taken from a paper written by Eugena Fama in 18970. Fama acknowledges that…

Q: What is beta in a single-index model. How do you calculate beta? Critically discuss the accuracy of…

A: Beta is the measure of the volatility of a security or a portfolio of an individual investor. Beta…

Q: Why is TIME the portfolio manager’s best friend?

A: Portfolio manager: Portfolio managers are specialists that manage investment portfolios in order to…

Q: Examine the weak, semi strong and the strong form if market efficiency, examine the various ways to…

A: Market efficiency refers to a market's ability to contain information that provides traders with the…

Q: What is the biggest advantage of using RI to evaluate investment centers?

A: The evaluation of investment centers based on whether the minimum rate of return of the company is…

Q: ■ What is the average beta?

A: Beta is a measure of Volatility and Systematic risk. Basically beta specifies the company position…

Q: Unlevered Beta is ? How it can be calculated?

A: Unlevered Beta: Unlevered beta is the beta of the firm without the impact of leverage or debt…

Q: What is a smart beta strategy? How does this strategy work

A: In the world of finance and investing there exists a concept called smart beta strategy.

Q: What is the beta for the other stock in your portfolio? What is the expected return of the risk-free…

A: Portfolio is the collection of securities or investments. It is the collection of securities…

Q: What is the Efficient Markets Hypothesis (EMH)?

A: Efficient market hypothesis (EMH): It is other ways known as efficient market theory, could be a…

Q: What is unlevered beta?

A: Unlevered Beta also known as asset beta is used to measure the market risk of the corporation…

Q: What is the expected rate of return on a security with beta = 0? 2.

A: In the given question we need to answer what will be the expected rate of return on a security if…

Q: Can someone explain and give an example of markowitz portfolio theory?

A: The question is based on the concept of Markowitz portfolio theory also called Modern portfolio…

Q: What must the beta of this stock be?

A: Beta is the value used to degree systematic risk or volatility. The beta represents the…

Q: Compare and contrast the beta of a project

A: Beta coefficient shows the systematic risk of the assets. In simple words, the beta coefficient…

Q: What is hedging and how is it different from diversification? If a firm needs to manage its risk,…

A: A hedge is an investment that is made fully intent on diminishing the danger of unfriendly value…

Q: Explain what is meant by beta. What risk does beta measure? What is the market return? How is the…

A: Beta is measure of risk and volatility of stock.

Q: Does it matter which beta is used, and if so, whichis best?

A: Beta value: It is the ratio of the volatility of a stock to that of the reference index. For Beta…

Step by step

Solved in 2 steps

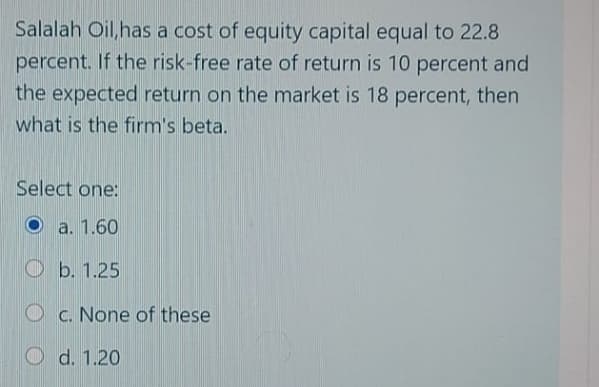

- Liu Industries is a highly levered firm. Suppose there is a large probability that Liu will default on its debt. The value of Lius operations is 4 million. The firms debt consists of 1-year, zero coupon bonds with a face value of 2 million. Lius volatility, , is 0.60, and the risk-free rate rRF is 6%. Because Lius debt is risky, its equity is like a call option and can be valued with the Black-Scholes Option Pricing Model (OPM). (See Chapter 8 for details of the OPM.) (1) What are the values of Lius stock and debt? What is the yield on the debt? (2) What are the values of Lius stock and debt for volatilities of 0.40 and 0.80? What are yields on the debt? (3) What incentives might the manager of Liu have if she understands the relationship between equity value and volatility? What might debtholders do in response?Salalah Oil,has a cost of equity capital equal to 22.8 percent. If the risk-free rate of return is 10 percent and the expected return on the market is 18 percent, then what is the firm's beta. Select one: a. None of these b. 1.20 c. 1.25 d. 1.60Terex company has a beta of 1.7 and is trying to calculate its cost of equity capital. If the risk-free rate of return is 5 percent and the average market return 16 percent, then what is the firm's after-tax cost of equity capital if the firm's marginal tax rate is 30 percent? Select one: a. 22.8 % b. 22.5 % c. 23.7 % d. None of these

- ABC, Inc. has equity beta of 1.75 with total assets financed with 80% of equity. The expected excess return on the market is 7 percent, and the risk-free rate is 3 percent. The firm is considering cutting total equity to 60% of total value. What would the cost of equity be if the firm meets its target?Landscapers R Us, Inc., has a beta of 1.6 and is trying to calculate its cost of equity capital. If the risk-free rate of return is 4 percent and the expected return on the market is 10 percent, then what is the firm's cost of equity capital?What would be the cost of retained earnings equity for Zola Mining if the expected return on S.A. Treasury Bills is 5.00%, the market risk premium is 10.00 percent, and the firm's beta is 1.3? Which answer is correct? A. 11.5% B. 18.0% C. 10.0% D. none of the above.

- Your estimate of the market risk premium is 6%. The risk-free rate of return is 1% and General Motors has a beta of 1.79. What is General Motors' cost of equity capital?Kaiser Aluminum has a beta of 0.70. If the risk-free rate (RRF) is 5.0%, and the market risk premium is (RPM) is 7.4 % what is the firm's cost of equity from retained earnings based on the CAPM?Your answer should be between 8.70 and 11.25, rounded to 2 decimal places, with no special characters.A. CALCULATE the cost of equity capital of H Ltd., whose risk-free rate of return equals 10%. The firm's beta equals 1.75 and the return on the market portfolio equals to 15%. B. The current ratio of H Ltd is 5:1 and standard current ratio given by accounting bodies is 2:1? Do you think that H Ltd should try to reduce its current ratio?

- Kaiser Aluminum has a beta of 0.70. If the risk-free rate (Rs) is 5.0%, and the market risk premium (RPM) is 7.4%, what is the firm's cost of equity from retained earnings based on the CAPM? Your answer should be between 8.70 and 11.25, rounded to 2 decimal places, with no special characters.The current beta for The Garner Company is 1.6. The risk-free rate of return is 3%, whereas the market risk premium is 7%. How much would the cost of equity rise if the company extends its operations to the point where its beta reaches 1.9?If a firm cannot invest retained earnings to earn a rate of return______________ (Pick either A- greater than or equal to or B- Less than) the required rate of return on retained earnings, it should return those funds to its stockholders. The current risk-free rate of return is 4.60% and the current market risk premium is 6.10%. Green Caterpillar Garden Supplies Inc. has a beta of 1.56. Using the Capital Asset Pricing Model (CAPM) approach, Green Caterpillar’s cost of equity is_____________% Cute Camel Woodcraft Company is closely held and, as a result, cannot generate reliable inputs for the CAPM approach. Cute Camel’s bonds yield 10.20%, and the firm’s analysts estimate that the firm’s risk premium on its stock relative to its bonds is 3.50%. Using the bond-yield-plus-risk-premium approach, the firm’s cost of equity is___________% The stock of Cold Goose Metal Works Inc. is currently selling for $25.67, and the firm expects its dividend to be $2.35…