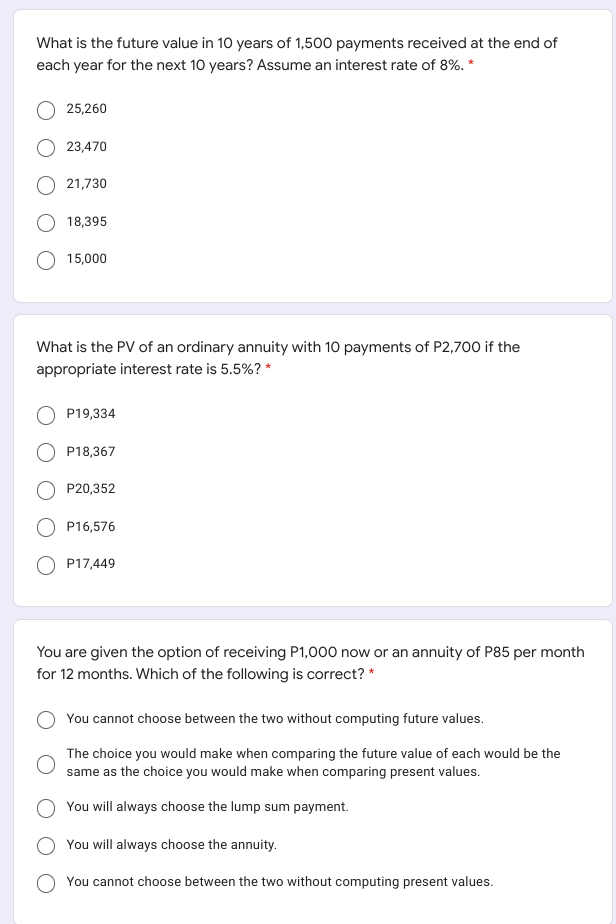

What is the future value in 10 years of 1,500 payments received at the end of each year for the next 10 years? Assume an interest rate of 8%. * 25,260 23,470 O 21,730 18,395 O 15,000

What is the future value in 10 years of 1,500 payments received at the end of each year for the next 10 years? Assume an interest rate of 8%. * 25,260 23,470 O 21,730 18,395 O 15,000

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 12MC: (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest...

Related questions

Question

Transcribed Image Text:What is the future value in 10 years of 1,500 payments received at the end of

each year for the next 10 years? Assume an interest rate of 8%. *

25,260

23,470

21,730

18,395

O 15,000

What is the PV of an ordinary annuity with 10 payments of P2,700 if the

appropriate interest rate is 5.5%? *

P19,334

P18,367

P20,352

P16,576

O P17,449

You are given the option of receiving P1,000 now or an annuity of P85 per month

for 12 months. Which of the following is correct? *

You cannot choose between the two without computing future values.

The choice you would make when comparing the future value of each would be the

same as the choice you would make when comparing present values.

You will always choose the lump sum payment.

You will always choose the annuity.

You cannot choose between the two without computing present values.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College