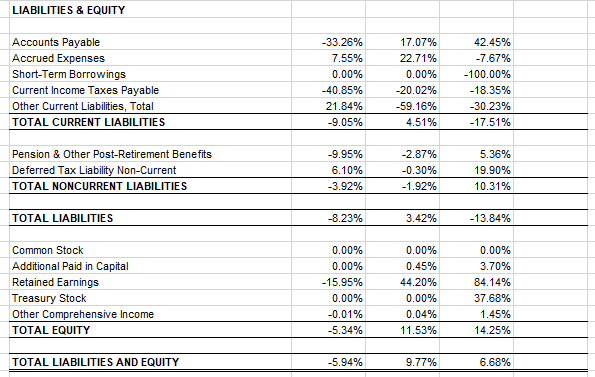

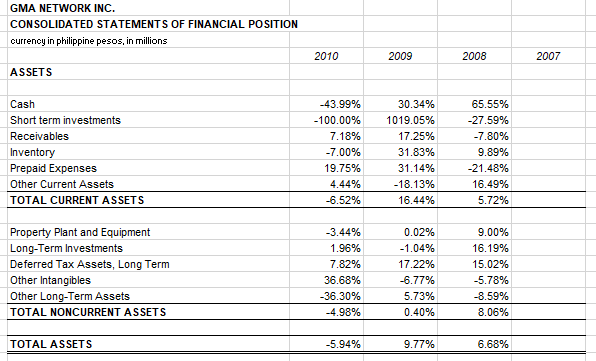

What is the general trend of the company’s current assets? Did you observe any account with significant fluctuations? What could be the reason for this? 2. What is the general trend of the company’s noncurrent assets? Did you observe any account with significant fluctuations? What could be the reason for this? 3. What is the general trend of the company’s current liabilities? Did you observe any account with significant fluctuations? What could be the reason for this?

1. What is the general trend of the company’s current assets? Did you observe any account with significant

fluctuations? What could be the reason for this?

2. What is the general trend of the company’s noncurrent assets? Did you observe any account with

significant fluctuations? What could be the reason for this?

3. What is the general trend of the company’s current liabilities? Did you observe any account with

significant fluctuations? What could be the reason for this?

4. What is the general trend of the company’s noncurrent liabilities? Did you observe any account with

significant fluctuations? What could be the reason for this?

5. What is the general trend of the company’s equity? Did you observe any account with significant

fluctuations? What could be the reason for this?

Step by step

Solved in 2 steps