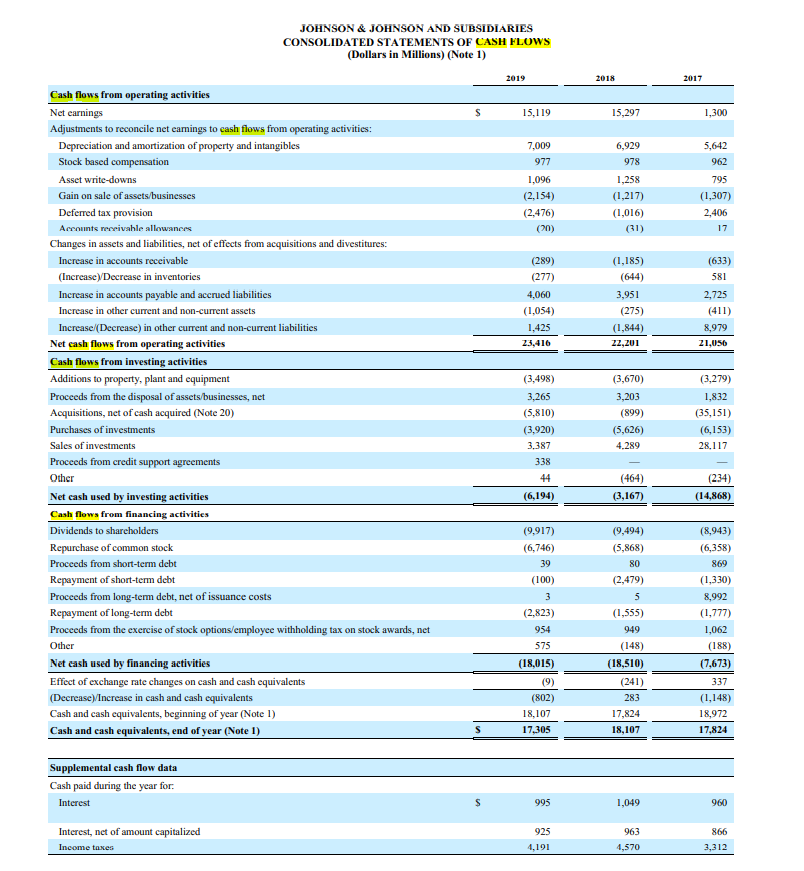

What is the largest investing activity outflow during the most recent year? (Indicate reconciling item and amount.) What was this transaction?

What is the largest investing activity outflow during the most recent year? (Indicate reconciling item and amount.) What was this transaction?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 40E

Related questions

Question

What is the largest investing activity outflow during the most recent year? (Indicate reconciling item and amount.) What was this transaction?

Transcribed Image Text:JOHNSON & JOHNSON AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Millions) (Note 1)

2019

2018

2017

Cash flows from operating activities

Net earnings

15,119

15,297

1,300

Adjustments to reconcile net eamings to cash flows from operating activities:

Depreciation and amortization of property and intangibles

7,009

6,929

5,642

Stock based compensation

977

978

962

Asset write-downs

1,096

1,258

795

Gain on sale of assets/businesses

(2,154)

(1,217)

(1,307)

Deferred tax provision

(2,476)

(1,016)

2,406

Accounts receivahle allowances

(20)

(31)

17

Changes in assets and liabilities, net of effects from acquisitions and divestitures:

Increase in accounts receivable

(289)

(1,185)

(633)

(Increase)/Decrease in inventories

(277)

(644)

581

Increase in accounts payable and accrued liabilities

4,060

3,951

2,725

Increase in other current and non-current assets

(1,054)

(275)

(411)

Increase/(Decrease) in other current and non-current liabilities

1,425

(1,844)

8,979

Net cash flows from operating activities

23,416

22,201

21,056

Cash flows from investing activities

Additions to property, plant and cquipment

(3,498)

(3,670)

(3,279)

Proceeds from the disposal of assets/businesses, net

3,265

3,203

1,832

Acquisitions, net of cash acquired (Note 20)

(5,810)

(899)

(35,151)

Purchases of investments

(3,920)

(5,626)

(6,153)

Sales of investments

3,387

4.289

28,117

Proceeds from credit support agreements

Other

338

44

(464)

(234)

Net cash used by investing activities

(6,194)

(3,167)

(14,868)

Cash flows from financing activities

Dividends to shareholders

(9,917)

(9,494)

(8,943)

(6,358)

Repurchase of common stock

Proceeds from short-term debt

(6,746)

(5,868)

39

80

869

Repayment of short-term debt

(100)

(2,479)

(1,330)

Proceeds from long-term debt, net of issuance costs

3

5

8,992

Repayment of long-term debt

(2,823)

(1,555)

(1,777)

Proceeds from the exercise of stock options/employec withholding tax on stock awards, net

954

949

1,062

Other

575

(148)

(188)

Net cash used by financing activities

(18,015)

(18,510)

(7,673)

Effect of exchange rate changes on cash and cash equivalents

(9)

(241)

337

(Decrease)/Increase in cash and cash equivalents

(802)

283

(1,148)

Cash and cash equivalents, beginning of year (Note 1)

18,107

17,824

18,972

Cash and cash equivalents, end of year (Note 1)

17,305

18,107

17,824

Supplemental cash flow data

Cash paid during the year for.

Interest

995

1,049

960

Interest, net of amount capitalized

925

963

866

Income taxes

4,191

4,570

3,312

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning