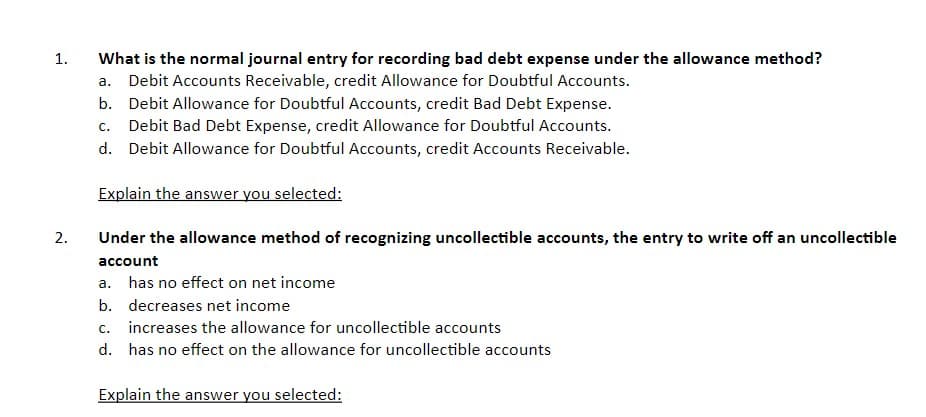

What is the normal journal entry for recording bad debt expense under the allowance method? a. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 1. b. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. c. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. d. Debit Allowance for Doubtful Accounts, credit Accounts Receivable. Explain the answer you selected: 2. Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account a. has no effect on net income b. decreases net income c. increases the allowance for uncollectible accounts d. has no effect on the allowance for uncollectible accounts

What is the normal journal entry for recording bad debt expense under the allowance method? a. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 1. b. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. c. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. d. Debit Allowance for Doubtful Accounts, credit Accounts Receivable. Explain the answer you selected: 2. Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account a. has no effect on net income b. decreases net income c. increases the allowance for uncollectible accounts d. has no effect on the allowance for uncollectible accounts

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 1BD

Related questions

Question

Transcribed Image Text:What is the normal journal entry for recording bad debt expense under the allowance method?

a. Debit Accounts Receivable, credit Allowance for Doubtful Accounts.

1.

b. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense.

Debit Bad Debt Expense, credit Allowance for Doubtful Accounts.

C.

d. Debit Allowance for Doubtful Accounts, credit Accounts Receivable.

Explain the answer you selected:

2.

Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible

account

а.

has no effect on net income

b. decreases net income

c. increases the allowance for uncollectible accounts

d. has no effect on the allowance for uncollectible accounts

Explain the answer you selected:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,