What is the operating cash flow in 2015? What is the change of working capital in 2015? What is the capital spending in 2015?

What is the operating cash flow in 2015? What is the change of working capital in 2015? What is the capital spending in 2015?

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

- What is the operating

cash flow in 2015? - What is the change of

working capital in 2015? - What is the capital spending in 2015?

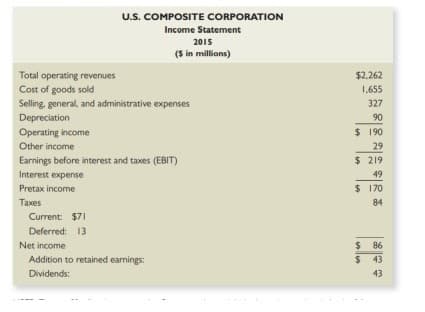

Transcribed Image Text:U.S.. COMPOSITE CORPORATION

Income Statement

2015

($ in millions)

Total operating revenues

Cost of goods sold

Selling, general, and administrative expenses

Depreciation

Operating income

$2,262

1,655

327

90

$ 1 90

Other income

29

Earnings before interest and taxes (EBIT)

$ 219

Interest expense

49

Pretax income

$ 170

Тахes

84

Current $71

Deferred: 13

Net income

%24

86

Addition to retained earnings:

43

Dividends:

43

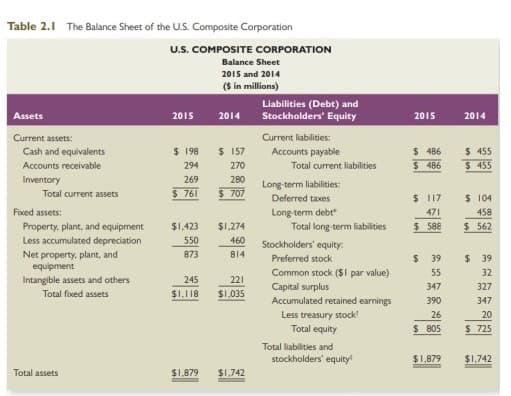

Transcribed Image Text:Table 2.1 The Balance Sheet of the U.S. Composite Corporation

U.S. COMPOSITE CORPORATION

Balance Sheet

2015 and 2014

($ in millions)

Liabilities (Debt) and

Stockholders' Equity

Assets

2015

2014

2015

2014

Current assets:

Current liabilities:

Cash and equivalents

$ 198

$ 157

$ 486

$ 486

$ 455

$ 455

Accounts payable

Accounts receivable

294

270

Total current liabilities

Inventory

Total current assets

269

280

Long-term liabilities:

$ 761

$ 707

Deferred taxes

$ 1 17

$ 104

Long-term debt

Total long-term liabilities

Fixed assets:

471

458

$ 588

Property, plant, and equipment

Less accumulated depreciation

$1,423

$1,274

$ 562

550

460

Stockholders' equity:

873

Net property, plant, and

equipment

814

Preferred stock

$ 39

$ 39

Common stock ($I par value)

55

32

Intangible assets and others

245

221

Capital surplus

Accumulated retained earnings

Less treasury stock

Total equity

347

327

Total fixed assets

$1.118

$1,035

390

347

26

20

$ 805

$ 725

Total liabilities and

stockholders' equity

$1,879

$1,742

Total assets

$1.879

$1,742

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning