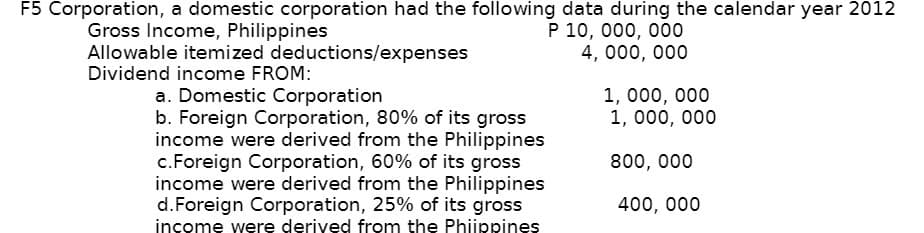

What is the Taxable Income? b. Assume F5 corporation is a resident foreign corporation, how much is the taxable income?

Q: ubject : Accounting Santana Rey receives the March bank statement for Business Solutions on April…

A: The bank reconciliation statement is prepared to find out the difference and reasons behind the bank…

Q: Calculate Asset Turnover for 2021 using the following information: Net Income Net Sales Total Assets…

A: Assets Turnover :— It is calculated by dividing total sales by average total assets. Asset…

Q: Luthan Company uses a plantwide predetermined overhead rate of $22.50 per direct labor-hour. This…

A: Manufacturing overhead is the amount of cost incurred by the entity on the making of the goods. It…

Q: The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next…

A: A cash budget is an estimate of a corporation's cash flows for a given time span. A cash budget is…

Q: Cala Manufacturing purchases land for $475,000 as part of its plans to build a new plant. The…

A: (1) Amount to be Capitalized as "Land" will include the following items- Purchase Price of Land All…

Q: operation activities profit for the year adjustments for depreciation amortization share of results…

A: A comparative analysis of the cash flow statement is done to analyze the corresponding changes in…

Q: The company adopted the straight-line depreciation method. Record the 15% depreciation on the plant…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: The following information pertains to Mason Company for Year 2. Beginning inventory 90 units @…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Question: I'm given a statement of owner's equity and I need to determine some of the missing…

A: Drawings are cash or non-cash withdrawals made by a proprietor or partner in a partnership firm for…

Q: s with a common characteristic, the total of which should equal the balance in the related ly known…

A: Control ledger is a summary account of individual accounts. It helps to keep track of the individual…

Q: Exercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has…

A: Net present value is difference between present value of cash inflows and present value of cash…

Q: Mr. Igiria started business on January 01, 2018, with cash of Kshs. 50,000, furniture of Kshs.…

A: As per the Honor code of Bartleby we are bound to give the answer of first three sub part only,…

Q: Calculate the Quick Ratio using the following information: Cash Short Term Investments Accounts…

A: QUICK RATIO Quick ratio is the one which is determined by the entity to know its liquidity…

Q: Set up and solve an equation for the following business situation. You are moving to a new home and…

A: Total rental cost of truck is the sum of all the costs relating to truck rental.

Q: Ellis Company has 2,000,000 shares of ordinary stock authorized with a par value of P3 per share of…

A: Lets understand the basics. Common stockholders are given dividend as a return on their investment.…

Q: Problem 6-11A The following information is available for The Coca-Cola Company (in U.S. millions):…

A: Lets understand the basics. Inventory turnover ratio indicates firm's ability to convert its…

Q: Prepare the relevant journal entries that are required in Corona Ltd's books for 10 July 2019 and 30…

A: As per International Accounting Standards, a Financial Liability shall be initially recognized at…

Q: XCountry Train Inc. specializes in trans-American moves for businesses and individuals through the…

A: Break-even is the point at which the entity is in a situation of no profit and no loss. It is the…

Q: The following data are available pertaining to Household Appliance Company's retiree health care…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: The following information is related to Concord Company for 2020. Retained earnings balance, January…

A: Dividends declared on preferred stock 78,400 Loss due to flood damage 382,200 500,000 shares of…

Q: The following information applies to the questions displayed below. The equity sections for Atticus…

A: The dividend is declared to the shareholders from the retained earnings of the business. The net…

Q: July August September October November December Units Produced 19.150 34,048 38,304 23,408 42,560…

A: Lets understand the basics. In high low method, total costs are bifurcated between the variable…

Q: Sheffield & Sons produces tomato juice and tomato puree from fresh tomatoes grown by local farmers.…

A: COST ALLOCATION When item of cost are Identifiable directly with some products or departments such…

Q: sh counts receivable wentory ore equipment cumulated depreciation counts payable ne of credit loan…

A: A cash budget is simply an estimation of cash inflows and cash outflows over a particular period of…

Q: On October 1, 2021, the Allegheny Corporation purchased equipment for $278,000. The estimated…

A: Depreciation Expense is incurred every year to account cost of use of assets like normal wear and…

Q: Derrick Wells decided to start a dental practice. The first five transactions for the business…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Subject: Work Space In The Home Costs During the current year, Jobul Krist has the following costs:…

A: The annual deduction that is claimed on depreciable assets in the Canadian tax system under the…

Q: O Calculate the amount required in the allowance for doubtful debts as on 31st December 2021, using…

A: Given in the question: Credit Sales = RO 550,000 Received from credit sales = RO 100,000 Allowance…

Q: Consider these transactions. (Credit account titles are automatically indented when amount is…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: A calendar year C corporation reports a $41,000 NOL in 2022, but it elects S status for 2023 and…

A: Net Operating losses- when the deductions of a taxable person are more than his income for the year,…

Q: When Bruno's basis in his LLC interest is $251,600, he receives cash of $100,640, a proportionate…

A: Rules for recognition and ordering Cash is distributed first Unrealized receivables and inventory…

Q: PLEASE PROVIDE ANSWER IN TEXT STEPWISE AND ALSO EXPLANATION OF ANSWER...? Nash's Trading Post,…

A: Retained earnings (RE) are that part of the profit that has been retained by a company in place of…

Q: Ponce Company has 50,000 shares of $100 par value, 8% cumulative preferred stock and 160,000 shares…

A: Dividend is the amount of return paid to the shareholders of the entity for investing in the…

Q: Instructions Chart of Accounts General Journal Income Statement Balance Sheet Instructions Southeast…

A: Unrealized gain or loss are the amount either up or down on the securities purchased but not yet…

Q: Elroy Corporation repurchased 3,900 shares of its own stock for $35 per share. The stock has a par…

A: Treasury stock is the shares bought back by the company which was already issued in the market at…

Q: On 1 July 2019 Melissa acquired an antique Camel statue for $300 which she kept in the hallway of…

A: Capital gain is the gain that represents the increase in the value of an asset over a considerable…

Q: Calculate the gross profit percentage using the following information: Net Sales Cost of Goods Sold…

A: Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue or Net…

Q: H7. What specific information would you need to begin a cash receipts forecast? Identify three…

A: Cash budget is a tool used by businesses to forecast their cash receipts and cash payments for…

Q: Instructions Chart of Accounts Instructions Journal Alpha Sounds Corp, an electric guitar retailer,…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Mary transfers assets that yield interest income of $2,300 each Missy, age 12. How will the interest…

A: Please find the answer to all questions in the steps below.

Q: Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's…

A: Average operating assets can be used in conjunction with other financial metrics, such as return on…

Q: On December 10, Daniel Co. split its stock 5-for-2 when the market value was P65 per share. Prior to…

A: Lets undersand the basics. The concept of stock split up is to indicate the effective increase of…

Q: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income…

A: According to the financial data given in the question, we need to prepare the statement of cash…

Q: When the accounts of Tamarisk Inc. are examined, the adjusting data listed below are uncovered on…

A: Adjusting entries: Adjusting entries are those entries that are recorded at the end of the year, to…

Q: A group of assets including land, a building, and equipment were purchased for $1,000,000. The…

A: The purchase price allocation for each asset can be calculated based on its relative fair market…

Q: The partnership agreement of Madi-Maxi Traders provided for the following: Balances on 1 March…

A: Journal entry It s a record of a business transactions in the business books. In double-entry…

Q: Which statement may not always hold true? A. Increase in the units sold always lead to unfavorable…

A: In the given question, Option B - "Increase in Sale Price will always lead to favorable sales…

Q: a) How many minutes of machine time are required for the company to fulfill all demand for all of…

A: In the given case machine time is constraint. Hence the product with highest contribution margin per…

Q: The following transaction occurred during March 2023, for Rehearsal Gift Shop, a SOLE…

A: "Since you posted multiple questions and we will answer one question for you. When multiple…

Q: Compute taxable income for 2022. Taxable income 252.185.71

A: Taxable Income(for a business entity) - It is the Income for a financial year which is derived after…

a. What is the Taxable Income?

b. Assume F5 corporation is a resident foreign corporation, how much is the taxable income?

Step by step

Solved in 4 steps

- 4. XYZcorporation reported the following gross income and expenses: Gross income in the Philippines is 38,000,000 while deductions is 15,000,000 for a total taxable income of 23,000,000. Abroad, the gross income is 14,000,000 while the deduction is 3,000,000 for a total taxable income of 11,000,000. Compute the income tax due for 2021 if XYZ is a domestic corporation. P10,200,000 P6,900,000 P8,500,000 P6,800,000BTS Corporation provided the following data for calendar year ending December 31, 2016: (1$ = P50) Philippines Abroad Gross income 4,000,000 $ 40,000 deductions 2,500,000 $15,000 Income tax paid $ 3,000If the corporation is a domestic corporation, its income tax payable is a. 450,000 b. 1,280,000 c. 825,000 d. 675,0004. Compute the income tax due for 2021 if XYZ is a domestic corporation. XYZ reported the following gross income and expenses: Philippines Abroad Gross income 38, 000, 000 14, 000, 000 52, 000, 000 Deductions 15, 000, 000 3, 000, 000 18, 000, 000 Taxable Income 23, 000, 000 11, 000, 000 34, 000, 000 P10,200,000 P6,900,000 P8,500,000 P6,800,000

- A resident foreign corporation has the following income and expenses for the year: Philippines Abroad Gross sales P100,000,000 P40,000,000 Cost of sales 40,000,000 20,000,000 Operating expenses 30,000,000 12,000,000 1. How much is the income tax due assuming the taxable year is 2021?2. Assuming the corporation is a nonresident foreign corporation and the taxable year is 2021, how much is the income tax due?Based on the below data, answer as required: WITHIN OUTSIDE Gross Income P8,000,000 P4,000,000 Business Expenses 5,000,000 3,000,000 Sale of land and warehouse (cost P2M) 3,000,000 A. If X is a domestic corporation, how much is the taxable income and income tax due in the Philippines per annual ITR? B. If X is a resident foreign corporation, how much is the taxable income and income tax due in the Philippines per annual ITR?A Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an non-resident owner or lessor of aircraft, machineries & other equipment A Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P500,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a business partnership organized in the Philippines Qalvin Corporation, a MSME, reported the following in 2023: in 2022:…

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation.Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation. (depends if it need the tabel)Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an International Carrier.

- The Tacurong Company has the following business income and expenses in year 2020: Gross Income From Philippine sources: From business P450,000 Dividends from domestic corporation 80,000 From Other Countries Saudi Arabia 180,000 Australia 75,000 Japan 190,000 Total Foreign Income Tax paid is P60,000 and Philippine quarterly income tax paid is P42,000. A. Compute for the income tax still due and payable if Tacurong is a domestic corporation. B. Compute for the tax still due and payable if Tacurong is a resident foreign corporation.1. BATO Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a domestic corporation with company assets amounting to more than P100M. Group of answer choices P837,500.00 P800,000.00 P492,500.00 P3,350,000.00 2. LENI Lugawan Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a resident corporation. Group of answer choices P600,000.00 P1,500,000.00 P500,000.00 3. YORMS Corp has the following data for the year ended December 31, 2021:…P Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Private Proprietary Educational Institution majority of its income is from related activities. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was incurred in connection with non-related activities. Compute the income tax due if all the income of Qalvin is used for educational purposes. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was…