What is the total amount of sales u a. 4,200,000 b. 4,220,000 c. 4,140,000 d. 4,160,000 What is the total amount of purcha a. 1,760,000 b. 2,100,000 с. 2,020,000 d. 1,680,000 What is the inventory on April 30? a. 1,476,000 b. 1,464,000 c. 1,440,000 d. 1,428,000 What is the fire loss to be recognize a. 1,440,000 b. 1,300,000 c. 1,340,000

What is the total amount of sales u a. 4,200,000 b. 4,220,000 c. 4,140,000 d. 4,160,000 What is the total amount of purcha a. 1,760,000 b. 2,100,000 с. 2,020,000 d. 1,680,000 What is the inventory on April 30? a. 1,476,000 b. 1,464,000 c. 1,440,000 d. 1,428,000 What is the fire loss to be recognize a. 1,440,000 b. 1,300,000 c. 1,340,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

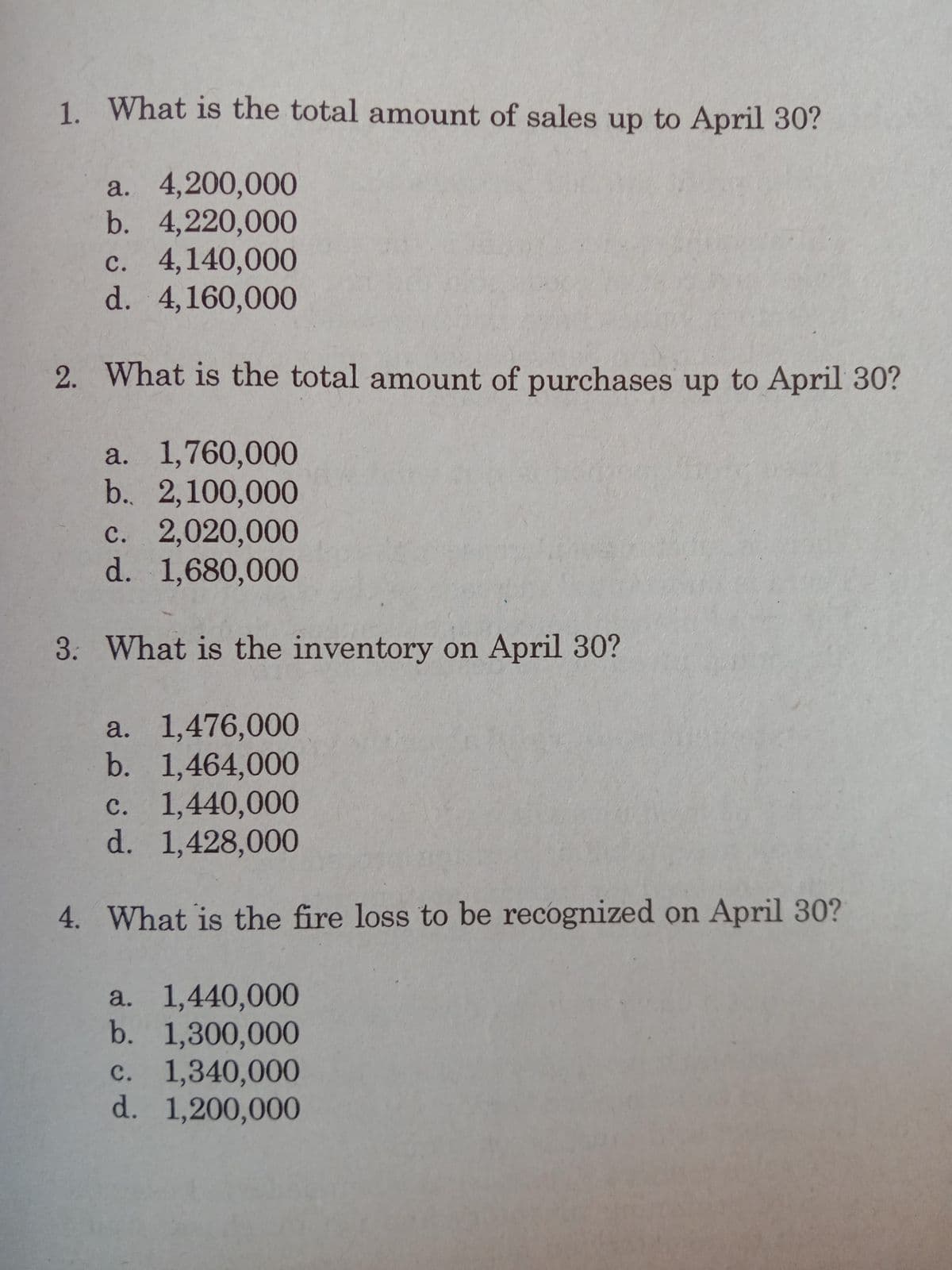

Transcribed Image Text:1. What is the total amount of sales up to April 30?

a. 4,200,000

b. 4,220,000

c. 4,140,000

d. 4,160,000

2. What is the total amount of purchases up to April 30?

a. 1,760,000

b. 2,100,000

с. 2,020,000

d. 1,680,000

3. What is the inventory on April 30?

a. 1,476,000

b. 1,464,000

c. 1,440,000

d. 1,428,000

4. What is the fire loss to be recognized on April 30?

a. 1,440,000

b. 1,300,000

c. 1,340,000

d. 1,200,000

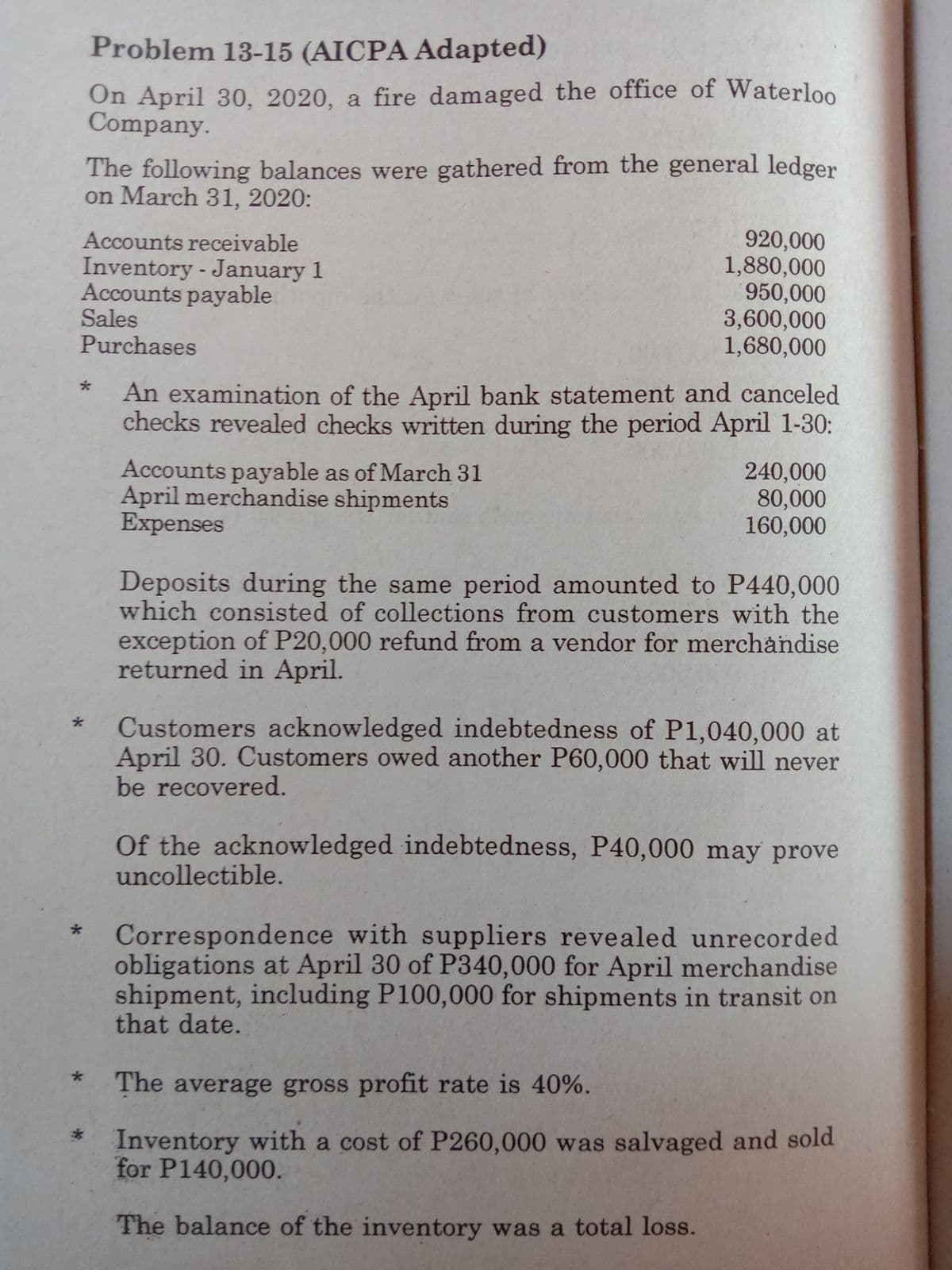

Transcribed Image Text:Problem 13-15 (AICPA Adapted)

On April 30, 2020, a fire damaged the office of Waterloo

Company.

The following balances were gathered from the general ledger

on March 31, 2020:

920,000

1,880,000

950,000

3,600,000

1,680,000

Accounts receivable

Inventory - January 1

Accounts payable

Sales

Purchases

An examination of the April bank statement and canceled

checks revealed checks written during the period April 1-30:

Accounts payable as of March 31

April merchandise shipments

Expenses

240,000

80,000

160,000

Deposits during the same period amounted to P440,000

which consisted of collections from customers with the

exception of P20,000 refund from a vendor for merchandise

returned in April.

Customers acknowledged indebtedness of P1,040,000 at

April 30. Customers owed another P60,000 that will never

be recovered.

Of the acknowledged indebtedness, P40,000 may prove

uncollectible.

Correspondence with suppliers revealed unrecorded

obligations at April 30 of P340,000 for April merchandise

shipment, including P100,000 for shipments in transit on

that date.

The average gross profit rate is 40%.

* Inventory with a cost of P260,000 was salvaged and sold

for P140,000.

The balance of the inventory was a total loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning