What is the totals credits and total debits? Also answer the following questions: Answer the following questions using the area provided. 1) Describe the type of transaction that is recorded in the Sales journal. What is happening and who is involved? 2) When merchandise is sold on account what account is debited? What type of account is this and what does it reflect 3) Why is Sales Tax Payable considered a liability to the business? 4) Why would the business want to record the customer name in the sales journal Account Debited column?

What is the totals credits and total debits? Also answer the following questions: Answer the following questions using the area provided. 1) Describe the type of transaction that is recorded in the Sales journal. What is happening and who is involved? 2) When merchandise is sold on account what account is debited? What type of account is this and what does it reflect 3) Why is Sales Tax Payable considered a liability to the business? 4) Why would the business want to record the customer name in the sales journal Account Debited column?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 33P

Related questions

Question

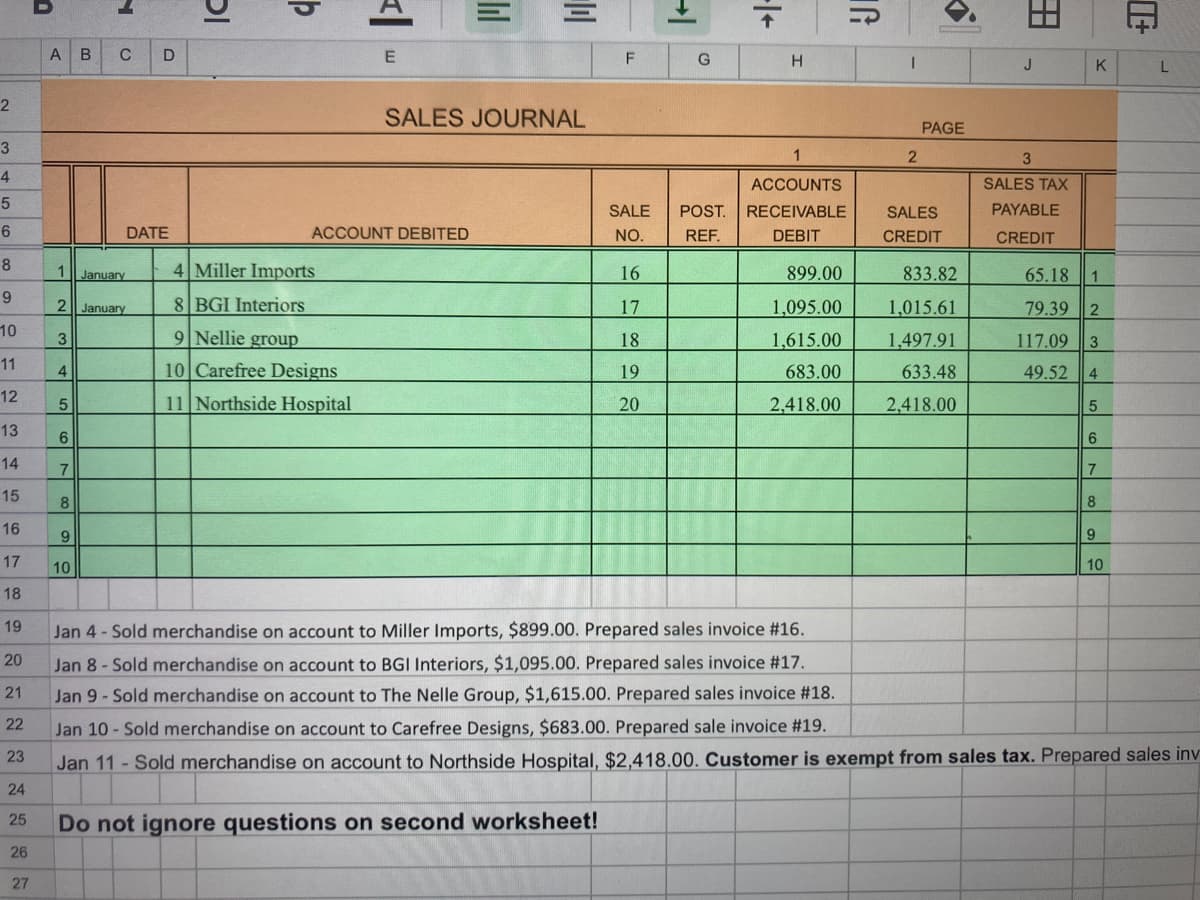

What is the totals credits and total debits?

Also answer the following questions:

Answer the following questions using the area provided.

1) Describe the type of transaction that is recorded in the Sales journal. What is happening and who is involved?

2) When merchandise is sold on account what account is debited? What type of account is this and what does it reflect

3) Why is Sales Tax Payable considered a liability to the business?

4) Why would the business want to record the customer name in the sales journal Account Debited column?

Transcribed Image Text:A B

C

F

J

K

SALES JOURNAL

PAGE

3

4

ACCOUNTS

SALES TAX

SALE

POST.

RECEIVABLE

SALES

PAYABLE

6.

DATE

ACCOUNT DEBITED

NÓ.

REF.

DEBIT

CREDIT

CREDIT

8

1| January

4 Miller Imports

16

899.00

833.82

65.18 1

9

January

8 BGI Interiors

17

1,095.00

1,015.61

79.39

10

9 Nellie group

1,615.00

1,497.91

3

18

117.09

3

11

4

10 Carefree Designs

19

683.00

633.48

49.52 4

12

11 Northside Hospital

20

2,418.00

2,418.00

13

14

7

15

8

8

16

9

9.

17

10

10

18

19

Jan 4 - Sold merchandise on account to Miller Imports, $899.00. Prepared sales invoice #16.

20

Jan 8- Sold merchandise on account to BGI Interiors, $1,095.00. Prepared sales invoice #17.

21

Jan 9-Sold merchandise on account to The Nelle Group, $1,615.00. Prepared sales invoice #18.

22

Jan 10- Sold merchandise on account to Carefree Designs, $683.00. Prepared sale invoice #19.

23

Jan 11 - Sold merchandise on account to Northside Hospital, $2,418.00. Customer is exempt from sales tax. Prepared sales inv

24

25

Do not ignore questions on second worksheet!

26

27

田

-/-

lil

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,