What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 3% but there is no change in investors' risk aversion, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. Assume now that there is no change in inflation, but risk aversion increases by 1%. What is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 3% and risk aversion increases by 1%, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places.

What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 3% but there is no change in investors' risk aversion, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. Assume now that there is no change in inflation, but risk aversion increases by 1%. What is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 3% and risk aversion increases by 1%, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 11QE: Market equity beta measures the covariability of a firms returns with all shares traded on the...

Related questions

Question

1

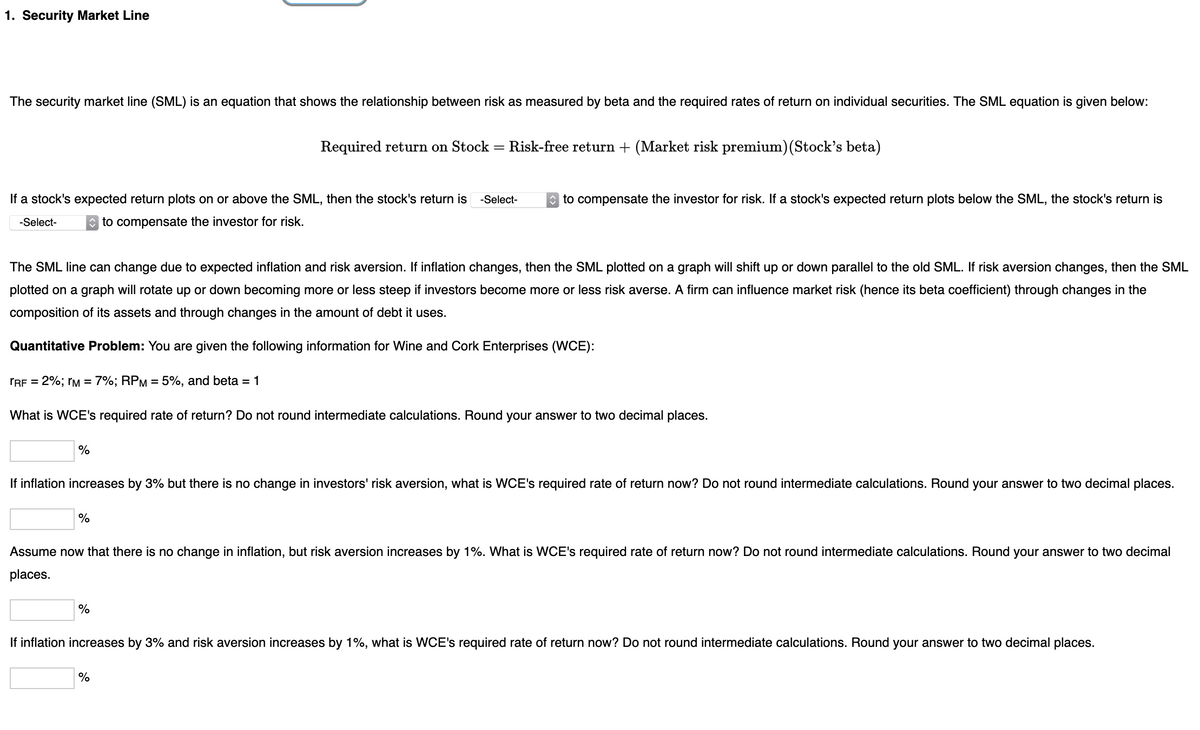

Transcribed Image Text:1. Security Market Line

The security market line (SML) is an equation that shows the relationship between risk as measured by beta and the required rates of return on individual securities. The SML equation is given below:

Required return on Stock =

Risk-free return + (Market risk premium)(Stock's beta)

If a stock's expected return plots on or above the SML, then the stock's return is

-Select-

O to compensate the investor for risk. If a stock's expected return plots below the SML, the stock's return is

-Select-

to compensate the investor for risk.

The SML line can change due to expected inflation and risk aversion. If inflation changes, then the SML plotted on a graph will shift up or down parallel to the old SML. If risk aversion changes, then the SML

plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the

composition of its assets and through changes in the amount of debt it uses.

Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE):

TRF = 2%; rM = 7%; RPM = 5%, and beta = 1

What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places.

%

If inflation increases by 3% but there is no change in investors' risk aversion, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places.

%

Assume now that there is no change in inflation, but risk aversion increases by 1%. What is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal

places.

%

If inflation increases by 3% and risk aversion increases by 1%, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning