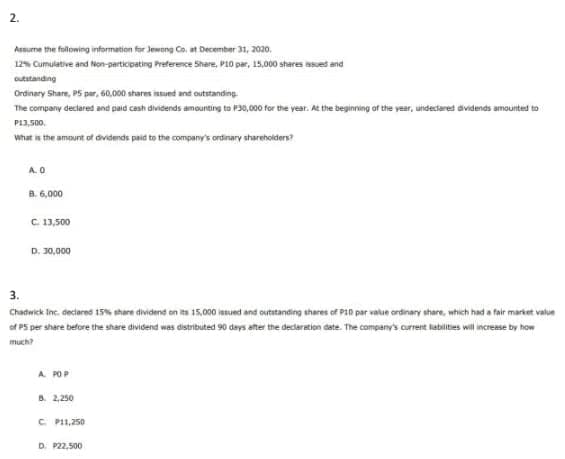

what the amount of dividends paid to the company's ordinary shareholders

Q: These are cumulative profits which are retained in the business and not yet distributed to the…

A: We prepare the following financial statements - Income statement Balance sheet Cash flows statement…

Q: Question Which of the following is NOT a form of corporate dividend? A. regular cash dividend…

A: Dividend: It can be defined as the distribution of the company’s after tax earnings to its…

Q: What is the capital called that is contributed to the corporation by the stockholders and others?…

A: Stockholders are the owners, who invest in the company in the form of cash or kind. They can be…

Q: declare the dividend

A: Proprietors and speculators in independent companies get an incentive from their possession stakes…

Q: What are some reasons corporations issue stock dividends?

A: Stock Dividends: It refers to the payment of dividends by a company to its existing shareholders, in…

Q: Retained earnings refer to the portion of a corporation's profits that are paid out to shareholders.…

A: B. false Retained earnings are not paid to shareholders. Generally dividend paid to shareholders ,…

Q: xplain the difference between a Shar

A: Efforts of various people in order to run a successful business and many people associated with the…

Q: When is a statement of shareholders' equity given, what information is included?

A: Statement of shareholders equity is also known as statement of changes in equity. This is a part of…

Q: Describe the procedures a company followswhen it makes a distribution through dividendpayments.

A: Answer: The company follows the following procedures through the dividend payments while making…

Q: Describe the statement of shareholders’ equity.

A: Shareholders’ equity: The claims of owners on a company’s resources, after the liabilities are paid…

Q: Comparing dividends per share to earnings per share indicates the extent to which the corporation is…

A: Dividend is the amount distributed to the shareholders out of excess profits.

Q: What is shareholders equity

A: Share holders are the real owners of the company. Formula: Share holders equity = Total Assets -…

Q: Describe the components of shareholders’ equity and explain how they are reported in a statement of…

A: A stockholders’ equity section is prepared by the company to measure the total amount of capital…

Q: Which method is used to distribute dividends to common share holders?

A: Dividend Dividend is the share of profit distributed to the shareholders of the company. When a…

Q: Briefly explain the concept of ex-dividend date, record date, date payable, dividend franking and…

A: Ex-dividend date: The ex-dividend date is a particular day on which stock goes ex-dividend. Such an…

Q: How is the accounting for a purchase of a company’s own stock (treasury stock) different from the…

A: A company’s stock is the shares a company holds or the shares on which a company has its ownership…

Q: What is the purpose of The Statement of Shareholders’ Equity?

A: Definition: Statement of stockholder’s equity: The statement which reports the changes in stock,…

Q: Why might earnings per share be more significant to a stock-holder in a large corporation than the…

A: Earnings per share: It is calculated by dividing the net income after making adjustments for…

Q: Why the agent issues dividend checks to the individual shareholders and sends the corporation a list…

A: Dividends are the distribution of profits to the shareholders of the company like equity…

Q: explain the difference between the net income and net income available for common shareholders.

A: Introduction:- i)Net income means as follows under:- Net income means deduction of all expenses…

Q: Which of the following affects the total Shareholders’ Equity? Appropriation of retained earnings…

A: Appropriation of retained earnings: The appropriation of retained earnings means to allocate the…

Q: How to make a shareholder's Equity? How to journalized retained earnings and dividends?

A: ‘’Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The balance of the income summary account of a corporation is transferred to which of the following…

A: Lets understand the basics. Net income is earned when revenue exceed the expenditure of corporation.…

Q: compute for the Equity Shareholder's Net Income

A:

Q: Explain the basis of corporate dividends, including the similarities and differencesbetween cash and…

A: Dividend: It is a distribution of profits by a corporation to their shareholders. When a company…

Q: Which of the following is considered as a liability in the balance sheet of a firm? Accounts…

A: Balance sheet of a firm involves both assets as well as liabilities

Q: In a limited company which of the following is shown in the statement of changes in equity? a.…

A: Statement of changes in equity: The statement of change in equity includes profit earned or transfer…

Q: A shareholder in a company:

A: Shareholders A person or entity who holds the shares or stocks of a company is known as shareholders…

Q: Dividends are paid to: a) The holders of record b) The holders of ex-dividends c) Bondholders d)…

A: Dividend are paid to shareholder on record date. The ex-dividend is the first date that the share…

Q: What is advantges and dis advantge of shares repurchacse to the company

A: A share repurchase is also known as buyback. Here the concerned company buys back its own shares…

Q: . Explain the accounting and reporting issues related to dividends.

A: Dividend Dividend are refer as the payment made by the company to their shareholders. When the…

Q: shareholders' equity section of the statement of financial position

A: A) 15% Mortgage Payable, due May 1, 2022 - It is a current liability. B) Allowance for Uncollectible…

Q: Enumerate and explain dividend of a company and also discuss the legal rules in regards to payment…

A: Dividend refers to the part of profit that is shared with the company’s shareholders when company…

Q: How would a share split affect the amount of total share capital, total shareholder's equity and…

A: Stock split results in division of outstanding shares. Hence, the total number of shares outstanding…

Q: Why the bank or trust company serving as stock transfer is usually appointed to distribute the…

A: Introduction: Bank or trust company serving as stock transfer is usually appointed to distribute the…

Q: When do dividends become legal debt of the company?

A: Once the dividend is declared by the company, it has to pay dividend in certain deadlines. It…

Q: What are the distribution of either cash or stock to shareholders by a corporation called?

A: A corporation distributes the amount of its earnings in form of cash or stock to its investors or…

Q: Discuss the impact of issuance of share dividends to the existing shareholders. Knowledge)

A: A stockholder is a person who owns stock in a company. Stockholders own a portion of the company. If…

Q: describe the components of shareholders’ equity

A: Shareholder's equity is calculated as the difference between the company's total assets and the…

Q: Which of the following dates has the shareholder theoretically realized income from dividend? a.…

A: Solution: The date when shareholders theortically realized income from dividends is "The date the…

Q: WHAT IS THE TOTAL SHAREHOLDERS' EQUITY?

A: Owner equity means the amount that belong to the owner of the business. Any profit will increase…

Q: which characteristics of a corporation limits a stockholder's loss to the amount of his or her…

A: Business organisation can take many forms like Sole Proprietorship, Partnership or Corporation.…

Step by step

Solved in 2 steps with 2 images

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Cumulative Preferred Dividends Capital stock of Barr Company includes: As of December 31, 2018, 2 years dividends are in arrears on the preferred stock. During 2019, Barr plans to pay dividends that total S360.000. Required: Determine the amount of dividends that will be paid to Barrs common and preferred stockholders in 2019. If Barr paid $280,000 of dividends, determine how much each group of stockholders would receive.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Common Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.

- Common Dividends Fusion Payroll Service began 2019 with 1,200,000 authorized and 375,000 issued and outstand ing $5 par common shares. During 2019, Fusion entered into the following transactions: Declared a S0.30 per-share cash dividend on March 10. Paid the $0.30 per-share dividend on April 10. Repurchased 8,000 common shares at a cost of $18 each on May 2. Sold 1.500 unissued common shares for $23 per share on June 9. Declared a $0.45 per-share cash dividend on August 10. Paid the $0.45 per-share dividend on September 10. Declared and paid a 5% stock dividend on October 15 when the market price of the common stock was $25 per share. Declared a $0.50 per-share cash dividend on November 10. Paid the $0.50 per-share dividend on December 10. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) Determine the total dollar amount of dividends (cash and stock) for the year. CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.