What total amount of additional paid-in capital will Campbell recognize from this acquisition?

What total amount of additional paid-in capital will Campbell recognize from this acquisition?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter14: Intercorporate Investments In Common Stock

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:QUESTION 1

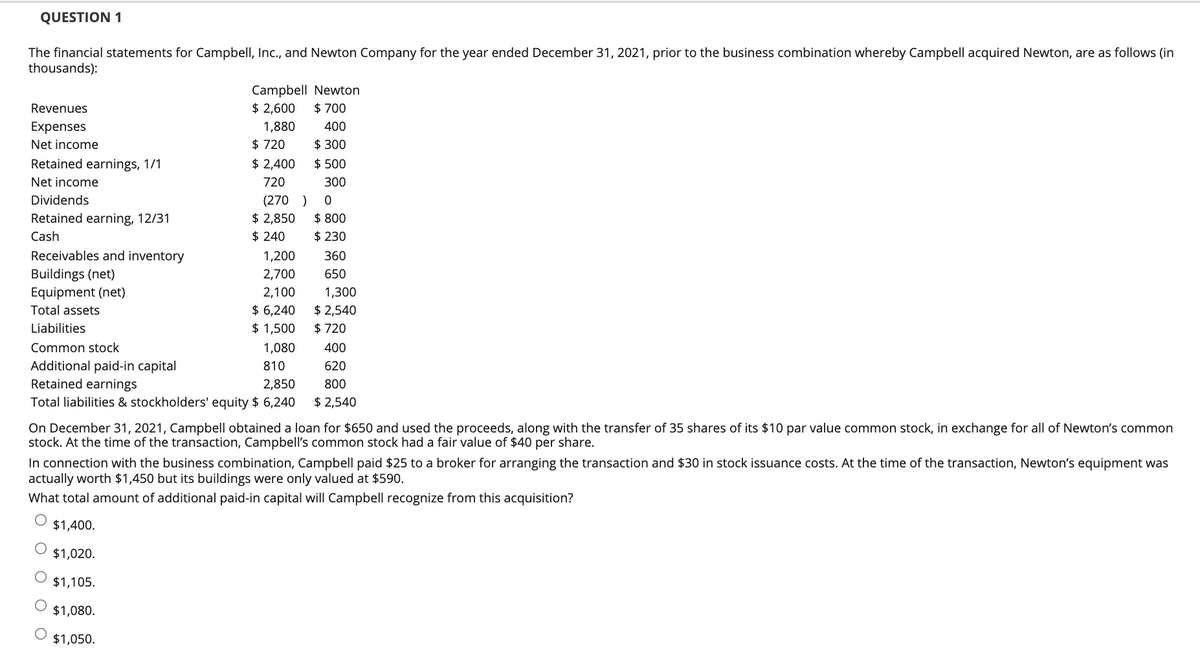

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in

thousands):

Revenues

Expenses

Net income

Retained earnings, 1/1

Net income

Dividends

Retained earning, 12/31

Cash

Receivables and inventory

Buildings (net)

Equipment (net)

Total assets

Liabilities

Common stock

Additional paid-in capital

Retained earnings

Campbell Newton

$ 2,600

$ 700

1,880

400

$300

$ 500

300

0

$ 800

$ 230

$ 720

$ 2,400

720

(270)

$ 2,850

$ 240

1,200

2,700

2,100

$ 6,240

$ 1,500

1,080

810

360

650

1,300

$ 2,540

$ 720

400

620

2,850

800

Total liabilities & stockholders' equity $ 6,240 $ 2,540

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common

stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.

In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was

actually worth $1,450 but its buildings were only valued at $590.

What total amount of additional paid-in capital will Campbell recognize from this acquisition?

$1,400.

$1,020.

$1,105.

$1,080.

$1,050.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning