Q: that today is December 31, 2021. Use the following information that applies to Harrison Corporation…

A: Corporate valuation approach use the free cash flow available and that is discounted on WACC and…

Q: Assume an investor with the coefficient of risk aversion A=5.5. To maximize her expected utility,…

A: Utility functions are used to measure the risk-reward tradeoff as the maximum return that a person…

Q: ABC Co. has recently purchased ordinary shares of XYZ Co, one of its competitors, as part of a…

A: a. Call option is purchased when the share price of a company is expected to increase in the future.…

Q: A proposed acquisition may create synergy by: I. increasing the market power of the…

A: Synergy is an important aspect of mergers and acquisitions. Synergy refers to all forms of benefits…

Q: What should be the firm’s growth rate in order to attain a weighted average cost of capital of…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: The common stock of Salazar Insurance pays a constant annual dividend of $4.80 per share. What is…

A: To calculate the value of stock we will use the following formula Stock value = Annual…

Q: You have $21,600 to invest in a stock portfolio. Your choices are Stock X with an expected return of…

A: To calculate the investment in stock X we will solve the following equation Portfolio return =…

Q: Please critically evaluate and discuss in detail how a deferred tax provision can arise under IAS…

A: Typically, publicly listed corporations are held to high standards. Small and midsized enterprises…

Q: Personal financial planning is the process of managing other people's money to achieve economic…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: A 5-year long-term corporate bond yields 12%. The real risk-free rate is 2%. Inflation is forecasted…

A: Interest rate determinants help in calculation required return on a debt security. But, if the value…

Q: Suppose that you have a plan to pay RO 0592 as an annuity at the end of n month for 20 years in the…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: ABC Co. bought 20 long forward contracts for corn at strike price of $3.67 per bushel (each contract…

A: To calculate the profit on forward contract we will use the formula as follows: Profit = (Market…

Q: Determine the monthly amortization for a 30-year mortgage of P6,000,000 at a 5% interest rate,…

A: This question is an application of annuity. The monthly amortization is the equal monthly instalment…

Q: Panelli's is analyzing a project with an initial cost of $139,000 and cash inflows of $74,000 in…

A: WACC = ( weight of equity * Cost of equity) + ( weight of debt * after Tax cost of debt) = ( 1/1.39…

Q: A common stock offers dividend of $2 next period and its price is $30 next period. Suppose that the…

A: Data given: Dividend next period= $2 Price next period = $30 Covariance of stock and market=24 Av.…

Q: Calculate the expected return, variance, and standard deviation for a portfolio of four equally…

A: The expected return of the portfolio is the return that an investor gets based on the weightage…

Q: The type of the risk that can be eliminated by diversification is called

A: the type of the risk that can be eliminated by diversification is called

Q: The company DstriBut.inc decides to take a technological shift by replacing its old distribution…

A: NPV NPV is a capital budgeting tool to decide on whether the capital project should be accepted or…

Q: ABC Inc., purchased 75,000 units call option on British pounds for $.021 per unit. The strike…

A: Answer - Calculation of Profit per unit on exercising the option - Exercise Price - $…

Q: revenue-generating and pricing mechanisms for a new traveling business site

A: The ways by which one can generate revenue for a new travelling business site are as follows:…

Q: True or False. 1. Financial goals can be classified as to timing and purpose. 2. Consumable-product…

A: Financial goals- are the target i.e., saving target, spending target , investment target, etc., set…

Q: hat the Duration of Assets (DA) is 5 years and the duration of liabilities (DL) is 3 years. The…

A: Duration of security tells us that how much will be change in value of security with change in…

Q: by Given that: Spot rate 1 month forward 3 month forward £1/$1.6365-1.6385 0.005-0.0047 0.0003 -…

A: We will take the spot rate as provided in the question and we will then solve for the one forward…

Q: 1. Graph investors' long-term expected inflation rate since 2003 by subtracting from the 10-year…

A: A financial crisis is any of a number of scenarios in which the nominal value of some financial…

Q: Changes in yield-to-maturity (YTM) produce market price risk and reinvestment risk. A __________ in…

A: The answer is option B. decrease/increase. A decrease in yield-to-maturity (YTM) increases a bond’s…

Q: a) Let's say you invest $10,000 into each account. What is the final amount after 10 years? b) How…

A: Future Value: It represents the future worth of the present amount and is estimated by compounding…

Q: Co. has a debt to equity ratio of 25% and a weighted average cost of capital at 25%. The firm used…

A: Debt to equity ratio = 0.25 Therefore; Debt = 0.25 Equity = 1 Total capital = 1.25 (i.e. 0.25 + 1)…

Q: d. Monthly e. Continuously

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: ABC Corporation has a developing market for its product. Good financial risk management will allow…

A: Financial risk management is the protection of the financial interests of a company from any…

Q: Identify the following interest rates as nominal or effective: (ABET, SO1) A: 1%= 6% per semiannual,…

A: Effective rate is the rate of return for particular period. Say 1 month, 1 year and compounded 1…

Q: An analyst is studying the movement of the stock Shrek. His research and came up with a different…

A: Probability of strong economy = 0.30 Probability of normal economy = 0.50 Probability of weak…

Q: A bank applies a semi-annually capitalized nominal rate of 11.8% for an investment. Calculate…

A: The effective rate for any period refers to the actual proportionate cost which will be paid for…

Q: direct-financing lease

A: A lease refers to the contract between two parties in which one party gives another the right to use…

Q: funde and exchange traded funds (ETES) is that:

A: A person looking to make investments in stocks and securities can consider different investment…

Q: With reference to IAS 16 (Property, Plant and Equipment), discuss the differences between “the cost…

A: Except when another standard requires or enables other accounting treatments, such as assets…

Q: Fatima buys an 11-year, $314,530, a zero-coupon bond with an annual YTM of 1.74%. If she sells the…

A: Zero coupon bond will not pay any coupon throughout its life, hence the present value of the bond…

Q: D3

A: A money market hedge is a method for securing in the value of a country's currency in a…

Q: Discuss to what extent deferred tax accounting can be used for income smoothing.

A: Deferred tax is referred as an income taxes for the tax on the losses or profits of the company…

Q: d liabil

A: The entire direct obligation that company owners and associates undertake for all commercial…

Q: What is the portfolio beta?

A: To calculate the portfolio beta we will multiply weight of each stock with beta of each stock.

Q: Coronary artery bypass grafting DRG price is $31,329. If the hospital agreed to a payment of $35,000…

A: To calculate the interest rate we will use time value of money concept as follows: Interest rate =…

Q: True or False 1. Personal financial planning pertains to assessment of one's current financial…

A: Financial planning is defined as the step by step approach for meeting an individual's life goals.…

Q: 1) The finance manager is required to lo into the financial implications of every decision in the…

A: Financial managers are concerned with financial aspect of each decision and increase the…

Q: What is the default risk premium imputed on the 1-year short-term corporate bond?

A: Default risk premium refers to the additional amount or higher interest rate which is paid by the…

Q: National Co.’s stock sells for P35 that recently paid a P5 dividend. The growth rate will remain the…

A: As per formula Cost of newly issued equity = [D0*(1+g)/(P0-F)]+g Where D0 - Recent dividend i.e. P5…

Q: Discuss the relative merits of different methods of corporate growth (e.g. internal development,…

A: Corporate expansion strategies and their accompanying economic benefits may be classified into at…

Q: The stock price is $25. A company has reported earnings per share (EPS) of $4.60 and has a dividend…

A: Stock price per share of a company is the value placed by the investors on a stock. Earnings per…

Q: can i get solution with manual formula that i can apply through using my calculator

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: What does it mean when a person is unbanked? And how does fintech actually integrate themselves into…

A: Financial technology is a combination of technology and innovation aimed at competing with…

Q: Identify the type of merger in the following case: ABC manufactures furniture. It acquired a…

A: Merger means acquistion of one business by another. There are two parties involved in merger…

10

Step by step

Solved in 2 steps with 2 images

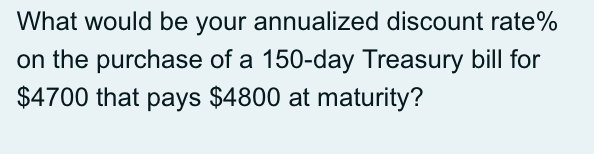

- Define the stated (quoted) or nominal rate INOM as well as the periodic rate IPER. Will the future value be larger or smaller if we compound an initial amount more often than annually—for example, every 6 months, or semiannually—holding the stated interest rate constant? Why? What is the future value of $100 after 5 years under 12% annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? What is the effective annual rate (EAR or EFF%)? What is the EFF% for a nominal rate of 12%, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily?What would be your annualized discount rate % on the purchase of a 182-day Treasury bill for 4790 that pays 4850 at maturity?What is the annualized investment rate % on a Treasury bill that you purchase for 9310 that will mature in 91 days for 9533?

- Calculate the price of a 180-day Treasury bill purchased at a 5% discount rate if the T-bill has a face value of £5,000.Calculate the percentage return on a 1-year Treasury bill with a face value of $10,000if you pay $9,138.01to purchase it and receive its full face value at maturity. The percentage return is ______%. (Round to two decimal places.)Calculate the percentage return on a 1-year Treasury bill with a face value of $10 comma 00010,000 if you pay $9 comma 859.819,859.81 to purchase it and receive its full face value at maturity.

- To buy a Treasury bill (T-bill) that matures to $10,000 in 6 months, you must pay $9720. What annual simple interest rate does this earn? (Round your answer to one decimal place.)Which one is the approximate periodic interest rate % on a Treasury bill that you purchase for 4,908 $ that will mature in 270 days for 5,000 $? (Assume one year is 360 days)You can purchase a 1 million treasury bill that is currently selling on a discount basis at 97 1/2 % of its face value. The T-bill is 140 days from maturity. what is the Discount Yield rate?

- If you want to earn an annualized investment rate of 3%, what is the most you can pay for a 91-day Treasury bill that pays 5100 at maturity?You have purchased a $1,000 Face Value, 9-month (270-day) Treasury-bill (T-bill) with a quoted market discount yield equal to 5.25%. What is the annual money market yield for this 270-day T-bill?What is the purchase price of a 50-day T-bill with a maturity value of $1,421 that earns an annual interest rate of 4.446%? ( Assume a 360-day a years)