What would the journal entries be for the transactions noted above? Assume that all amounts are paid in cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

What would the journal entries be for the transactions noted above? Assume that all amounts are paid in cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 91IP

Related questions

Question

G.230.

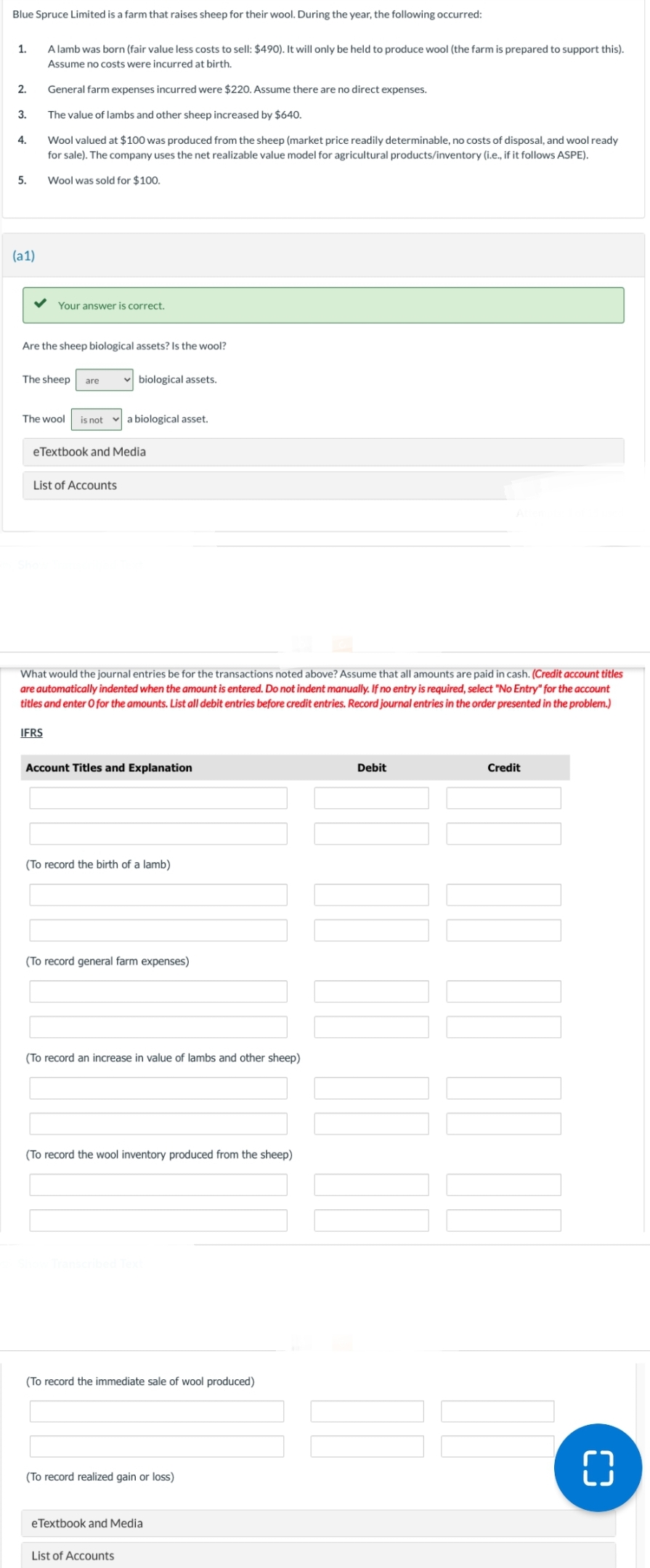

Transcribed Image Text:Blue Spruce Limited is a farm that raises sheep for their wool. During the year, the following occurred:

1.

2.

3.

4.

5.

(a1)

A lamb was born (fair value less costs to sell: $490). It will only be held to produce wool (the farm is prepared to support this).

Assume no costs were incurred at birth.

General farm expenses incurred were $220. Assume there are no direct expenses.

The value of lambs and other sheep increased by $640.

Wool valued at $100 was produced from the sheep (market price readily determinable, no costs of disposal, and wool ready

for sale). The company uses the net realizable value model for agricultural products/inventory (i.e., if it follows ASPE).

Wool was sold for $100.

Your answer is correct.

Are the sheep biological assets? Is the wool?

The sheep are

The wool is not a biological asset.

eTextbook and Media

List of Accounts

IFRS

✓biological assets.

What would the journal entries be for the transactions noted above? Assume that all amounts are paid in cash. (Credit account titles

are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account

titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

Account Titles and Explanation

(To record the birth of a lamb)

(To record general farm expenses)

(To record an increase in value of lambs and other sheep)

(To record the wool inventory produced from the sheep)

(To record the immediate sale of wool produced)

(To record realized gain or loss)

eTextbook and Media

List of Accounts

Debit

Credit

_

()

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT