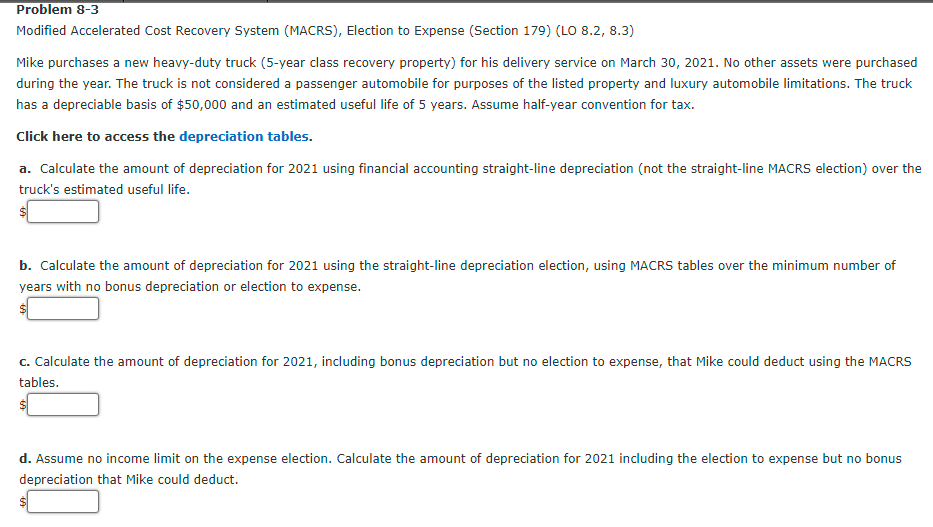

Modified Accelerated Cost Recovery System (MACRS), Election to Expense (Section 179) (LO 8.2, 8.3) Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2021. No other assets were purchased during the year. The truck is not considered a passenger automobile for purposes of the listed property and luxury automobile limitations. The truck has a depreciable basis of $50,000 and an estimated useful life of 5 years. Assume half-year convention for tax. Click here to access the depreciation tables. a. Calculate the amount of depreciation for 2021 using financial accounting straight-line depreciation (not the straight-line MACRS election) over the truck's estimated useful life. b. Calculate the amount of depreciation for 2021 using the straight-line depreciation election, using MACRS tables over the minimum number of years with no bonus depreciation or election to expense. c. Calculate the amount of depreciation for 2021, including bonus depreciation but no election to expense, that Mike could deduct using the MACRS tables.

Modified Accelerated Cost Recovery System (MACRS), Election to Expense (Section 179) (LO 8.2, 8.3) Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2021. No other assets were purchased during the year. The truck is not considered a passenger automobile for purposes of the listed property and luxury automobile limitations. The truck has a depreciable basis of $50,000 and an estimated useful life of 5 years. Assume half-year convention for tax. Click here to access the depreciation tables. a. Calculate the amount of depreciation for 2021 using financial accounting straight-line depreciation (not the straight-line MACRS election) over the truck's estimated useful life. b. Calculate the amount of depreciation for 2021 using the straight-line depreciation election, using MACRS tables over the minimum number of years with no bonus depreciation or election to expense. c. Calculate the amount of depreciation for 2021, including bonus depreciation but no election to expense, that Mike could deduct using the MACRS tables.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

100%

Transcribed Image Text:Problem 8-3

Modified Accelerated Cost Recovery System (MACRS), Election to Expense (Section 179) (LO 8.2, 8.3)

Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2021. No other assets were purchased

during the year. The truck is not considered a passenger automobile for purposes of the listed property and luxury automobile limitations. The truck

has a depreciable basis of $50,000 and an estimated useful life of 5 years. Assume half-year convention for tax.

Click here to access the depreciation tables.

a. Calculate the amount of depreciation for 2021 using financial accounting straight-line depreciation (not the straight-line MACRS election) over the

truck's estimated useful life.

b. Calculate the amount of depreciation for 2021 using the straight-line depreciation election, using MACRS tables over the minimum number of

years with no bonus depreciation or election to expense.

$1

c. Calculate the amount of depreciation for 2021, including bonus depreciation but no election to expense, that Mike could deduct using the MACRS

tables.

$1

d. Assume no income limit on the expense election. Calculate the amount of depreciation for 2021 including the election to expense but no bonus

depreciation that Mike could deduct.

Expert Solution

Step 1

Note:

Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and specify the other subparts (up to 3) you’d like answered.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT