When Kelsey receives the first $1,200 monthly annuity payment, how much will be taxable and how much will be a nontaxable return of basis? b. Kelsey lives to age 92. What is the tax effect of each monthly annuity payment she receives after age 85? c. Instead, Kelsey dies after receiving all of her monthly payments for age 80. What is the amount of her unrecovered basis and how is it treated for tax purposes? а.

When Kelsey receives the first $1,200 monthly annuity payment, how much will be taxable and how much will be a nontaxable return of basis? b. Kelsey lives to age 92. What is the tax effect of each monthly annuity payment she receives after age 85? c. Instead, Kelsey dies after receiving all of her monthly payments for age 80. What is the amount of her unrecovered basis and how is it treated for tax purposes? а.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 52P

Related questions

Question

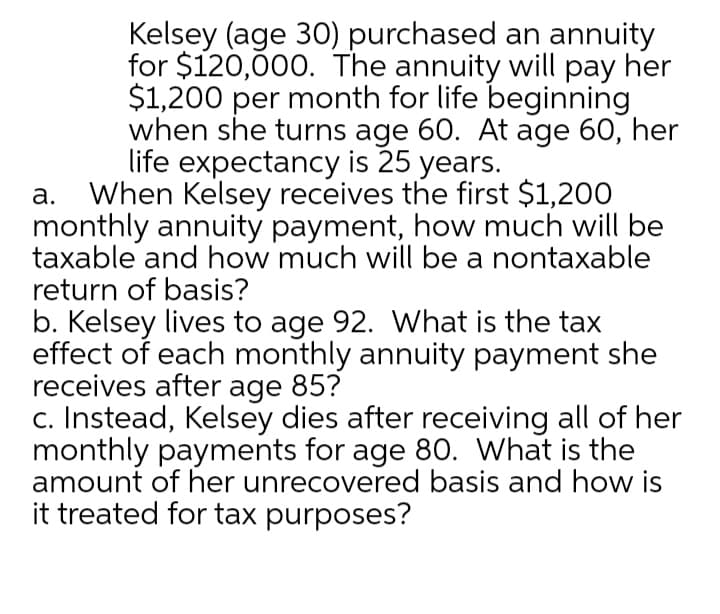

Transcribed Image Text:Kelsey (age 30) purchased an annuity

for $120,00. The annuity will pay her

$1,200 per month for life beginning

when she turns age 60. At age 60, her

life expectancy is 25 years.

a. When Kelsey receives the first $1,200

monthly annuity payment, how much will be

taxable and how much will be a nontaxable

return of basis?

b. Kelsey lives to age 92. What is the tax

effect of each monthly annuity payment she

receives after age 85?

c. Instead, Kelsey dies after receiving all of her

monthly payments for age 80. What is the

amount of her unrecovered basis and how is

it treated for tax purposes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT