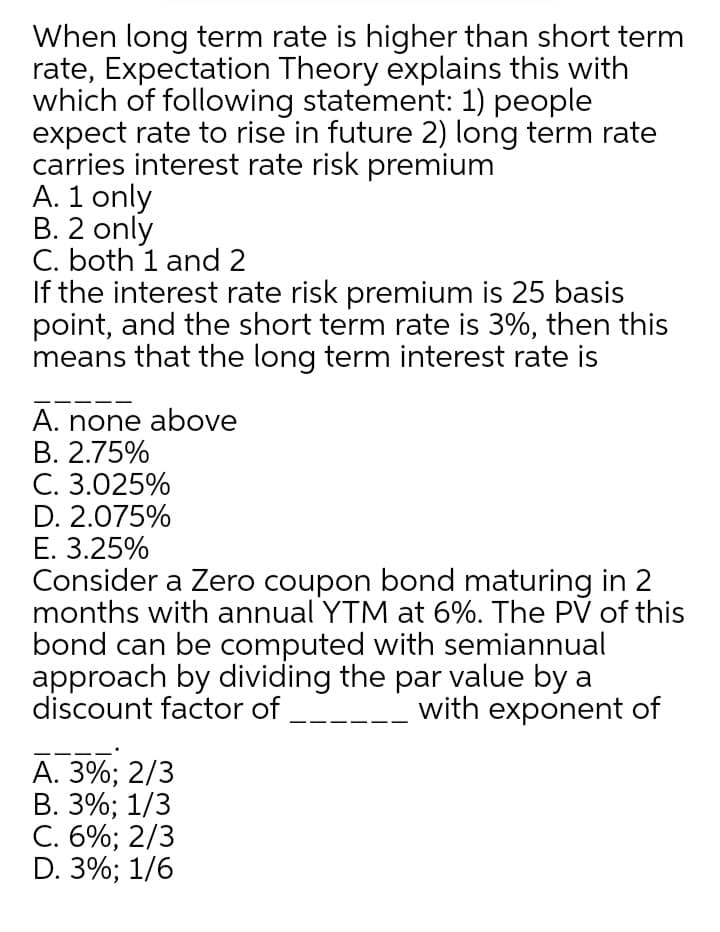

When long term rate is higher than short term rate, Expectation Theory explains this with which of following statement: 1) people expect rate to rise in future 2) long term rate carries interest rate risk premium A. 1 only B. 2 only C. both 1 and 2 If the interest rate risk premium is 25 basis point, and the short term rate is 3%, then this means that the long term interest rate is A. none above B. 2.75% C. 3.025% D. 2.075% E. 3.25% Consider a Zero coupon bond maturing in 2 months with annual YTM at 6%. The PV of this bond can be computed with semiannual approach by dividing the par value by a discount factor of with exponent of А. 3%;B 2/3 В. 3%;B 1/3 C. 6%; 2/3 D. 3%; 1/6

When long term rate is higher than short term rate, Expectation Theory explains this with which of following statement: 1) people expect rate to rise in future 2) long term rate carries interest rate risk premium A. 1 only B. 2 only C. both 1 and 2 If the interest rate risk premium is 25 basis point, and the short term rate is 3%, then this means that the long term interest rate is A. none above B. 2.75% C. 3.025% D. 2.075% E. 3.25% Consider a Zero coupon bond maturing in 2 months with annual YTM at 6%. The PV of this bond can be computed with semiannual approach by dividing the par value by a discount factor of with exponent of А. 3%;B 2/3 В. 3%;B 1/3 C. 6%; 2/3 D. 3%; 1/6

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 26P

Related questions

Question

f3

Transcribed Image Text:When long term rate is higher than short term

rate, Expectation Theory explains this with

which of following statement: 1) people

expect rate to rise in future 2) long term rate

carries interest rate risk premium

A. 1 only

B. 2 only

C. both 1 and 2

If the interest rate risk premium is 25 basis

point, and the short term rate is 3%, then this

means that the long term interest rate is

A. none above

В. 2.75%

C. 3.025%

D. 2.075%

E. 3.25%

Consider a Zero coupon bond maturing in 2

months with annual YTM at 6%. The PV of this

bond can be computed with semiannual

approach by dividing the par value by a

discount factor of

with exponent of

А. 3%; 2/3

В. 3%;B 1/3

С. 6%;B 2/3

D. 3%; 1/6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT