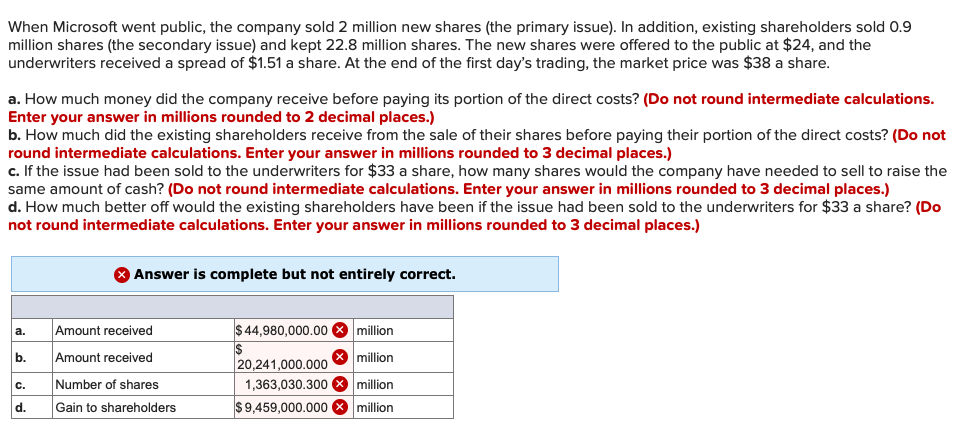

When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, existing shareholders sold 0.9 million shares (the secondary issue) and kept 22.8 million shares. The new shares were offered to the public at $24, and the underwriters received a spread of $1.51 a share. At the end of the first day's trading, the market price was $38 a share. a. How much money did the company receive before paying its portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) c. If the issue had been sold to the underwriters for $33 a share, how many shares would the company have needed to sell to raise the same amount of cash? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) d. How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $33 a share? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) Answer is complete but not entirely correct. Amount received Amount received Number of shares Gain to shareholders a. $44,980,000.00 0 million b. million 20,241,000.000 1,363,030.300 O million $9,459,000.000 O million с. d.

When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, existing shareholders sold 0.9 million shares (the secondary issue) and kept 22.8 million shares. The new shares were offered to the public at $24, and the underwriters received a spread of $1.51 a share. At the end of the first day's trading, the market price was $38 a share. a. How much money did the company receive before paying its portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) c. If the issue had been sold to the underwriters for $33 a share, how many shares would the company have needed to sell to raise the same amount of cash? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) d. How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $33 a share? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) Answer is complete but not entirely correct. Amount received Amount received Number of shares Gain to shareholders a. $44,980,000.00 0 million b. million 20,241,000.000 1,363,030.300 O million $9,459,000.000 O million с. d.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 4CP

Related questions

Question

Transcribed Image Text:When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, existing shareholders sold 0.9

million shares (the secondary issue) and kept 22.8 million shares. The new shares were offered to the public at $24, and the

underwriters received a spread of $1.51 a share. At the end of the first day's trading, the market price was $38 a share.

a. How much money did the company receive before paying its portion of the direct costs? (Do not round intermediate calculations.

Enter your answer in millions rounded to 2 decimal places.)

b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? (Do not

round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.)

c. If the issue had been sold to the underwriters for $33 a share, how many shares would the company have needed to sell to raise the

same amount of cash? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.)

d. How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $33 a share? (Do

not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.)

Answer is complete but not entirely correct.

a.

Amount received

$ 44,980,000.00 X million

b.

Amount received

X million

20,241,000.000

Number of shares

1,363,030.300 X million

c.

d.

Gain to shareholders

$9,459,000.000 X million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College