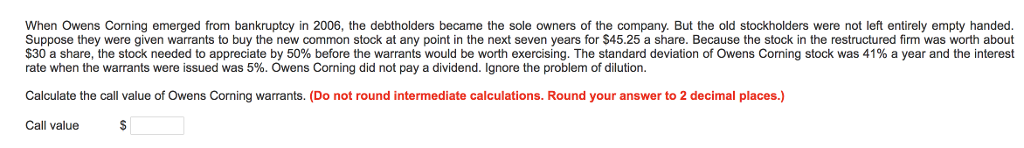

When Owens Corning emerged from bankruptcy in 2006, the debtholders became the sole owners of the company. But the old stockholders were not left entirely empty handed. Suppose they were given warrants to buy the new common stock at any point in the next seven years for $45.25 a share. Because the stock in the restructured firm was worth about $30 a share, the stock needed to appreciate by 50% before the warrants would be worth exercising. The standard deviation of Owens Corning stock was 41% a year and the interest rate when the warrants were issued was 5%. Owens Corning did not pay a dividend. Ignore the problem of dilution. Calculate the call value of Owens Corning warrants. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Call value $

When Owens Corning emerged from bankruptcy in 2006, the debtholders became the sole owners of the company. But the old stockholders were not left entirely empty handed. Suppose they were given warrants to buy the new common stock at any point in the next seven years for $45.25 a share. Because the stock in the restructured firm was worth about $30 a share, the stock needed to appreciate by 50% before the warrants would be worth exercising. The standard deviation of Owens Corning stock was 41% a year and the interest rate when the warrants were issued was 5%. Owens Corning did not pay a dividend. Ignore the problem of dilution. Calculate the call value of Owens Corning warrants. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Call value $

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 16P

Related questions

Question

Don't hand writing solution.

Transcribed Image Text:When Owens Corning emerged from bankruptcy in 2006, the debtholders became the sole owners of the company. But the old stockholders were not left entirely empty handed.

Suppose they were given warrants to buy the new common stock at any point in the next seven years for $45.25 a share. Because the stock in the restructured firm was worth about

$30 a share, the stock needed to appreciate by 50% before the warrants would be worth exercising. The standard deviation of Owens Corning stock was 41% a year and the interest

rate when the warrants were issued was 5%. Owens Corning did not pay a dividend. Ignore the problem of dilution.

Calculate the call value of Owens Corning warrants. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Call value

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning