When treasury stock is purchased for more par value of the stock and the cost method is used to account for treasury than the stock, what account(s) should be debited? * Treasury stock for the par value and paid-in O capital in excess of par for the excess of the purchase price over the par value. Paid-in capital in excess of par for the purchase price. Treasury stock for the purchase price. Treasury stock for the par value and O retained earnings for the excess of the purchase price over the par value.

When treasury stock is purchased for more par value of the stock and the cost method is used to account for treasury than the stock, what account(s) should be debited? * Treasury stock for the par value and paid-in O capital in excess of par for the excess of the purchase price over the par value. Paid-in capital in excess of par for the purchase price. Treasury stock for the purchase price. Treasury stock for the par value and O retained earnings for the excess of the purchase price over the par value.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter20: Hybrid Financing: Preferred Stock, Warrants, And Convertibles

Section: Chapter Questions

Problem 1Q

Related questions

Question

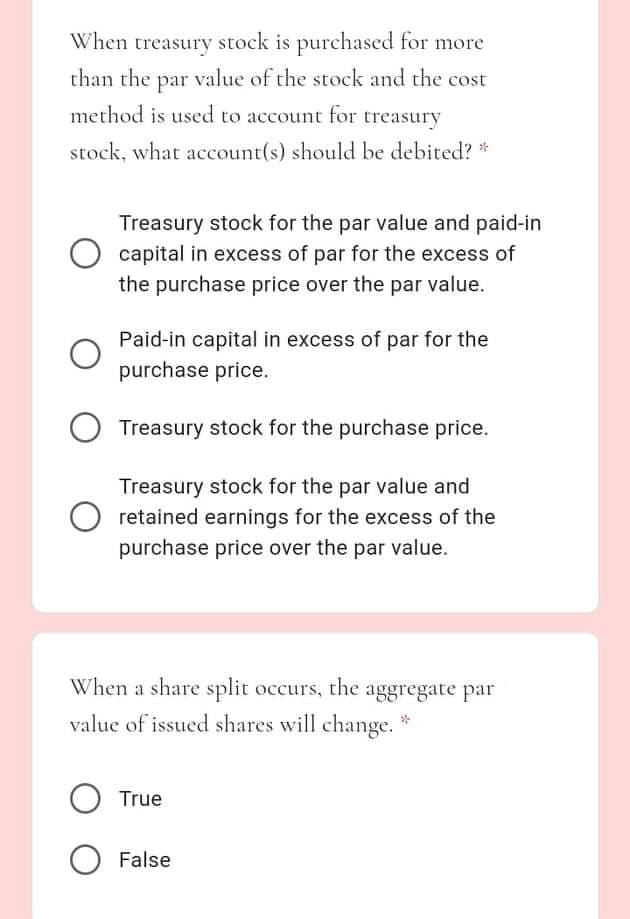

Transcribed Image Text:When treasury stock is purchased for more

than the par value of the stock and the cost

method is used to account for treasury

stock, what account(s) should be debited? *

Treasury stock for the par value and paid-in

capital in excess of par for the excess of

the purchase price over the par value.

Paid-in capital in excess of par for the

purchase price.

Treasury stock for the purchase price.

Treasury stock for the par value and

retained earnings for the excess of the

purchase price over the par value.

When a share split occurs, the aggregate par

value of issued shares will change. *

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,