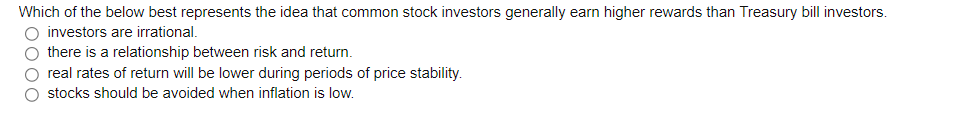

Which of the below best represents the idea that common stock investors generally earn higher rewards than Treasury bill investors. investors are irrational. there is a relationship between risk and return. real rates of return will be lower during periods of price stability. stocks should be avoided when inflation is low.

Q: Brief Exercise 3-5 Determine accrual-basis and cash-basis net income (LO3-1, 3- 2) Rebel Technology ...

A: Under cash basis accounting, only cash received and cash payments will be considered for calculation...

Q: HYZEL Manufacturing Company presents the following: Statement of Comprehensive Income December 31, 2...

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three, as per...

Q: Total Current Assets 700 610 Plant and Equipment 1,800 1,470 Less: Accumulated Depreciation 500 400 ...

A: Total Assets on the balance sheet is the sum of the current assets and fixed assets adjusted for dep...

Q: Which technique is expected to be most accurate in the valuation of an operating retail shopping cen...

A: The analytical process of determining the current (or future) worth of an asset or a firm is known a...

Q: Negative net working capital, is when current assets exceed current liabilities True False Mar...

A: The net working capital refers to the difference between the current assets and current liabilities....

Q: Which of the following is a type of captive formed to write most types of liability insurance covera...

A: A captive insurance firm is a special arrangement for insurance, which is a subsidiary insurer to mi...

Q: Find the nominal rate of an investment with duration of 4 and a half years compounded once a year. T...

A: The nominal rate of investment can be found using the RATE function in excel. RATE = (NPER, PMT, PV,...

Q: Nick’s Enchiladas has preferred stock outstanding that pays a dividend of $5 at the end of each year...

A:

Q: The cash price of a motorcycle is Php325,000. A fixed amount is to be paid at every end of the mont...

A: Cash price (PV) = Php 325,000 Interest rate = 9% Monthly interest rate (r) = 9%/12 = 0.75% Period = ...

Q: Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at a...

A: Here, Cost of Debt (rd) is 9% Weight of Debt is 35% Weight of Equity is 65% Dividend (D0) is $1.85 G...

Q: A project requires an initial investment of $225,000 and is expected to generate the following net c...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: orksheet Net worksheet Using the information provided, complete Figure 1.1, Seller Net Worksheet. Se...

A: Seller Net Worksheet Various issues to consider.

Q: 5 factors contributing to the financial Crisis and why each helped to bring on the crisis.

A: Financial crisis is a situation which leads to the decline in the asset , businesses , consumers, an...

Q: During 2013, Rand Co. purchased P960,000 of inventory. The cost of goods sold for 2013 was P900,000,...

A: Inventory turnover ratio is one of the efficiency ratio which shows how many times inventory is sold...

Q: Figure 1.1 | Seller Net Worksheet Vorksheet Seller Net Worksheet Using the information provided, com...

A: As per the information provided : Seller Net Worksheet Various Issues to consider

Q: You are in the process of creating your department's projected operating budget. As you create this ...

A: Operating Budget for a department refers to making forecasts for future figures of the respective de...

Q: The Uptowner has 11,000 shares of stock outstanding with a par value of $1 per share and a market va...

A: The net income earned by the company's shareholders on its invested capital is known as a dividend. ...

Q: Currently, international reserve assets in the Balance of Payments of countries are comprised of: O ...

A: Following are the international reserve assets in the BOP of countries accounts:

Q: Pedro Corp. currently has sales of P2,000,000, and its days sales outstanding is 2 week. The financi...

A: SINCE YOU WANT US TO SOLVE THREE PARTS BUT THE LAST PART BELONGS TO ACCOUNTS AS IT REQUIRES PREPARAT...

Q: ABM Enterprise would like to evaluate/analyze an investment proposal. Given the following: Investmen...

A: Since you have posted a question with multiple sub parts, therefore as per the guidelines we will be...

Q: What are some feasible and stable investment activities during pandemic?

A: An Inestment is a form of acquring assets for a long run or short run to have good rate of return.It...

Q: A lender requires PMI that is 0.8% of the loan amount of $490,000. How much (in dollars) will this a...

A: A loan's PMI or Private mortgage insurance is a kind of mortgage insurance that is used by lenders w...

Q: How much is the total assets for 2021?

A: Total Assets = Net Book value of Non current assets or Plant and equipments + Total current assets

Q: You bought a car and borrowed $25,067 for 48 months. If the rate is 3.56%, what is your monthly paym...

A: Loan amount (L) = $25067 n = 48 months r = 3.56% per annum = 0.29667% per month X = Monthly payment

Q: A publicly listed traded company is in financial distress. It is projected to stop paying dividends ...

A: There are various valuation methods that can be used to value a comopany like discounted cash flow m...

Q: Horizon Communications stock pays a fixed annual dividend of $3.00. Because of lower inflation, the ...

A: Given Information : Fixed Annual Dividend = $3 Original yield on preferred stock = 12% New Yield on...

Q: Ray Miller was looking for funds to support his company's expansion. His bank offered him a $25,000 ...

A: Value of simple discount loan is $25,000 Interest rate is 10% Time period is 90days To Use: 30/360 ...

Q: discuss in detail the adminstration of financial management within the public sector

A: Financial management include applying general management concepts to the enterprise's financial reso...

Q: Why is trading volume an important consideration when undertaking technical analysis?

A: Trading volume refers to the number of shares that was traded for a security for a given period of t...

Q: You have just received a bonus of $10,000 and are looking to deposit the money in a bank account for...

A: Value after a period can be calculated as: = Principal * (1 + Periodic Interest rate)^number of conv...

Q: Moral hazard is mostly a problem in countries with universal insurance programs like the United King...

A: Moral hazard is a an example of risk which arises when one of the parties involved in a contract doe...

Q: I met Mr. Talagitok a year ago and he told me that he had invested a hundred thousand dollars in a b...

A: The question is based on the application of the time value of money, the value of money increases wi...

Q: An investment will give you monthly payments of $890 for 9 years. If your required return is 8.13%, ...

A: Monthly payment (M) = $890 n = 9 years = 108 months r = 8.13% per annum = 0.6775% per month

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A:

Q: At 6% simple discount, find the present value of $300 which is due at the end of 90 days. What is th...

A: Discount rate (d) = 6% Amount (P) = $300 n = 90 days

Q: You will invest $31 per month. If the rate is 8.07%, how much will you have in 6 years?

A: Future value can be calculated using FV (rate, nper, pmt, [Pv], [type]) Rate The interest rate Nper...

Q: Suppose James will have $25,000.00 for a down payment on a house in 6 years. How much would he have...

A: The question is based on the concept of future value calculation of an investment with a monthly com...

Q: Question: Tatsumi invested Php 10,000 now for the college education of his three-year old son. If th...

A: Investment made (X) = Php 10000 Let's find the future value of this investment after 15 years (At s...

Q: After the due date on Sept.4, Ashley made the following transactions using her credit card. Sept. 6 ...

A: Interest on average daily balance is 1% To Find: Average daily balance Finance Charge

Q: An investment will have a future value equal to Php180,250 after 6 years. It has a nominal rate of 1...

A: Future value of the investment (F) = Php 180250 r = 10.5% per annum = 2.625% per quarter n = 6 years...

Q: A preferred stock will pay a dividend of $1 per quarter. If the annual return is 6.06%, what is the ...

A: Here, Dividend per Quarter is $1 Therefore, Dividend per year will be: =$1*4 =$4 Annual Return is 6....

Q: Differentiate primary markets from secondary markets?

A: Financial Markets refers to the place where financial assets or securities are being created , purc...

Q: What are the portfolio weights for a portfolio that has 110 shares of Stock that sell for $79 per sh...

A: Number of shares of stock A = 110 Shares Price per share stock A = $79 Number of shares of stock B =...

Q: The home the Bensons purchased 12 years ago for $93,000 is now appraised at $223,000. What has been ...

A: Appreciation is the term used in time value of money which shows the increase in nominal value of an...

Q: You own a portfolio that is 23 percent invested in Stock X, 38 percent in Stock Y, and 39 percent in...

A: Stock Weight Return X 23% 11% Y 38% 14% Z 39% 16%

Q: The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The un...

A: Net present value - It is the sum of the present value of all future cash inflows minus the sum of ...

Q: Analyst forecasts which focus on a top-down approach to forecasting future performance are most like...

A: Top down approach in fundamental analysis involves analysis of macroeconomic factors first, then ind...

Q: Current Assets Cash Php 25,000 Php 30.000 Marketable Securities 40,000 10,000 Accounts Receivable 60...

A: Current ratio of an organisation is a measure to calculate the organisation’s ability to pay off its...

Q: You have been offered a project paying $300 at the beginning of each year for the next 20 years. Wha...

A: Annual payment (P) = $300 Interest rate (r) = 9% Period (n) = 20 Years

Q: On a given day, 350 of the S&P 800 stocks were up, 450 were down. Volume for up stocks was 600 milli...

A: Advancing stocks (AS) = 350 Declining stocks (DS) = 450 Advancing volume (AV) = 600 million Declinin...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: What is the Capital Asset Pricing Model (CAPM)? What are the assumptions that underlie the model? What is the Security Market Line (SML)?You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Construct a plausible graph that shows risk (as measured by portfolio standard deviation) on the x-axis and expected rate of return on the y-axis. Now add an illustrative feasible (or attainable) set of portfolios and show what portion of the feasible set is efficient. What makes a particular portfolio efficient? Don’t worry about specific values when constructing the graph—merely illustrate how things look with “reasonable” data.The small firm effect refers to the observed tendency for stock prices to behave in a manner that is contrary to normal expectations. Describe this effect and discuss whether it represents sufficient information to conclude that the stock market does not operate efficiently. In formulating your response, consider: (a) what it means for the stock market to be inefficient, and (b) what role the measurement of risk plays in your conclusions about each effect.

- No matter how the stock price fluctuates, as long as it can provide a positive return, the risk of investing in stocks is low.If the concept of standard deviation is applied, is this true or false?Many financial economists believe that the random walk model is a gooddescription of the logarithm of stock prices. It implies that the percentagechanges in stock prices are unforecastable. A financial analyst claims to havea new model that makes better predictions than the random walk model.Explain how you would examine the analyst’s claim that his model is superior?Which is true with regards to the systematic and unsystematic risk? To mitigate the unsystematic risk, an investor must choose two stocks that has a perfectly negative correlation when establishing ones portfolio of securities A portfolio with stocks that has high Sharpe ratios does not have both unsystematic and systematic risk because then generate excess returns The likes of inflation, recession, changes in interest rates are examples of market risk that can be reduced to zero by a portfolio that is fully diversified Systematic risk can be diversified by choosing stocks that has a small standard deviation but high correlation coefficient since these stocks are less riskier

- You buy a stock from the capital market. If the capital market is semi-strong efficient, which of the following statements is NOT correct? a. You cannot earn any abnormal returns above the required return by trading on public information. b. Past stock prices can be used to predict future stock prices. c. The technical analysis of publicly available information will not lead to any abnormal returns. d. The stock is fairly priced. e. Stock prices reflect all publicly available information.Why will the standard deviation not be a good measure of risk when returns are negatively skewed? What are the risk implications for an investor for a returns series that exhibits fat tails? A price weighted index places more weight on stocks with a higher price, whilst a value weighted index places more weight on stocks with a higher market capitalization. Discuss.Which statement is TRUE regarding the riskiness of money market instruments and capital market instruments? * Changing economic prospects can cause very large changes in current stock values. Distant cash flows for stocks can be known with certainty, make them riskier than money market instruments. Money market instruments have predictable cash flows and mature in one year or less, so they are much more risky. The prices of long-term capital market instruments are less sensitive to changes in interest rates than prices of short-term instruments.

- Which of the following are consistent with the efficient market hypothesis? Check all that apply. Changes in stock prices can be accurately predicted by investors. At the market price, the number of people who believe the stock is overvalued exactly equals the number of people who think the stock is undervalued. A positive news release about a company will increase the value and stock price for that firm. Some investors cite the existence of anomalies—observations that do not fit the model—as evidence that stock markets are not efficient. Which of the following are such anomalies? Check all that apply. The best time to sell a stock is late on Wednesday or Friday, whereas the best time to buy a stock is late on Tuesday or Thursday. The movement of stock prices of companies over time is the same as the changes in their earnings. High returns to a stock in one period are associated with even higher returns in a later period. There is a…Day traders try to take advantage of the normal ebbs and flows of the market, seeking to buy stocks that are undervalued and sell them when they become overvalued. How does this compare to Warren Buffet’s investing strategy?Is it reasonable to ignore IDIOSYNCRATIC RISK and care only about MARKET (SYSTEMIC) risk? What about investors who put all their money into only a single risky stock...is that prudent and can they ignore idiosyncratic risk?