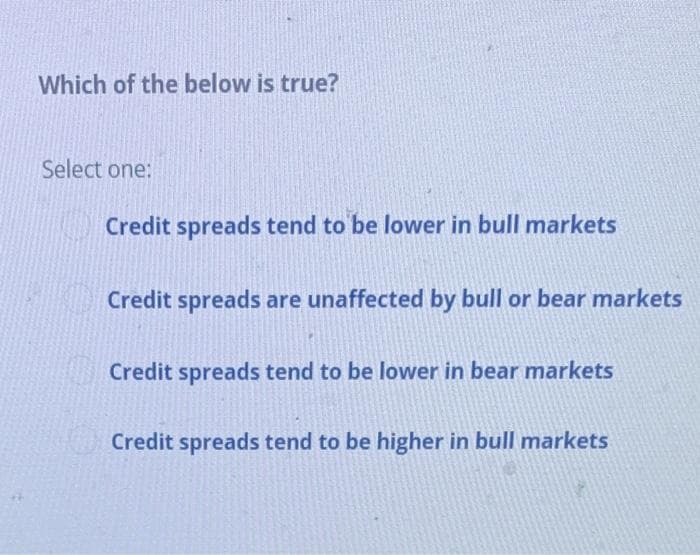

Which of the below is true? Select one: Credit spreads tend to be lower in bull markets Credit spreads are unaffected by bull or bear markets Credit spreads tend to be lower in bear markets Credit spreads tend to be higher in bull markets

Q: Arcmat plc owns a factory which at present is empty. Mrs X, a business strategist, has been working…

A: Incremental cash flows: The cash flows that accrue solely on account of the initiation of a new…

Q: School fees at a certain school are due at the beginning of the year. The fees are set at R12000 for…

A: This question can be answered in light of time value of money. The time value of money is a concept…

Q: What was the closing price for McKesson on July 7, 2016?

A: The closing price for McKesson on July 7, 2016, is 191.20

Q: Determining whether an amount is of a capital or a revenue nature forms part of the subjective test.…

A: Capital is the amount invested in the particular asset, while revenue is the amount earned on the…

Q: Refer to the table to answer the following questions: Question Answer What was the closing price for…

A: a. The closing Price for Mckesson on July 7, 2016 is 191.20 b. The high for McKesson per share for…

Q: Write a comprehensive analysis of the given candlestick chart

A: Technical Analysis: Technical Analysis is the science and art of reading stock price charts and…

Q: The most important feature of Limited Liability Companies is that it provides limited liability for…

A: limited liability company benefits the members provide limited liability.

Q: Praxis Corp. is expected to generate a free cash flow (FCF) of $2,285.00 million this year (FCF₁ =…

A: Terminal value = [FCF 1 ×(1+ Growth rate for year 2 mad 3)2 (1+Growth rate for year 4)]/(WACC-Growth…

Q: In computing the B/C ratio, is the annual revenue counted as benefits? Please compute the B/C ratio…

A: The B/C ratio is known as the Benefit-Cost ratio. It shows the relationship between the cost and…

Q: How many years will it take for $136,000 to grow to $468,000 if it is invested in an account with an…

A: Future Value = Present Value (1 + Interest Rate) Number of years FV =PV (1+r)n Here, Present Value…

Q: 13. What was the principal for a continuously compounded account earning 2.1% interest that now has…

A: A Continuous Compounded Interest rate is the interest rate that is calculated on the principal…

Q: Use the following information for the next three questions. Instrument Corp. has the following…

A: Available for sale security (Non-Trading Investment): It is a a debt or equity instrument which is…

Q: An investor is holding bonds with long duration and interest rates are expected to rise. What advice…

A: Long term bonds are sensitive to interest rates. Investors holding long-duration bonds possess…

Q: The blue stair-step line depicts the value of future stock dividends. The orange stair-step line…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: You take out a loan in the amount of $271,000 with annual equal repayments over the next 20 years.…

A: Annual Payment = P / ((1-(1+r)-n)/r) Where P = Principal Amount r = Rate of interest n = Numbers…

Q: Knight Inventory Systems, Incorporated, has announced a rights offer. The company has announced that…

A: Here, No. of Right is 3 Price before ex right date is $80 Price after ex right date is $60…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909…

A: When we need to compute the PV of any future sum receivable at a specific point in time, we use the…

Q: Changes in stock prices are impossible to predict from public information.

A: The efficient market hypothesis refers to the market which is efficient and leaves no chance of…

Q: Master Machines, Inc. 2017 2018 Sales $1,240 $1,385 COGS 820 910 Interest 25 20 Dividends 25.50…

A: Operating cash flow is cash flow available after the payment of all operating expenses including the…

Q: 19. Odette has a base monthly salary of S1,500 and earns a 5% commission on all sales she makes at…

A: In this question, we need to calculate the total sales, which we need to derive from Odette's total…

Q: Explain the process of securitisation as carried out by banks and discuss its role in the 2008…

A: Securitization Securitization is the process of grouping or pooling together numerous financial…

Q: When establishing their optimal capital structure, firms should strive to minimize the amount of…

A: The capital structure is said to be optimum capital structure when the firm has selected such a…

Q: What equal annual payments you have to deposit in your account (EOY 4 until EC order to provide…

A: Present value of both options must be same than the both options will be equal and same considering…

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery…

A: Evaluation of the project on the basis of initial cash flow and earnings before taxes.

Q: A Treasury bill has a bid yield of 5.44% and an ask yield of 5.29%. The bill matures in 69 days.…

A: Given, The face value is $10,000 Time to maturity is 69 days

Q: The Cookie Jar bakes 80 dozen cookies at a cost of $1.08 per dozen. If a markup of 60% on selling…

A: Solution:- Markup means the percentage margin either on cost or sales price.

Q: ex is at £411.79. Find the intrinsic value and the time valı

A: The price of options have two components one is intrinsic value and other is time value of option…

Q: Cookie Dough Corporation has two different bonds currently outstanding. Bond M has a face value of…

A: Bond M Solved using Financial Calculator CF Mode CF0 = 0 C1 = 0 F1 = 12 C2 = 900 F2 = 16 C3 = 1300…

Q: The Tamaraw Corporation is trying to determine the effect of its inventory turnover ratio and DSO on…

A: Answer - Part 1 - Cash Conversion Cycle - Inventory conversion period + average collection period…

Q: the main role of Activity Ratio for pep

A: Activity ratio are very important metrics to judge the efficiency of the company and how company is…

Q: What will $82,000 grow to be in 11 years if it is invested today at 8% and the interest rate is…

A: The formula for the future value of the principal = P(1 + (r/m) )mtwhere, P = Principal r= interest…

Q: You just won a prize that comes with two payout choices. The first option is to get $130,000 right…

A: For evaluating which proposal out of the given options is better, present worth of the cash flows…

Q: For the reader's advantage, provide a cost-benefit analysis of the project. How can the value of a…

A: An analysis is a systematic procedure used by businesses to determine which decisions to make and…

Q: 1. Suppose for an investment of $500, you will receive a monthly payment of $2 for perpetuity…

A: As per the information provided: Investment amount = $500 Monthly payment = $2 for perpetuity…

Q: Giant Eagle Markets is considering the following two dividend policies for the next five years. Year…

A: Present value of future amount With future value (FV), discount rate (r) and period (n), the present…

Q: Perit Industries has $115,000 to invest. The company is trying to decide between two alternative…

A: Net Present value is present value of cash flow minus initial investment

Q: 9. Forecast the 10th day exchange rate 95.45

A: In finance exchange rates are value of one currency for the purposing of converting that currency to…

Q: “If markets are semistrong-form efficient, investors would only adopt passive investment strategies…

A: The Efficient Market Hypothesis (EMH) describes a stock market that is both operationally and…

Q: If the annual interest rate is 8%, what is the daily interest rate that would be used as the "r" in…

A: Daily interest rate is often used in finance to determine the amount of interest that one will owe…

Q: Formulate the model on a spread and solve using Solver. Give the following: i. Objective function:…

A: NPV stands for net present value. It is one of the often used capital budgeting tool that companies…

Q: Sun Life Investment Fund lends $500,000 for each new idea. The Fund's history is that it selects…

A: Given: Amount Sun Life Investment Fund lend for each new idea= $500,000 The Fund's history is that…

Q: Alfredo wants to know how much he must put in a bank account today to have within 14 years an amount…

A: Here, To Find: Part A. Conversion rate to current dollar =? Part B. Present value of investment…

Q: The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $45,000. It had…

A: NPV or net present value is defined as the sum of the PV of all future cash inflows minus the sum of…

Q: Estimates for one of two process upgrades are as follows: First Cost = Php 40,000 Annual Cost = Php…

A: Annual worth is the net revenue from the investment annually. It is calculated using the discounting…

Q: LENLEN Company is considering on investing in new automated machinery. The machinery will be used…

A: Present value = (C1 * (1+r)-1)+ (C2 * (1+r)-2) + ...... +(Cn * (1+r)-n) Where r = Required rate of…

Q: In the fourth and final year of a project, XYZ expects operating cash flow after taxes of P440,000.…

A: The cash flow of the year is what is received after payment of all operating expenses and all…

Q: Describe how the 2008 financial crisis, when analyzed alongside the fall of LTCM, provides evidence…

A: The 2008 financial crisis occurred due to the burst in housing bubble that was fueled by subprime…

Q: Mia just received her bank statement. The statement lists three deposits and 32 checks that cleared.…

A: Outstanding check are check written and issued to party but not presented before banks for payment…

Q: It is likely that airplane tickets will increase 5% in each of the next 5 years. The cost of a plane…

A: Data given: Cost of a plane ticket at the end of the first year = ₱10720. Increase in airplane…

Q: In a Modigliani and Miller world with no taxes, a 100% equity financed company has generated £1m…

A: Modigliani Miller theory states that in a perfect market the value of a company is the present value…

Step by step

Solved in 2 steps

- Which of the following statements is correct? Credit spreads decrease with volatility Credit spreads increase with volatility Credit spreads do not depend on volatility The relation between credit spreads and volatility is nonlinear Which of the followings is not an important determinant of bond credit ratings? corporate governance risk business risk interest rate risk financial riskMarket prices and credit spreads change much faster than credit ratings. Select one: True FalseWhat are the TRIN Statistics and Cofidence Index and what do their values describe about the bullish and bearish direction of the market?

- Which one of the following is the hypothesis that securities markets are efficient? Multiple Choice A Geometric market hypothesis B Standard deviation hypothesis C Efficient markets hypothesis D Capital market hypothesis E Financial markets hypothesisWhich of the following is correct with regards to Theories of Term Structure? When the shape of the yield curve depends on investors’ expectations about prospective prevailing interest rates, the Pure Exception Theory is being applied. When the economic outlook is improving, the yield curve inverts as it reflects no changes in inflation premium. The liquidity preference theory suggests that long-term rates are generally higher than short-term rates since investors perceive more liquidity in long-term investments. Under the Market segmentation theory, there is an apparent relationship between the yield curve and the prevailing rate of returns in each market segment.1. Credit spreads least likely depend on which of the following: A. Market supply B. Market demand C. Financial markets D. Inflation

- Which of the following statements is true? A. The percentage decrease in value when the yield-to-maturity (YTM) increases by a given amount is smaller than the increase in value when the yield-to-maturity (YTM) decreases by the same amount. B. Ratio analysis expands GAP analysis to focus on the sensitivity of bank profits across different interest rate environments. C. The repurchase price is smaller than the selling price and accounts for the interest charged by the buyer, who is lending funds to the seller with the security as collateral. D. The issuers or the firms issuing the bonds are rated on their junior unsecured debt.Which of the following is true of risk-return trade off? A) Risk can be measured on the basis of variability of return. B) Risk and return are inversely proportional to each other. C) T-bills are more riskier than equity due to imbalances in government policies. D) Riskier investments tend to have lower returns.Explain the reasons why do investors prefer high or low pay out ratio?

- Both EV-to-EBITDA and PE multiples can be linked to interest rates through the discount rate used in discounted cash flow valuation. Holding all else equal, when discount rates are higher, valuation ratios are lower. Perhaps because of this, we tend to see stock prices as well as, the value of private business transactions decline when interest rates increase. Macroeconomists like to describe interest rates as consisting of two components: the real interest rate component and an expected inflation component. In some situations, increases in interest rates are the result of an increasing real interest rate; in other situations, the cause of an interest rate increase is an increase in expected inflation. How might valuation ratios be expected to respond to an interest rate increase generated by an increase in expected inflation versus an interest rate increase that represents an increase in real interest rates?Which one of the following statements about the term structure of interest rates is true?a. The expectations hypothesis indicates a flat yield curve if anticipated future short-term rates exceed current short-term rates.b. The expectations hypothesis contends that the long-term rate is equal to the anticipated short-term rate.c. The liquidity premium theory indicates that, all else being equal, longer maturities will have lower yields.d. The liquidity preference theory contends that lenders prefer to buy securities at the short end of the yield curve.Discuss the importance of market efficiency, and explain why some markets are more efficient than others. Develop a simple understanding of behavioral finance.