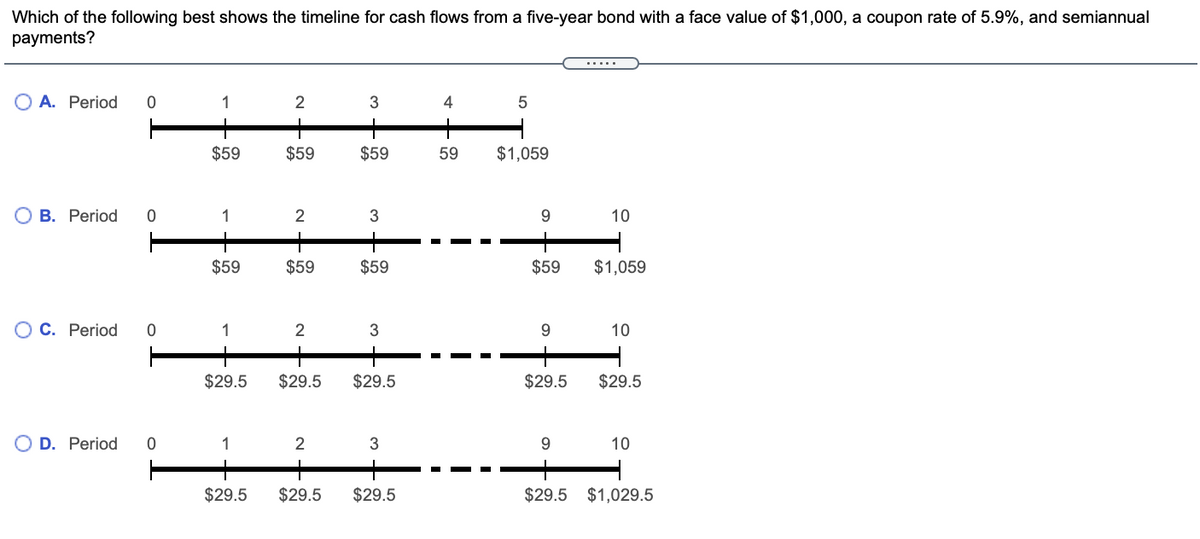

Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $1,000, a coupon rate of 5.9%, and semiannual payments? ..... O A. Period 1 2 4 $59 $59 $59 59 $1,059 О В. Рeriod 1 3 9. 10 $59 $59 $59 $59 $1,059 O C. Period 1 2 3 10 $29.5 $29.5 $29.5 $29.5 $29.5 O D. Period 1 9. 10 $29.5 $29.5 $29.5 $29.5 $1,029.5

Q: The nominal rate of return is ______% earned by an investor in a bond that was purchased for $963,…

A: Bond It is an obligation security, where borrowers issue securities to fund-raise from financial…

Q: Yield to maturities on zero coupon T-bill soro Year YTm -3.100 3.30o 3. 3.226 5- 3.100 3.02. whof is…

A: using the PV function in excel

Q: If the 5-year Treasury bond yield is 2.25% and 5-year LIBOR swap rate is 2.69%, determine the…

A: Given Information: Yield of 5year Treasury Bond Yield = 2.25% 5 year LIBOR swap Rate = 2.69%…

Q: A $3600, 6.9% bond with semi-annual coupons redeemable at par in 5 years was purchased at 100.1.…

A: Par value (F) = $3600 Coupon rate = 6.9% Annual coupon amount (C) = 3600*0.069 = $248.40 Years to…

Q: Compute the yield to maturity of a 19% coupon purchased for a 970± three-year bond whose principal…

A: The internal rate of return of the cash flow of buying and redemption of bond is the known as yield…

Q: a) Write the formula of the Price-Earnings ratio and explain how a result of 11 should be…

A: Thank you for posting questions. Since you have posted multiple questions, as per the guideline I am…

Q: 1. An 8% corporate bond with face value of P 100, o00 matures in 5 years. The yield to maturity is…

A: Note: It is a case where no question is specified to solve among the multiple questions posted, so…

Q: How much will the coupon payments be of a 25 year $5,000 bond with a 8% coupon rate and semi annual…

A: We require to calculate the coupon payment from following details : Face value of bonds = $5000…

Q: A Treasury bond that you own at the beginning of the year is worth $1,020. During the year, it pays…

A: Dollar return = Ending value + interest - beginning value Dollar return = $1,030 + 32 - $1,020…

Q: Two bonds, each with a face value of $16000, are redeemable at par in t-years and priced to yield y2…

A: Value of a bond is the price of the bond. It is the present value of future cash flows occurring…

Q: A 20,000, 1 ½% bonds with annually coupons are priced to yield 4 ½% converted annually. If it is…

A: Face value = 20,000 Coupon rate = 1.50% Yield rate = 4.50% Redemption to face value ratio = 104%…

Q: What is the Macaulay Duration of a 9.5% annual coupon bond with 3 years to maturity, $1,000 face…

A: Duration is a measure of how sensitive a bond's price is to fluctuations in the market interest…

Q: A bond certificate with a value of P 1,081,038.07 has a par value of P 1,000,000.00 and a redemption…

A: Using financial Calculator, PV (Price) = P 1,081,038.07 FV (Face Value) = P 1,030,000.00 N = 10…

Q: Paul Dirac & Associates begin operations on 1/1/X1 by issuing a 3.00 year term (Bullet) bond with a…

A: Paul Dirac & Associates begin operations on 01.01.X1 Issued bonds payable = $2600000 Bonds pays…

Q: % earned by an investor in a bond that was purchased for $944, has an annual coupon The nominal rate…

A: To calculate the realized return we will use the below formula as follows: Nominal rate of return…

Q: Calculate the dollar price for each of the following Treasury securities given the quoted price/…

A: Price of quoted on 32nds convention. Price in decimals = preceding no. + no of 32nd/32 + no of…

Q: Paul Dirac & Associates begin operations on 1/1/X1 by issuing a 3.00 year term (Bullet) bond with a…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: A 15,000, 5 ½% bonds with quarterly coupons is priced to yield 4 ½% converted quarterly. If it is…

A: The question is based on the concept of Bond valuation and pricing. The price of a bond is…

Q: What is the Macaulay Duration of a 4.5% annual coupon bond with 3 years to maturity, $1,000 face…

A: The bond is the long-term debt instrument or security. Bonds issued by the government do not…

Q: A semiannual corporate bond has a face value of $1,000, a price of $785.24, a coupon rate of 9.5%…

A: A financial instrument that does not affect the ownership of the common shareholders or management…

Q: Compute the yield to maturity of a 19% coupon purchased for a 970₺ three-year bond whose principal…

A: Bond is the long-term fixed security instrument. The income payment paid on the bonds is fixed…

Q: A P1,000 bond which mature in 10 years and with a bond rate of 5% payable annually is to be redeemed…

A: The yield on the bond will reflect the rate of return at which the PV of all future cash flows is…

Q: 1. Compute for a present value of the bond with details below: FV: P500,000 Coupon rate: 4.5%…

A: Computation of Present Value of Bond with 6 years Year Interest PVF@4.5% Present Value 1…

Q: A) You invest OMR 900 in a bond which gives 9% interest over a period of 2 years, the compounding is…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: What is the cash flow of a 6% coupon bond that pays interest annually, matures in 9 years, and was…

A: Given, The coupon rate is 6% term of bond is 9 years Par value of bond is $1000

Q: A $1,000 bond, redeemable at par, with annual coupons at i(1)=10%/a is purchases for $1,134.20. If…

A: Bond value = 1000 Coupon = 10%

Q: A S9,000, 10% bond redeemable at par in two years with semi-annual coupons is purchased to yield 8%…

A: Bonds: Bonds are investment securities where an investor lends money to a company or a government…

Q: A $200,000, 6.50% bond redeemable at par, with semi-annual coupon payments, is purchased 12 years…

A: Bond Purchase Price: The present discounted value of a future cash stream provided by a bond is…

Q: At the beginning of the year, Marshall Square, Inc. issued TA 2, 3 $100 million (maturity value) of…

A: Market value of Bond: It is the price at which you might sell a bond to another investor before the…

Q: 1) Create an amortization table for the Bond. 2) What is the Price of the bond? What is the Value…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: ppose at obse ne following forward (0,0, 1/4) F(0,1/4, 1/2) F(0, 1/2, 3/4) F(0,3/4,1) 8% 6% 7% 5%…

A: Zero coupon bond do not h.ve the coupon payment and only pay the principal amount on the maturity of…

Q: What is the coupon rate of a two-year, $5,000 bond with semiannual coupons and a price of $4,767.59,…

A: Face value of the bond = $5,000 Current price of the bond (P0) = $4,767.59 Yield to maturity = 0.069…

Q: Consider a newly issued 7-yr, 8% coupon annual-pay bond priced at $1,112.96. If the…

A: A financial instrument that doesn’t affect the ownership of the common shareholders or management of…

Q: Suppose a 19-year, 11% coupon bond selling for $1,233.64 is first callable in 6 years at $1,055.…

A: The given problem can be solved using RATE function in excel. RATE function computes yield to…

Q: The following data relate to a corporate bond which pays coupons semi-annually: Settlement date 01…

A: Bond is an instrument sold by the companies for a period of time with a fixed interest rate. This…

Q: A company issued a 10-year Rp500 million bond that pays annual coupon 10% and records the bond…

A: Present Value of Bonds=Book Value of Bonds×PVIF+Annual Interest×PVAF

Q: of 5%. Face value of the corporate bond Php. 1,500. can you compute the following? a. Annual…

A: The given problem can be solved using PV function in excel. PV function will compute present value…

Q: A $85,000, 8.50% bond redeemable at par, with annual coupon payments, is purchased 8 years before…

A: The bond's value or the price can be computed as the sum of the bond's coupons and principal after…

Q: The nominal rate of return is % earned by an investor in a bond that was purchased for $901, has an…

A: Given information: Purchase price : $901 Selling price : $1031 Face value : $1,000 Annual coupon :…

Q: A $400,000, 8.50% bond redeemable at par, with semi-annual coupon payments, is purchased 10 years…

A: A financial instrument that doesn’t affect the ownership of the common shareholders or management of…

Q: A $85,000, 8.50% bond redeemable at par, with annual coupon payments, is purchased 8 years before…

A: Bond value is the value of a bond measured on the basis of the present value of all the expected…

Q: . WAY Co., issued a 5-year bond with a face value of ₱50,000 with a coupon rate of 10% on a…

A: Duration of bond gives change in price of bond with change in market rate or required rate. Given:…

Q: How much will the coupon payments be of a 10-year $1,000 bond with a 9.5% coupor rate and quarterly…

A: Par value = $1000 Coupon rate = 9.5% Number of coupon payment per year = 4

Q: Determine the amount of the semi- annual coupon for a bond with a face value of Php 850,000.00 that…

A: Coupon of bond shall be calculated on face value of bond. Semi annual coupon =Fae value*Coupon…

Q: Construct a bond schedule showing the accumulation of discount on a 6,000 4% bond with quarterly…

A: This question is related to bond valuation. Before the construction of the bond schedule, we have to…

Q: What is the last payment amount of a bond with 1 payment per years, Coupon Rate 8.50% and principal…

A: Bonds are basically loans taken by the bond issuer, where coupons are interest payments and the…

Q: P1,000 face-value bond with coupon rate of 8% paying interest semi-annual arket price of P1,050.…

A: Interest on bond will be calculated on face value. Interest amount =face value*interest rate…

Q: A bond: pay $75 each year in interest, and a $1,000 payment at maturity. The $1,000 is called? A)…

A: The answer is mentioned on the next sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $2,000, a coupon rate of 5.5%, and semiannual payments?A government bond with a par value of R1000, maturing in 5 years, offers an annual coupon of 9.5%, and a yield to maturity of 11.5%. PART A: What is the current value of the bond? Give your answer in Rands (R) correct to TWO decimal places.R........ PART B: Use the table approach to determine the value on the right-hand side of the convexity calculation. That is, what is the sum of the discounted cash flows, multiplied by (t2 + t)?Provide your answer correct to TWO decimal places. Answer.......... PART C: Given your results above, what is the convexity of this bond?Give your answer, correct to TWO decimal places. Answer....... PART D: If this bond has a modified duration of 4 and yields increase by 200 basis points, the correction for convexity ((∆P/P) will forecast that the bond price will decrease by what percentage?Provide your answer, in percent (%), correct to TWO decimal places. Answer% ..........You do not have to indicate the negative with `–` or `() `, simply provide your…The bond certificate with a par value P1,000,000 and a bond rate of 10 % was sold for P1,064, 176.58 . Calculate the yield that the investor obtained from his investment .

- What is the Macaulay duration of a 7 percent semiannual coupon bond with two years to maturity and a current price of $1,055.30? (Note: You are required to solve the problem by calculating "Years \times PV / Bond Price" for each cash flow and summing the results. YTM and PV must be calculated using a financial calculator. Round your answer to four decimal places.)Han Corporation issues a bond which has a coupon rate of 7.2%, a yield to maturity of 9.3%, a face value of $1,000, and a market price of $990. What is the semiannual interest payment? Round to two decimal placesSuppose a ten-year, $1,000 bond with an 8.1% coupon rate and semiannual coupons is trading for $1,034.23.

- Answer the following: B1- What is the cash flow of a 6% coupon bond that pays interest annually, matures in 9 years, and was originally priced at par value.of $1,000? b. Assuming a current market yield of 5%, what is the price of this bond? B2-Assuming a current market yield of 8.5%, what is the price of the bond? B3-Assuming a market yield of 1.5%, what is the price of the bond?You have a 7 - year bond, with $1,000 face value, 5.50% coupon rate, semiannual coupon payments, and yield to maturity of 6.50%. What is its price? - $94.45-S1, 138.87-5674.37 - $944.47Compute the current yield on a bond with a yield to maturity of 3.9%, a par value of $1000, a coupon rate of 6.7% paid semi - annually, a remaining life of 11 years? (Round to 100th of a percent and enter as a percentage, e. g. 12.34% as 12.34 and state as an annual rate.)

- Doha plc has some surplus funds that it wishes to invest in bonds. The company requires a return of 15% on bonds, and the finance director has asked you to analyse whether it should invest in either of the following bonds that are available:Company A: Expected profit 12% bonds, redeemable at par at the end of two more years, with a current market value of QAR 95 per QAR 100 bondCompany B: Expected profit 8% bonds, redeemable at QAR110 at the end of two more years, with a current market value of QAR 95 per QAR 100 bonda. Calculate the expected value (price) of the two bonds and evaluate if either offer an appropriate return for Doha Plc.b. Critically evaluate what would be the impact on the price of bonds if Doha Plc reduces their required return.c. Critically evaluate and discuss the factors that should be considered by the directors of a company when choosing whether to use debt or equity finance for a new projectd. Recently one director has attended a finance conference, on their…A bond certificate with a value of P 1,081,038.07 has a par value of P 1,000,000.00 and a redemption price of P 1,030,000.00 at the end of 10 years . If the bond rate is 9% . Calculate the yield that the investor obtained from his investment .A P1,000 bond which mature in 10 years and with a bond rate of 5% payable annually is to be redeemed at par at the end of this period. It is sold at P1,030. Determine the yield at this price. With Cash flow diagram