Which of the following is not a common difference between net business income on the books (following GAAP) and net business income on a tax return (following the Internal Revenue Code) for a typical business? O Business Meals Expense O Depreciation Expense Bad Debt Expense O Advertising Expense

Which of the following is not a common difference between net business income on the books (following GAAP) and net business income on a tax return (following the Internal Revenue Code) for a typical business? O Business Meals Expense O Depreciation Expense Bad Debt Expense O Advertising Expense

Chapter4: Additional Income And The Qualified Business Income Deduction

Section: Chapter Questions

Problem 27MCQ

Related questions

Question

100%

Please Solve In 15mins I will Thumbs-up

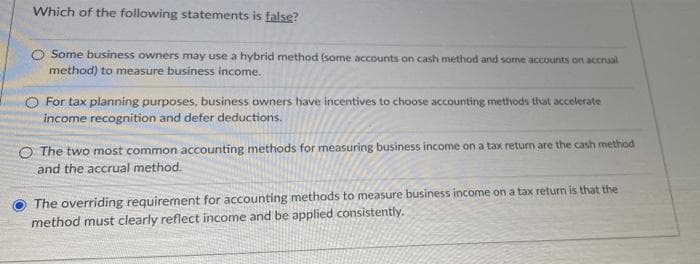

Transcribed Image Text:Which of the following statements is false?

O Some business owners may use a hybrid method (some accounts on cash method and some accounts on accrual

method) to measure business income.

For tax planning purposes, business owners have incentives to choose accounting methods that accelerate

income recognition and defer deductions.

O The two most common accounting methods for measuring business income on a tax return are the cash method

and the accrual method.

The overriding requirement for accounting methods to measure business income on a tax return is that the

method must clearly reflect income and be applied consistently.

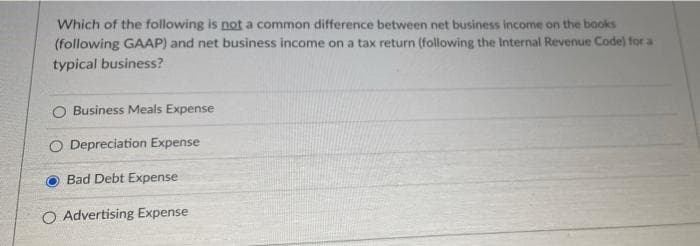

Transcribed Image Text:Which of the following is not a common difference between net business income on the books

(following GAAP) and net business income on a tax return (following the Internal Revenue Code) for a

typical business?

Business Meals Expense

O Depreciation Expense

Bad Debt Expense

O Advertising Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning