Which of the following is NOT a valid use of Form 990-1? O Request credit for certain excise taxes paid. Apply for reinstatement after an exempt organization has their status revoked. Claim the Small Employer Health Insurance Premium Tax Credit. Determine tax liability from UBI.

Which of the following is NOT a valid use of Form 990-1? O Request credit for certain excise taxes paid. Apply for reinstatement after an exempt organization has their status revoked. Claim the Small Employer Health Insurance Premium Tax Credit. Determine tax liability from UBI.

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 6CPA

Related questions

Question

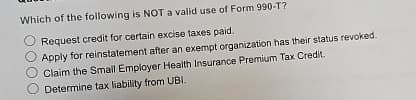

Transcribed Image Text:Which of the following is NOT a valid use of Form 990-T?

Request credit for certain excise taxes paid.

Apply for reinstatement after an exempt organization has their status revoked.

Claim the Small Employer Health Insurance Premium Tax Credit.

Determine tax liability from UBI.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub