Which of the following is not true about the major differences in the scope of audit responsibilities for CPAS, GAO auditors, IRS agents, and internal auditors? CPAS perform audits of financial statements of private and public companies prepared in accordance with U.S. or international auditing standards. GAO auditors perform compliance or operational audits in order to assure the B government of the expenditure of public funds in accordance with its directives and the law. IRS agents perform compliance audits to enforce the federal tax laws as defined by the government, interpreted by the courts, and regulated by the IRS.

Which of the following is not true about the major differences in the scope of audit responsibilities for CPAS, GAO auditors, IRS agents, and internal auditors? CPAS perform audits of financial statements of private and public companies prepared in accordance with U.S. or international auditing standards. GAO auditors perform compliance or operational audits in order to assure the B government of the expenditure of public funds in accordance with its directives and the law. IRS agents perform compliance audits to enforce the federal tax laws as defined by the government, interpreted by the courts, and regulated by the IRS.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter5: Professional Auditing Standards And The Audit Opinion Formulation Process

Section: Chapter Questions

Problem 3CYBK

Related questions

Question

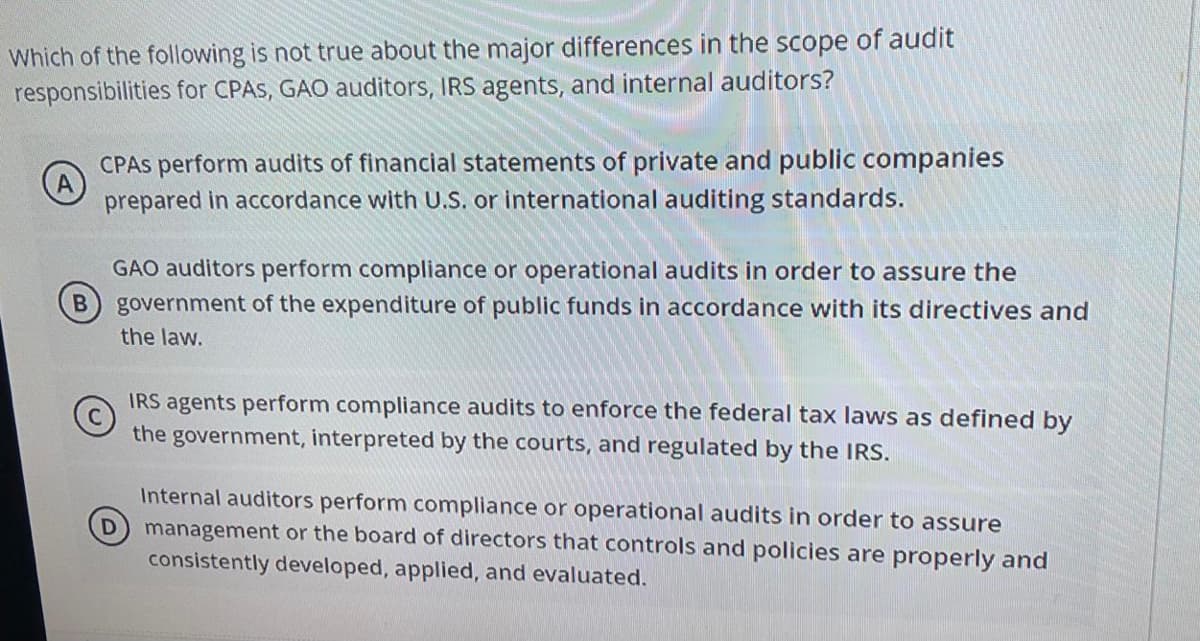

Transcribed Image Text:Which of the following is not true about the major differences in the scope of audit

responsibilities for CPAS, GAO auditors, IRS agents, and internal auditors?

CPAS perform audits of financial statements of private and public companies

(A)

prepared in accordance with U.S. or international auditing standards.

GAO auditors perform compliance or operational audits in order to assure the

B government of the expenditure of public funds in accordance with its directives and

the law.

IRS agents perform compliance audits to enforce the federal tax laws as defined by

the government, interpreted by the courts, and regulated by the IRS.

Internal auditors perform compliance or operational audits in order to assure

management or the board of directors that controls and policies are properly and

consistently developed, applied, and evaluated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub