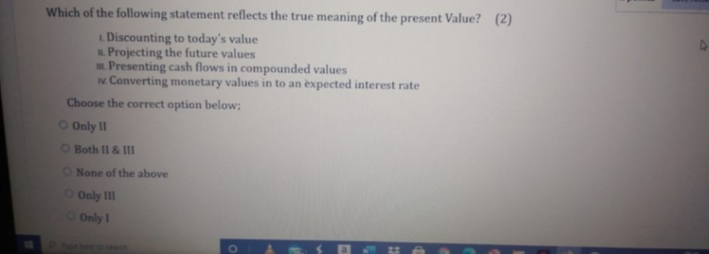

Which of the following statement reflects the true meaning of the present Value? (2) LDiscounting to today's value Projecting the future values Presenting cash flows in compounded values N Converting monetary values in to an expected interest rate Choose the correct option below: O Only II OBoth II& IIl ONone of the above OOnly II Only

Which of the following statement reflects the true meaning of the present Value? (2) LDiscounting to today's value Projecting the future values Presenting cash flows in compounded values N Converting monetary values in to an expected interest rate Choose the correct option below: O Only II OBoth II& IIl ONone of the above OOnly II Only

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13MC: Which of the following discounts future cash flows to their present value at the expected rate of...

Related questions

Question

100%

Transcribed Image Text:Which of the following statement reflects the true meaning of the present Value? (2)

L Discounting to today's value

Projecting the future values

. Presenting cash flows in compounded values

N. Converting monetary values in to an expected interest rate

Choose the correct option below;

O Only II

OBoth II & II

O None of the above

O Only II

Only I

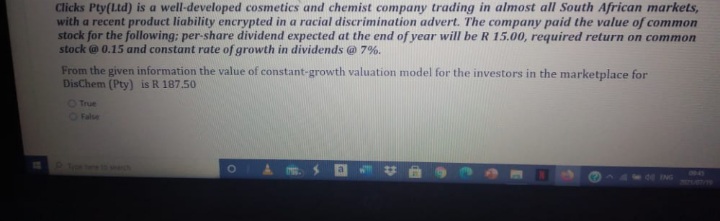

Transcribed Image Text:Clicks Pty(Ltd) is a well-developed cosmetics and chemist company trading in almost all South African markets,

with a recent product liability encrypted in a racial discrimination advert. The company paid the value of common

stock for the following; per-share dividend expected at the end of year will be R 15.00, required return on common

stock @ 0.15 and constant rate of growth in dividends @ 7%.

From the given information the value of constant-growth valuation model for the investors in the marketplace for

DisChem (Pty) is R 187.50

OTrue

OFalse

ING

TEFUBVTE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College