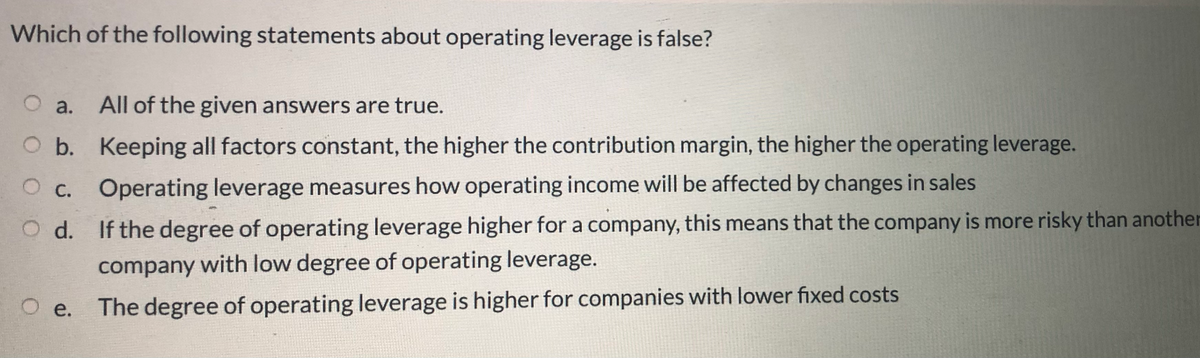

Which of the following statements about operating leverage is false? O a. All of the given answers are true. O b. Keeping all factors constant, the higher the contribution margin, the higher the operating leverage. O c. Operating leverage measures how operating income will be affected by changes in sales O d. If the degree of operating leverage higher for a company, this means that the company is more risky than anothe company with low degree of operating leverage. The degree of operating leverage is higher for companies with lower fixed costs e.

Which of the following statements about operating leverage is false? O a. All of the given answers are true. O b. Keeping all factors constant, the higher the contribution margin, the higher the operating leverage. O c. Operating leverage measures how operating income will be affected by changes in sales O d. If the degree of operating leverage higher for a company, this means that the company is more risky than anothe company with low degree of operating leverage. The degree of operating leverage is higher for companies with lower fixed costs e.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 2Q: Would each of the following increase, decrease, or have an indeterminant effect on a firms...

Related questions

Question

Transcribed Image Text:Which of the following statements about operating leverage is false?

O a.

All of the given answers are true.

O b. Keeping all factors constant, the higher the contribution margin, the higher the operating leverage.

OC.

Operating leverage measures how operating income will be affected by changes in sales

O d. If the degree of operating leverage higher for a company, this means that the company is more risky than another

company with low degree of operating leverage.

The degree of operating leverage is higher for companies with lower fixed costs

O e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College