Which of the following statements best describes the process of tax planning? Oa. Tax planning is the calculation of a taxpayer's marginal rate of tax. Ob. Tax planning is equivalent to tax evasion. Oc. Tax planning is the deferral of tax on income. Od. Tax planning is the avoidance of "tax traps." Oe. Tax planning is the process of arranging one's financial affairs to minimize one's overall tax liability.

Which of the following statements best describes the process of tax planning? Oa. Tax planning is the calculation of a taxpayer's marginal rate of tax. Ob. Tax planning is equivalent to tax evasion. Oc. Tax planning is the deferral of tax on income. Od. Tax planning is the avoidance of "tax traps." Oe. Tax planning is the process of arranging one's financial affairs to minimize one's overall tax liability.

Chapter12: Tax Administration And Tax Planning

Section: Chapter Questions

Problem 12P

Related questions

Question

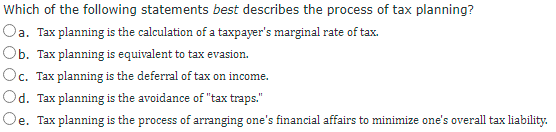

Transcribed Image Text:Which of the following statements best describes the process of tax planning?

Oa. Tax planning is the calculation of a taxpayer's marginal rate of tax.

Ob. Tax planning is equivalent to tax evasion.

Oc. Tax planning is the deferral of tax on income.

Od. Tax planning is the avoidance of "tax traps."

Oe. Tax planning is the process of arranging one's financial affairs to minimize one's overall tax liability.

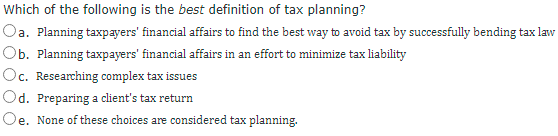

Transcribed Image Text:Which of the following is the best definition of tax planning?

Oa. Planning taxpayers' financial affairs to find the best way to avoid tax by successfully bending tax law

Ob. Planning taxpayers' financial affairs in an effort to minimize tax liability

Oc. Researching complex tax issues

Od. Preparing a client's tax return

Oe. None of these choices are considered tax planning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT