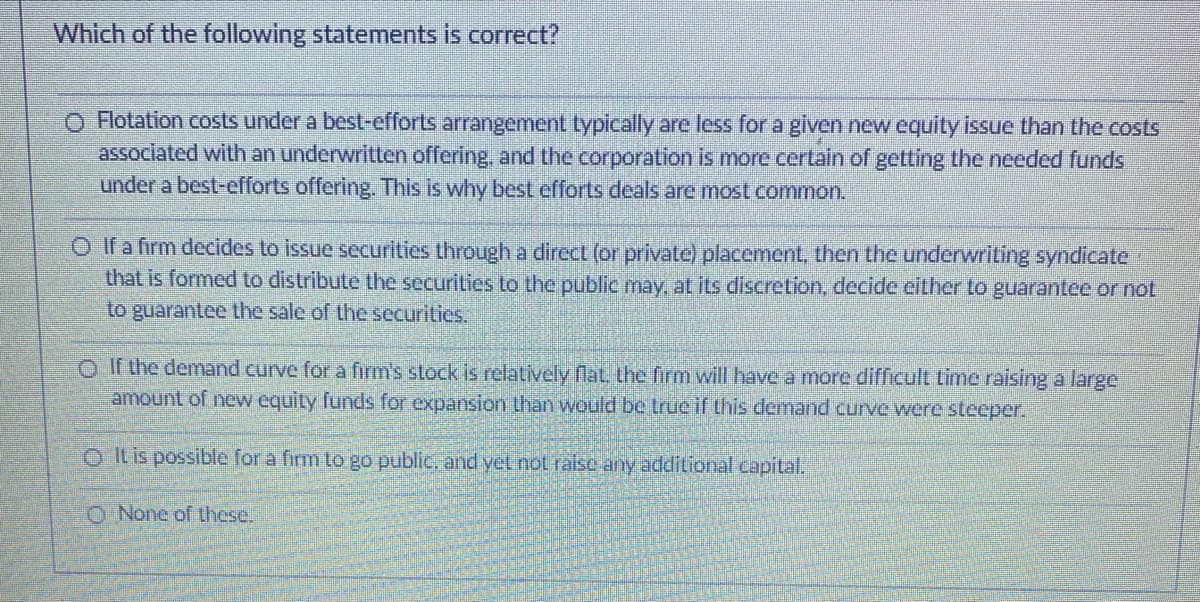

Which of the following statements is correct? O Flotation costs under a best-efforts arrangement typically are less for a given new equity issue than the costs associated with an underwritten offering, and the corporation is more certain of getting the needed funds under a best-efforts offering. This is why best efforts deals are most common. O If a firm decides to issue securities through a direct (or private) placement, then the underwriting syndicate that is formed to distribute the securities to the public may. at its discretion, decide either to guarantee or not to guarantee the sale of the securities. O If the demand curve for a firm's stock is relatively flat. the firm will have a more difficult time raising a large amount of new equity funds for expansion than would be true if this demand curve were steeper. O It is possible for a firm to go public, and yet not raisc any additional capital.

Which of the following statements is correct? O Flotation costs under a best-efforts arrangement typically are less for a given new equity issue than the costs associated with an underwritten offering, and the corporation is more certain of getting the needed funds under a best-efforts offering. This is why best efforts deals are most common. O If a firm decides to issue securities through a direct (or private) placement, then the underwriting syndicate that is formed to distribute the securities to the public may. at its discretion, decide either to guarantee or not to guarantee the sale of the securities. O If the demand curve for a firm's stock is relatively flat. the firm will have a more difficult time raising a large amount of new equity funds for expansion than would be true if this demand curve were steeper. O It is possible for a firm to go public, and yet not raisc any additional capital.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:Which of the following statements is correct?

O Flotation costs under a best-efforts arrangement typically are less for a given new equity issue than the costs

associated with an underwritten offering, and the corporation is more certain of getting the needed funds

under a best-efforts offering. This is why best efforts deals are most common.

O If a firm decides to issue securities through a direct (or private) placement, then the underwriting syndicate

that is formed to distribute the securities to the public may. at its discretion, decide either to guarantee or not

to guarantee the sale of the securities.

O If the demand curve for a firm's stock is relatively flat. the firm will havea more difficult time raising a large

amount of new equity funds for expansion than would be true if this demand curve were steeper.

OIt is possible for a firm to go public, and yet not ralse any additional capital.

O None of these.

Expert Solution

Introduction

The process of issuing shares of a private firm to the public in a new stock issue is known as an initial public offering (IPO), and it allows a company to obtain funds from public investors. To hold an IPO, companies must fulfil the standards of exchanges and the Securities and Exchange Commission (SEC).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education