Which of the following statements is correct? O Intangible assets used in the operation of a business are always long term Some intangible assets convey exclusive rights which are represented only by tangible physical substance Intangible assets are obtained in two ways: acquisition from an external source or internally developed O The process of recording the expiration of the economic benefits of an intangible asset is called depletion

Which of the following statements is correct? O Intangible assets used in the operation of a business are always long term Some intangible assets convey exclusive rights which are represented only by tangible physical substance Intangible assets are obtained in two ways: acquisition from an external source or internally developed O The process of recording the expiration of the economic benefits of an intangible asset is called depletion

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4MC: Which of the following statements about capitalizing costs is correct? A. Capitalizing costs refers...

Related questions

Question

100%

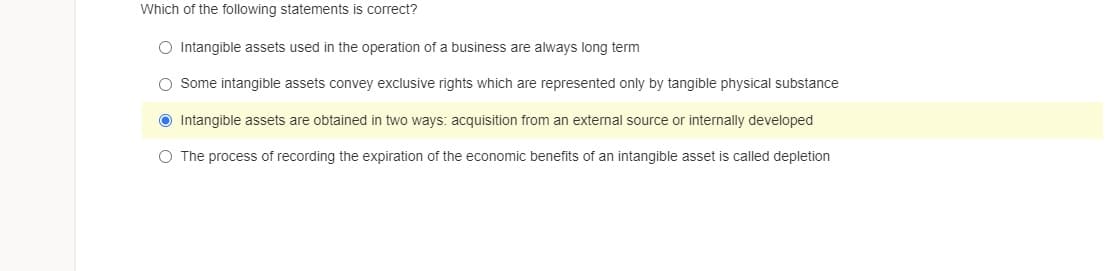

Transcribed Image Text:Which of the following statements is correct?

O Intangible assets used in the operation of a business are always long term

O Some intangible assets convey exclusive rights which are represented only by tangible physical substance

O Intangible assets are obtained in two ways: acquisition from an external source or internally developed

O The process of recording the expiration of the economic benefits of an intangible asset is called depletion

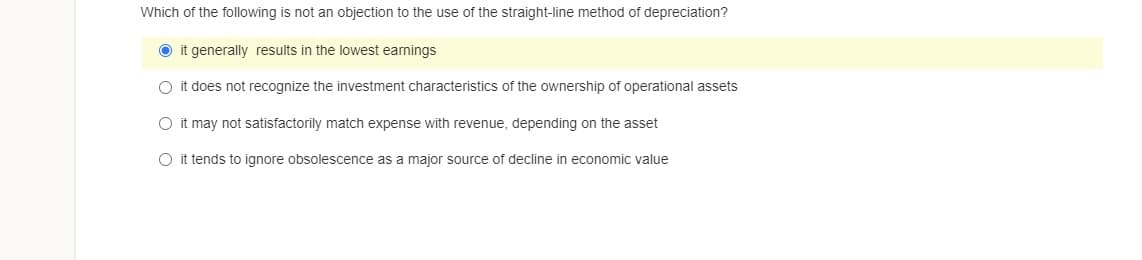

Transcribed Image Text:Which of the following is not an objection to the use of the straight-line method of depreciation?

O it generally results in the lowest earnings

O it does not recognize the investment characteristics of the ownership of operational assets

O it may not satisfactorily match expense with revenue, depending on the asset

O it tends to ignore obsolescence as a major source of decline in economic value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning