Which of the following statements is false regarding the different bases used for the allowance metho O A. Three bases are generally accepted, the percentage of sales, the percentage of receivables, a direct write-off. O B. Management can choose whichever basis it prefers. O C. If management wishes to emphasize the cash realizable value of receivables it will select the percentage of receivables basis.

Which of the following statements is false regarding the different bases used for the allowance metho O A. Three bases are generally accepted, the percentage of sales, the percentage of receivables, a direct write-off. O B. Management can choose whichever basis it prefers. O C. If management wishes to emphasize the cash realizable value of receivables it will select the percentage of receivables basis.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle

Section: Chapter Questions

Problem 20MCQ

Related questions

Question

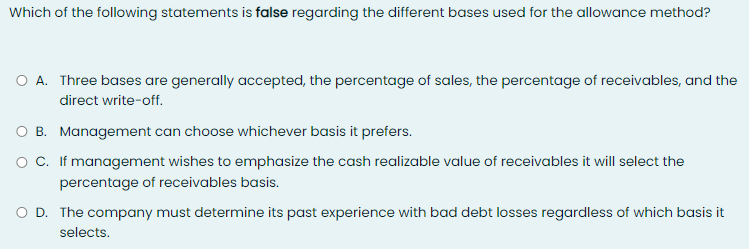

Transcribed Image Text:Which of the following statements is false regarding the different bases used for the allowance method?

O A. Three bases are generally accepted, the percentage of sales, the percentage of receivables, and the

direct write-off.

O B. Management can choose whichever basis it prefers.

o C. If management wishes to emphasize the cash realizable value of receivables it will select the

percentage of receivables basis.

O D. The company must determine its past experience with bad debt losses regardless of which basis it

selects.

Transcribed Image Text:Bueno Company's purchase and sales transactions for the month of July were as follows:

Purchases

July 3 (beg. balance)

4,000@ RM4.0o

July 16

12,000@ RM4.4

July 30

3,000@ RM4.75

The company sold 8,000 units on July 22.

Assuming that the Bueno keeps perpetual inventory records, July's cost of goods sold on a FIFO basis is

O A. RM33,600.

O B. RM53,400.

O C. RM54,200.

D. RM34,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,