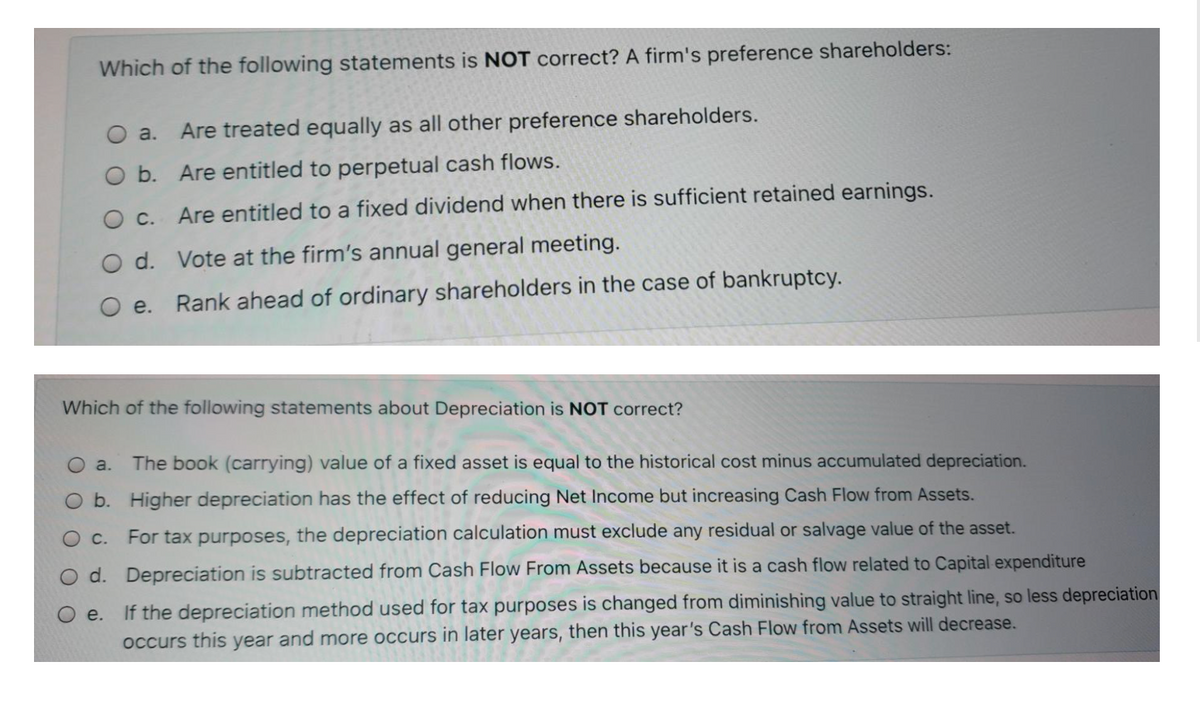

Which of the following statements is NOT correct? A firm's preference shareholders: O a. Are treated equally as all other preference shareholders. O b. Are entitled to perpetual cash flows. Are entitled to a fixed dividend when there is sufficient retained earnings. O d. Vote at the firm's annual general meeting. Oe. Rank ahead of ordinary shareholders in the case of bankruptcy.

Which of the following statements is NOT correct? A firm's preference shareholders: O a. Are treated equally as all other preference shareholders. O b. Are entitled to perpetual cash flows. Are entitled to a fixed dividend when there is sufficient retained earnings. O d. Vote at the firm's annual general meeting. Oe. Rank ahead of ordinary shareholders in the case of bankruptcy.

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Transcribed Image Text:Which of the following statements is NOT correct? A firm's preference shareholders:

O a.

Are treated equally as all other preference shareholders.

O b. Are entitled to perpetual cash flows.

O C. Are entitled to a fixed dividend when there is sufficient retained earnings.

O d. Vote at the firm's annual general meeting.

O e. Rank ahead of ordinary shareholders in the case of bankruptcy.

Which of the following statements about Depreciation is NOT correct?

Oa.

The book (carrying) value of a fixed asset is equal to the historical cost minus accumulated depreciation.

O b. Higher depreciation has the effect of reducing Net Income but increasing Cash Flow from Assets.

For tax purposes, the depreciation calculation must exclude any residual or salvage value of the asset.

O d. Depreciation is subtracted from Cash Flow From Assets because it is a cash flow related to Capital expenditure

e.

If the depreciation method used for tax purposes is changed from diminishing value to straight line, so less depreciation

occurs this year and more occurs in later years, then this year's Cash Flow from Assets will decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT