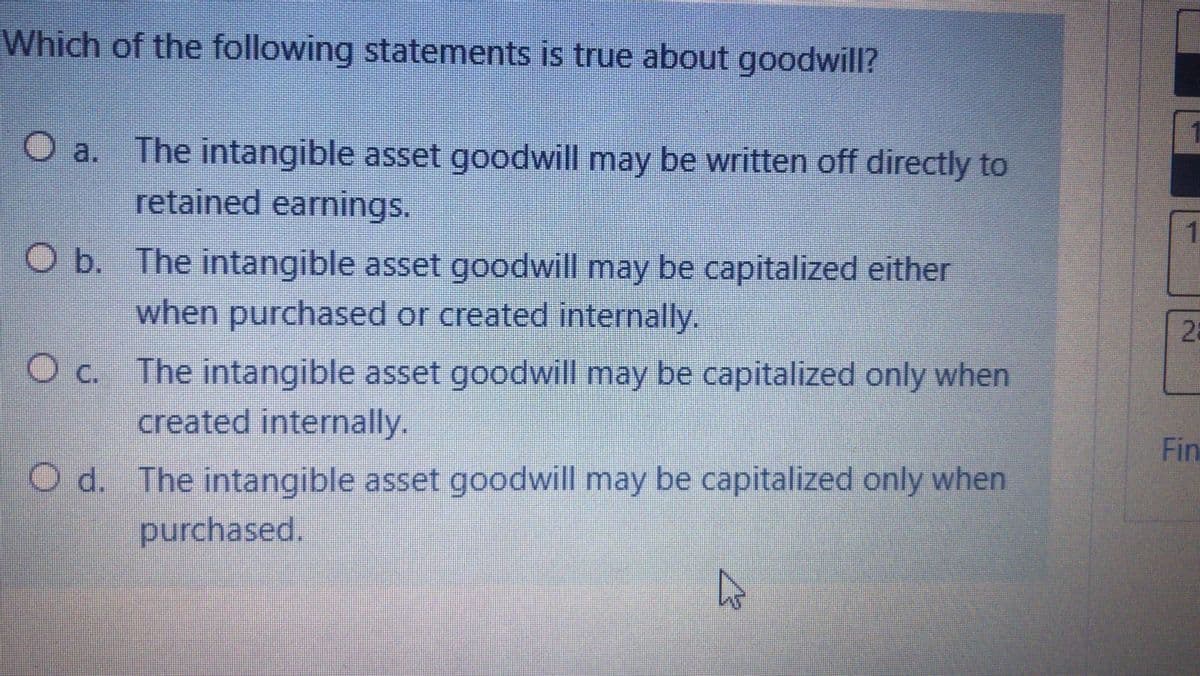

Which of the following statements is true about goodwill? The intangible asset goodwill may be written off directly to O a. retained earnings. O b. The intangible asset goodwill may be capitalized either when purchased or created internally. O c. The intangible asset goodwill may be capitalized only when created internally. O d. The intangible asset goodwill may be capitalized only when purchased.

Which of the following statements is true about goodwill? The intangible asset goodwill may be written off directly to O a. retained earnings. O b. The intangible asset goodwill may be capitalized either when purchased or created internally. O c. The intangible asset goodwill may be capitalized only when created internally. O d. The intangible asset goodwill may be capitalized only when purchased.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 33CYBK

Related questions

Question

Transcribed Image Text:Which of the following statements is true about goodwill?

O a.

The intangible asset goodwill may be written off directly to

retained earnings.

O b. The intangible asset goodwill may be capitalized either

when purchased or created internally.

O c. The intangible asset goodwill may be capitalized only when

created internally.

Fin

d. The intangible asset goodwill may be capitalized only when

purchased.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning