Which of the following statements is true? The CPA firm will lose its independence if: A. a staff auditor providing audit services to the client acquires stock in that client. B. a staff tax preparer who provides 15 hours of non-audit services to the client acquires stock in that client. C. an audit manager in an office different than the office providing audit services has a direct, immaterial financial interest in the audit client. D. an audit partner has an indirect, immaterial financial interest in an audit client that he is not in charge of.

Which of the following statements is true? The CPA firm will lose its independence if: A. a staff auditor providing audit services to the client acquires stock in that client. B. a staff tax preparer who provides 15 hours of non-audit services to the client acquires stock in that client. C. an audit manager in an office different than the office providing audit services has a direct, immaterial financial interest in the audit client. D. an audit partner has an indirect, immaterial financial interest in an audit client that he is not in charge of.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter4: Professional Liability, Auditor Judgment Frameworks, And Professional Responsibilities

Section: Chapter Questions

Problem 24MCQ

Related questions

Question

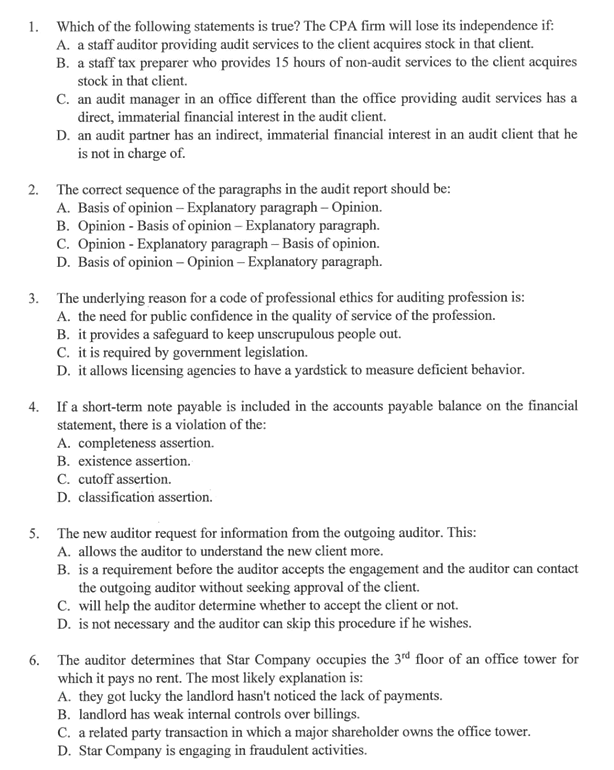

Transcribed Image Text:1. Which of the following statements is true? The CPA firm will lose its independence if:

A. a staff auditor providing audit services to the client acquires stock in that client.

B. a staff tax preparer who provides 15 hours of non-audit services to the client acquires

stock in that client.

C. an audit manager in an office different than the office providing audit services has a

direct, immaterial financial interest in the audit client.

D. an audit partner has an indirect, immaterial financial interest in an audit client that he

is not in charge of.

2. The correct sequence of the paragraphs in the audit report should be:

A. Basis of opinion – Explanatory paragraph – Opinion.

B. Opinion - Basis of opinion – Explanatory paragraph.

C. Opinion - Explanatory paragraph – Basis of opinion.

D. Basis of opinion – Opinion – Explanatory paragraph.

3. The underlying reason for a code of professional ethics for auditing profession is:

A. the need for public confidence in the quality of service of the profession.

B. it provides a safeguard to keep unscrupulous people out.

C. it is required by government legislation.

D. it allows licensing agencies to have a yardstick to measure deficient behavior.

4. If a short-term note payable is included in the accounts payable balance on the financial

statement, there is a violation of the:

A. completeness assertion.

B. existence assertion.

C. cutoff assertion.

D. classification assertion.

5. The new auditor request for information from the outgoing auditor. This:

A. allows the auditor to understand the new client more.

B. is a requirement before the auditor accepts the engagement and the auditor can contact

the outgoing auditor without seeking approval of the client.

C. will help the auditor determine whether to accept the client or not.

D. is not necessary and the auditor can skip this procedure if he wishes.

6. The auditor determines that Star Company occupies the 3rd floor of an office tower for

which it pays no rent. The most likely explanation is:

A. they got lucky the landlord hasn't noticed the lack of payments.

B. landlord has weak internal controls over billings.

C. a related party transaction in which a major shareholder owns the office tower.

D. Star Company is engaging in fraudulent activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage