Chapter4: Managing Income Taxes

Section: Chapter Questions

Problem 5LTAI

Related questions

Question

100%

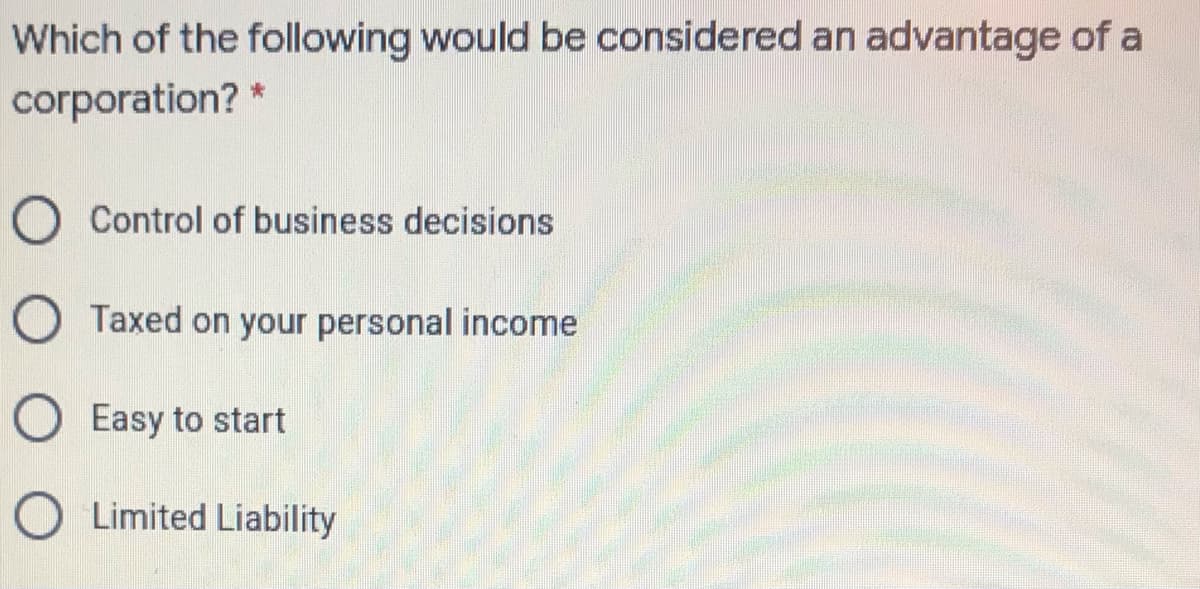

Transcribed Image Text:Which of the following would be considered an advantage of a

corporation?

O Control of business decisions

O Taxed on your personal income

O Easy to start

O Limited Liability

Expert Solution

Step 1

Corporation are those business that have separate individual identity from its owners. Corporation can make profits, pay tax and are legally liable.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage