Which one of the following statements is correct? Multiple Choice Short-term investments tend to have high levels of default risk. The rate of return earned on short-term securities tends to exceed that earned on long-term securities. Treasury bills are well suited for short-term investments. Short-term securities are more interest rate sensitive than long-term securities. The income earned on Treasury bills is exempt from all taxation.

Which one of the following statements is correct? Multiple Choice Short-term investments tend to have high levels of default risk. The rate of return earned on short-term securities tends to exceed that earned on long-term securities. Treasury bills are well suited for short-term investments. Short-term securities are more interest rate sensitive than long-term securities. The income earned on Treasury bills is exempt from all taxation.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 6QE

Related questions

Question

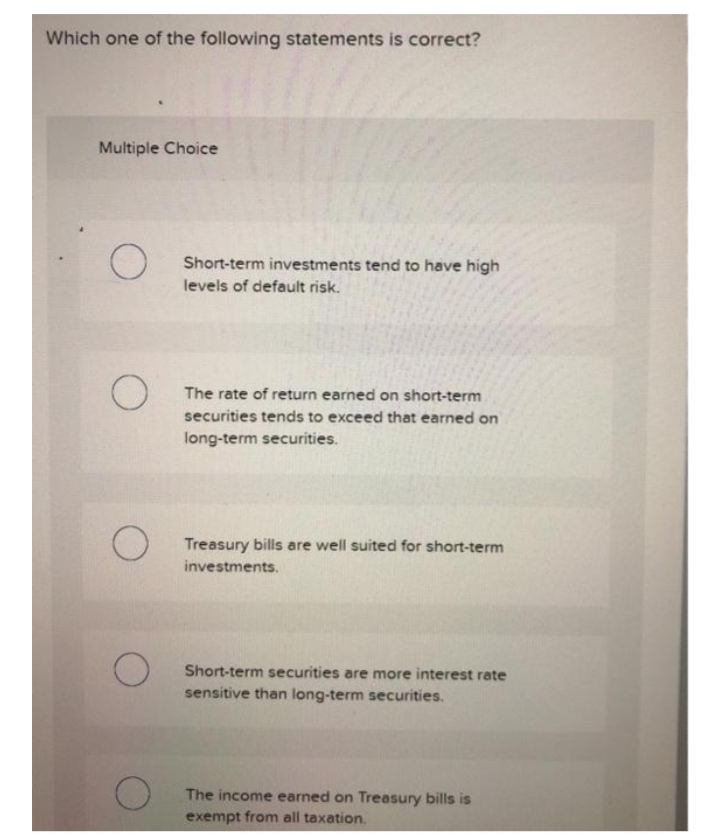

Transcribed Image Text:Which one of the following statements is correct?

Multiple Choice

Short-term investments tend to have high

levels of default risk.

The rate of return earned on short-term

securities tends to exceed that earned on

long-term securities.

Treasury bills are well suited for short-term

investments.

Short-term securities are more interest rate

sensitive than long-term securities.

The income earned on Treasury bills is

exempt from all taxation.

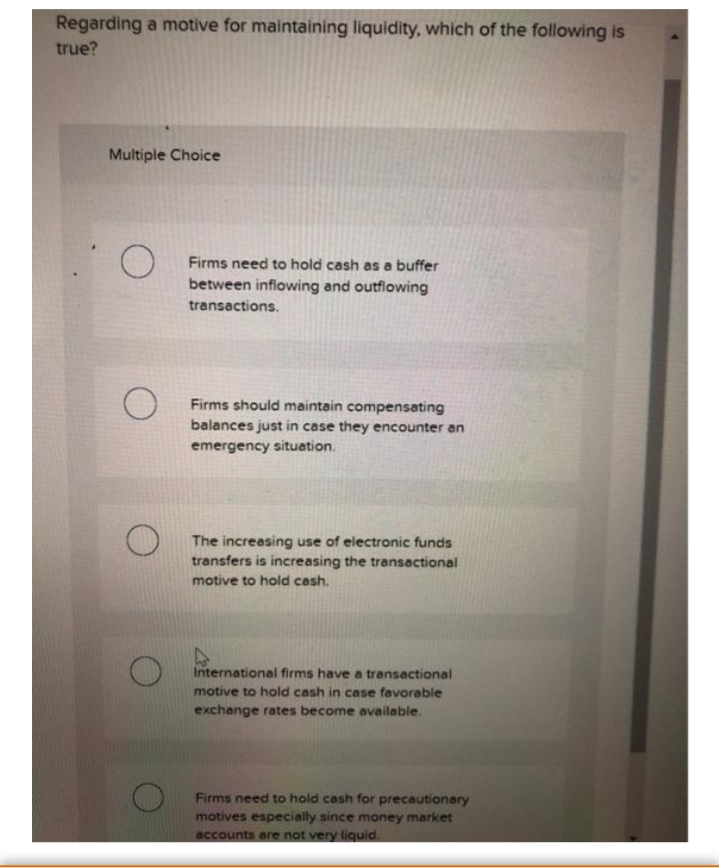

Transcribed Image Text:Regarding a motive for maintaining liquidity, which of the following is

true?

Multiple Choice

Firms need to hold cash as a buffer

between inflowing and outflowing

transactions.

Firms should maintain compensating

balances just in case they encounter an

emergency situation.

The increasing use of electronic funds

transfers is increasing the transactional

motive to hold cash.

International firms have a transactional

motive to hold cash in case favorable

exchange rates become available.

Firms need to hold cash for precautionary

motives especially since money market

accounts are not very liquid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning