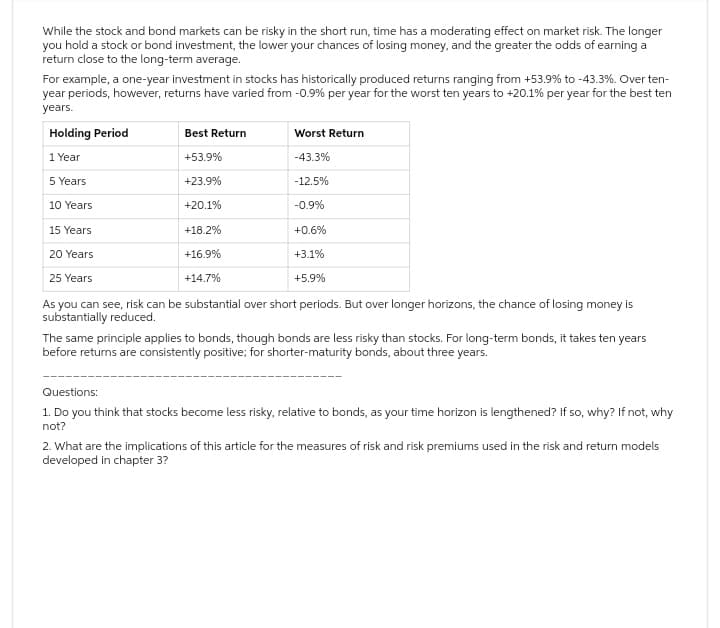

While the stock and bond markets can be risky in the short run, time has a moderating effect on market risk. The longer you hold a stock or bond investment, the lower your chances of losing money, and the greater the odds of earning a return close to the long-term average. For example, a one-year investment in stocks has historically produced returns ranging from +53.9% to -43.3%. Over ten- year periods, however, returns have varied from -0.9% per year for the worst ten years to +20.1% per year for the best ten years. Holding Period 1 Year 5 Years 10 Years 15 Years 20 Years 25 Years Best Return +53.9% +23.9% +20.1% +18.2% +16.9% +14.7% Worst Return -43.3% -12.5% -0.9% +0.6% +3.1% +5.9% As you can see, risk can be substantial over short periods. But over longer horizons, the chance of losing money is substantially reduced.

While the stock and bond markets can be risky in the short run, time has a moderating effect on market risk. The longer you hold a stock or bond investment, the lower your chances of losing money, and the greater the odds of earning a return close to the long-term average. For example, a one-year investment in stocks has historically produced returns ranging from +53.9% to -43.3%. Over ten- year periods, however, returns have varied from -0.9% per year for the worst ten years to +20.1% per year for the best ten years. Holding Period 1 Year 5 Years 10 Years 15 Years 20 Years 25 Years Best Return +53.9% +23.9% +20.1% +18.2% +16.9% +14.7% Worst Return -43.3% -12.5% -0.9% +0.6% +3.1% +5.9% As you can see, risk can be substantial over short periods. But over longer horizons, the chance of losing money is substantially reduced.

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter9: Counting And Probability

Section9.4: Expected Value

Problem 2E: If you played the game in Exercise 1 many times, then you would expect your average payoff per game...

Related questions

Question

Sh4

Transcribed Image Text:While the stock and bond markets can be risky in the short run, time has a moderating effect on market risk. The longer

you hold a stock or bond investment, the lower your chances of losing money, and the greater the odds of earning a

return close to the long-term average.

For example, a one-year investment in stocks has historically produced returns ranging from +53.9% to -43.3%. Over ten-

year periods, however, returns have varied from -0.9% per year for the worst ten years to +20.1% per year for the best ten

years.

Holding Period

1 Year

Best Return

+53.9%

+23.9%

+20.1%

+18.2%

20 Years

+16.9%

25 Years

+14.7%

As you can see, risk can be substantial over short periods. But over longer horizons, the chance of losing money i

substantially reduced.

5 Years

10 Years

Worst Return

-43.3%

-12.5%

-0.9%

+0.6%

+3.1%

+5.9%

15 Years

The same principle applies to bonds, though bonds are less risky than stocks. For long-term bonds, it takes ten years

before returns are consistently positive; for shorter-maturity bonds, about three years.

Questions:

1. Do you think that stocks become less risky, relative to bonds, as your time horizon is lengthened? If so, why? If not, why

not?

2. What are the implications of this article for the measures of risk and risk premiums used in the risk and return models

developed in chapter 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL