Whitney received $75,000 of taxable income in 2022. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Required: She files under the single filing status. She files a joint tax return with her spouse. Together their taxable income is $75,000. She is married but files a separate tax return. Her taxable income is $75,000. She files as a head of household.

Whitney received $75,000 of taxable income in 2022. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Required: She files under the single filing status. She files a joint tax return with her spouse. Together their taxable income is $75,000. She is married but files a separate tax return. Her taxable income is $75,000. She files as a head of household.

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 26P

Related questions

Question

100%

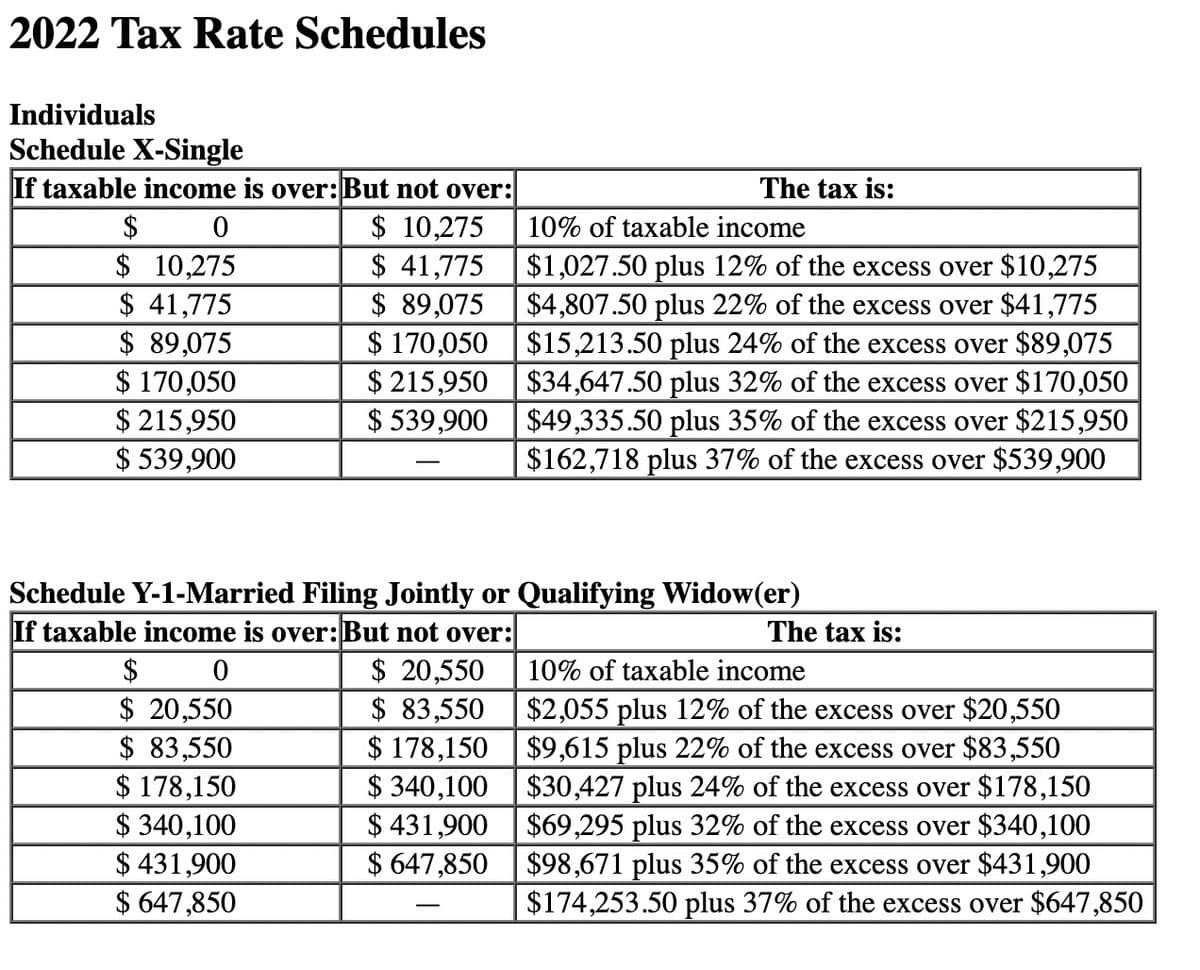

Whitney received $75,000 of taxable income in 2022. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference.

Note: Do not round intermediate calculations.

Required:

- She files under the single filing status.

- She files a joint tax return with her spouse. Together their taxable income is $75,000.

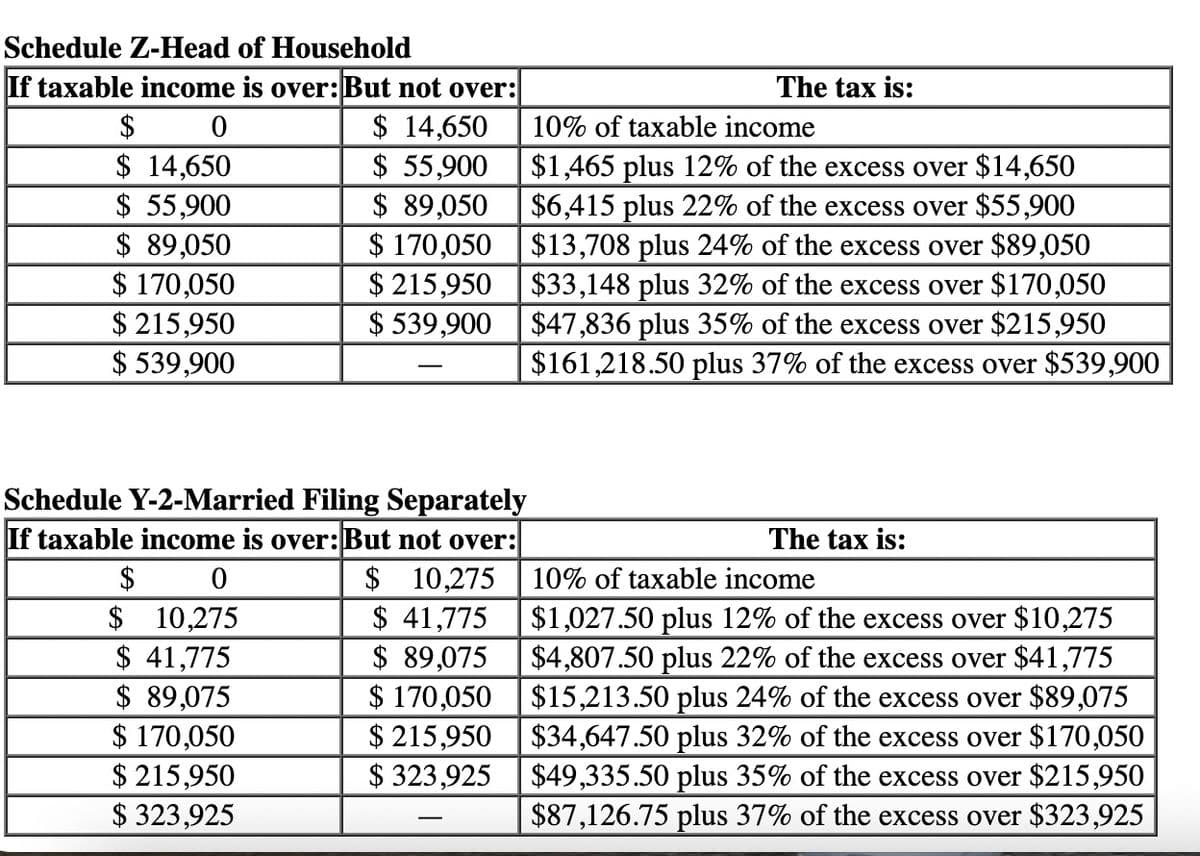

- She is married but files a separate tax return. Her taxable income is $75,000.

- She files as a head of household.

Transcribed Image Text:2022 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

$

0

$10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$ 539,900

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$ 539,900

The tax is:

$ 20,550

$ 83,550

$ 178,150

$ 340,100

$ 431,900

$ 647,850

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$162,718 plus 37% of the excess over $539,900

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

$

0

$ 20,550

$ 83,550

$ 178,150

$ 340,100

$431,900

$ 647,850

The tax is:

10% of taxable income

$2,055 plus 12% of the excess over $20,550

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

$69,295 plus 32% of the excess over $340,100

$98,671 plus 35% of the excess over $431,900

$174,253.50 plus 37% of the excess over $647,850

Transcribed Image Text:Schedule Z-Head of Household

If taxable income is over: But not over:

$

0

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$215,950

$ 539,900

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

$ 10,275

$ 41,775

$ 89,075

170,050

$215,950

$323,925

$

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$215,950

$539,900

0

$

10,275

$ 41,775

$ 89,075

$ 170,050

$ 215,950

$ 323,925

The tax is:

10% of taxable income

$1,465 plus 12% of the excess over $14,650

$6,415 plus 22% of the excess over $55,900

$13,708 plus 24% of the excess over $89,050

$33,148 plus 32% of the excess over $170,050

$47,836 plus 35% of the excess over $215,950

$161,218.50 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$87,126.75 plus 37% of the excess over $323,925

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you