who benefits: the buyer or the seller?

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 6DQ

Related questions

Question

!

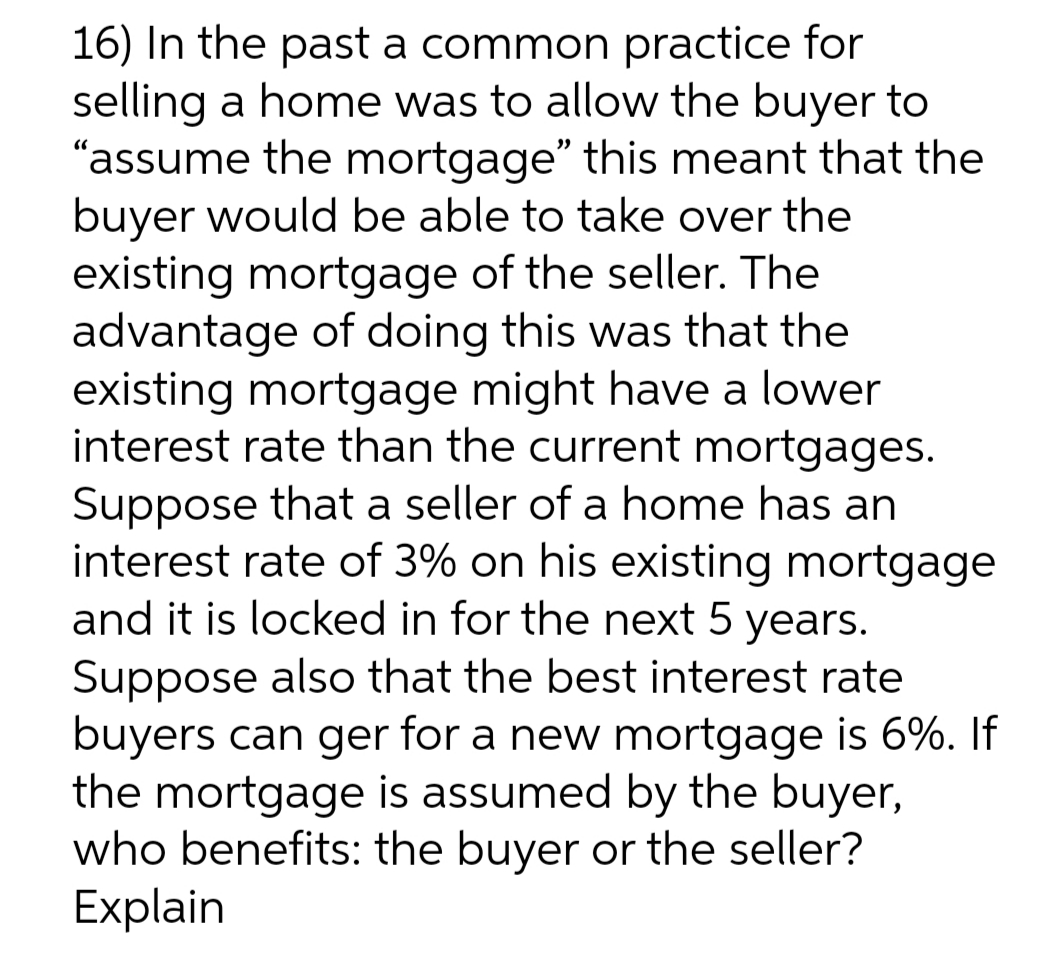

Transcribed Image Text:16) In the past a common practice for

selling a home was to allow the buyer to

"assume the mortgage" this meant that the

buyer would be able to take over the

existing mortgage of the seller. The

advantage of doing this was that the

existing mortgage might have a lower

interest rate than the current mortgages.

Suppose that a seller of a home has an

interest rate of 3% on his existing mortgage

and it is locked in for the next 5 years.

Suppose also that the best interest rate

buyers can ger for a new mortgage is 6%. If

the mortgage is assumed by the buyer,

who benefits: the buyer or the seller?

Explain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT