Why is there a positive leverage from use of debt? How can we tell that?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPA: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

Practice Pack

Why is there a positive leverage from use of debt? How can we tell that?

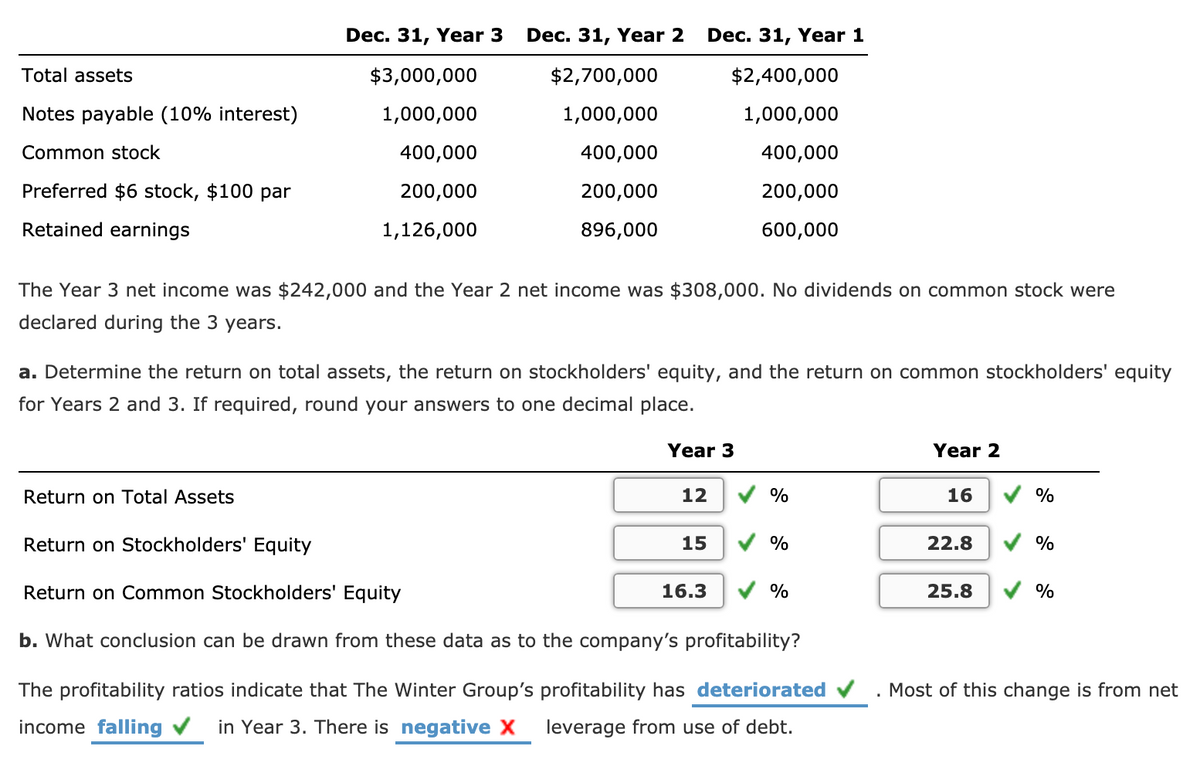

Transcribed Image Text:Dec. 31, Year 3

Dec. 31, Year 2

Dec. 31, Year 1

Total assets

$3,000,000

$2,700,000

$2,400,000

Notes payable (10% interest)

1,000,000

1,000,000

1,000,000

Common stock

400,000

400,000

400,000

Preferred $6 stock, $100 par

200,000

200,000

200,000

Retained earnings

1,126,000

896,000

600,000

The Year 3 net income was $242,000 and the Year 2 net income was $308,000. No dividends on common stock were

declared during the 3 years.

a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity

for Years 2 and 3. If required, round your answers to one decimal place.

Year 3

Year 2

Return on Total Assets

12

%

16

%

Return on Stockholders' Equity

15

%

22.8

%

Return on Common Stockholders' Equity

16.3

%

25.8

%

b. What conclusion can be drawn from these data as to the company's profitability?

The profitability ratios indicate that The Winter Group's profitability has deteriorated v

Most of this change is from net

income falling v

in Year 3. There is negative X

leverage from use of debt.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning